Best Canadian Gold ETFs to Invest in

Gold ETFs have become increasingly popular among Canadian investors seeking exposure to the precious metal without the hassle of physical ownership. These financial instruments offer a convenient way to diversify portfolios and hedge against economic uncertainties. Canadian gold ETFs provide investors with opportunities to gain from gold price movements while benefiting from the stability of the Canadian market.

Table of Contents

This article explores the top 10 Canadian gold ETFs to consider for investment in 2025. It examines various options, including gold bullion ETFs, leveraged gold ETFs, and gold miner ETFs listed on Canadian exchanges. The list covers well-known funds from major financial institutions as well as specialized offerings from smaller companies. By reviewing these options, investors can make informed decisions about adding gold exposure to their portfolios through ETFs traded on Canadian stock markets.

iShares Gold Bullion ETF (CGL)

Image Source: BlackRock

The iShares Gold Bullion ETF (CGL) is a popular choice among Canadian investors seeking exposure to gold. This ETF aims to replicate the performance of physical gold bullion, minus fees and expenses [1]. CGL offers targeted exposure to gold prices hedged to the Canadian dollar, providing a convenient and cost-effective way to invest in gold bullion [2].

CGL Fund Details

CGL was launched on May 28, 2009, and is traded on the Toronto Stock Exchange [3]. As of October 25, 2024, the fund had net assets of CAD 1,028,395,314 and 47,500,000 units outstanding [4]. The management fee is 0.50%, with a management expense ratio (MER) of 0.56% [5].

CGL Investment Strategy

The ETF invests in long-term holdings of unencumbered gold bullion, typically in 100 or 400 troy ounce international bar sizes [6]. This strategy allows investors to gain exposure to gold price movements without the hassle of physical ownership.

CGL Historical Returns

CGL has shown strong performance over the years. As of September 30, 2024, the fund’s 1-year return was 38.72%, while its 3-year and 5-year annualized returns were 13.33% and 10.78%, respectively [7]. The ETF’s year-to-date return as of October 24, 2024, stood at an impressive 31.05% .

Sprott Physical Gold Trust (PHYS)

Image Source: Sprott

The Sprott Physical Gold Trust (PHYS) is a closed-end trust that invests in physical gold bullion. It aims to provide a secure and convenient investment alternative for those seeking exposure to gold without the hassle of direct ownership [1]. PHYS offers several advantages, including full allocation to gold, potential tax benefits, and easy trading on major exchanges.

PHYS Fund Details

As of October 25, 2024, PHYS had a net asset value (NAV) of CAD 29.94 per unit and total net assets of CAD 12.49 billion [2]. The trust’s management expense ratio (MER) stands at 0.41%, making it a cost-effective option for gold investors [3].

PHYS Investment Strategy

PHYS exclusively invests in London Good Delivery physical gold bullion, holding 3,268,726 ounces of gold as of the latest report [4]. The trust’s assets are stored at the Royal Canadian Mint, ensuring secure and trustworthy custody [5].

PHYS Historical Returns

PHYS has demonstrated strong performance, with a 1-year return of 41.65% and 3-year and 5-year annualized returns of 13.83% and 11.61%, respectively [6]. These figures highlight the trust’s potential as a valuable addition to Canadian gold ETF portfolios.

BMO Gold Bullion ETF (ZGLD)

The BMO Gold Bullion ETF (ZGLD) offers investors a convenient way to gain exposure to gold prices. This ETF aims to replicate the performance of gold bullion, net of fees and expenses [1].

ZGLD Fund Details

ZGLD trades on the Toronto Stock Exchange with the ticker symbol ZGLD [2]. As of October 25, 2024, the fund had net assets of CAD 884.54 million [3]. The ETF has a competitive management fee of 0.20% and a management expense ratio of 0.23% [4].

ZGLD Investment Strategy

ZGLD invests in long-term holdings of unencumbered gold bullion in 400 troy ounce international bar sizes [5]. The fund does not speculate on short-term price changes and is not actively managed [6].

ZGLD Historical Returns

As a relatively new ETF launched on March 4, 2024, historical performance data is limited [7]. However, the fund’s strategy of tracking gold prices provides potential for portfolio diversification and inflation hedging .

Purpose Gold Bullion Fund (KILO)

Image Source: Purpose Investments

The Purpose Gold Bullion Fund (KILO) offers investors a convenient way to own physical gold without the need for a personal vault. This Canadian gold ETF provides exposure to gold prices through holdings of actual one-kilogram gold bars stored securely at the Royal Canadian Mint [1].

KILO Fund Details

As of October 24, 2024, KILO had assets under management of CAD 14.73 million [2]. The fund boasts competitive fees, with a management fee of 0.20% and an expense ratio of 0.23% [3]. KILO trades on the Toronto Stock Exchange under the ticker KILO.U [4].

KILO Investment Strategy

KILO aims to track the performance of the LBMA Gold Price AM – USD [5]. The fund offers physical exposure, meaning investors own parts of the underlying gold holdings [6]. This strategy provides a tangible connection to the precious metal.

KILO Historical Returns

KILO has shown strong performance, with a year-to-date gain of 32.28% as of 2024 [7]. The fund’s 1-year return stood at an impressive 40.97% , demonstrating its potential as a valuable addition to Canadian gold ETF portfolios.

Horizons Gold ETF (HUG)

Image Source: Horizons ETFs

The Horizons Gold ETF (HUG) offers investors exposure to gold prices through futures contracts. This Canadian gold ETF aims to track the performance of the Solactive Gold Front Month MD Rolling Futures Index ER [1].

HUG Fund Details

As of June 30, 2024, HUG had a total value of CAD 31.51 Million [2]. The ETF boasts a competitive management expense ratio (MER) of 0.34% [2]. HUG trades on the Toronto Stock Exchange under the ticker symbol HUG [2].

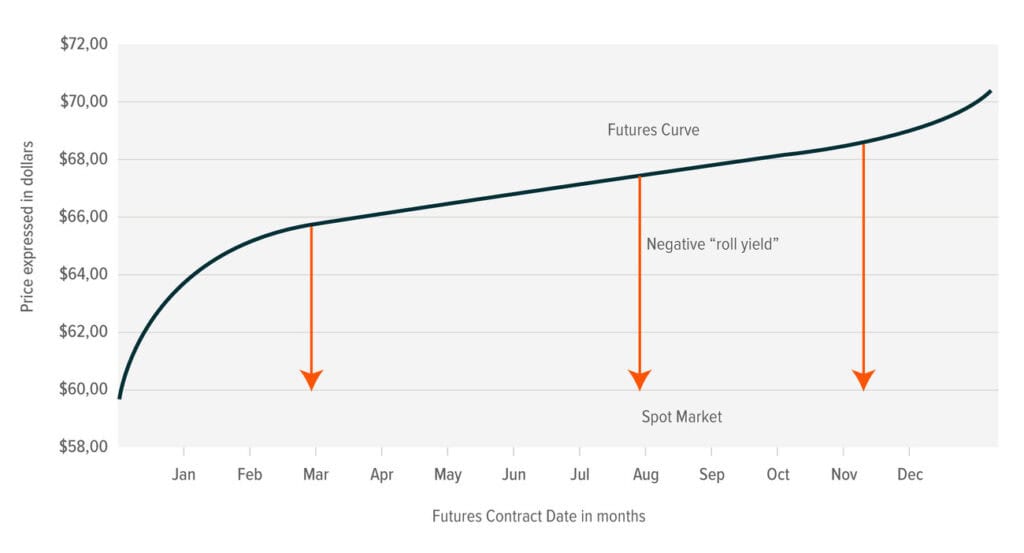

HUG Investment Strategy

HUG invests in gold futures contracts and hedges U.S. dollar gains or losses back to the Canadian dollar [1]. This strategy provides investors with a convenient way to gain exposure to gold prices without the need for physical storage.

HUG Historical Returns

HUG has demonstrated strong performance, with a year-to-date return of 25.72% as of 2024 [3]. The fund’s 3-year and 5-year annualized returns stood at 13.16% and 9.90%, respectively [3].

CI Gold Bullion Fund (VALT)

Image Source: ETF Market Canada – Cboe Canada

The CI Gold Bullion Fund (VALT) offers investors a cost-effective way to invest in physical gold bullion. This Canadian gold ETF aims to reflect the performance of gold prices, minus expenses.

VALT Fund Details

As of October 25, 2024, VALT had a net asset value of CAD 37.6316 per unit and total net assets of CAD 42.31 million [1]. The fund boasts competitive fees, with a management fee of 0.16% and a management expense ratio of 0.17% [2]. VALT trades on the Toronto Stock Exchange under the ticker VALT.B [3].

VALT Investment Strategy

VALT seeks to buy and hold substantially all of its assets in gold bullion [4]. This strategy provides investors with direct exposure to physical gold without the hassle of personal storage.

VALT Historical Returns

VALT has shown strong performance, with a year-to-date return of 25.54% as of 2024 [5]. The fund’s 1-year return stood at an impressive 39.11% [5], demonstrating its potential as a valuable addition to Canadian gold ETF portfolios.

Mackenzie Gold Bullion Fund (MNT)

Image Source: Mackenzie Investments

The Mackenzie Gold Bullion Fund (MNT) offers investors exposure to physical gold bullion. This Canadian gold ETF aims to track the performance of gold prices, providing a convenient way to invest in the precious metal.

MNT Fund Details

As of October 25, 2024, MNT had total net assets of CAD 667.63 million [1]. The fund has a competitive management expense ratio of 0.35% [1]. MNT trades on the Canadian stock exchange and is available in both Canadian and US dollars [2].

MNT Investment Strategy

MNT invests primarily in unencumbered, fully allocated gold bullion and permitted gold certificates [3]. The fund may also allocate a portion of its assets to cash and money market instruments [3]. This strategy provides investors with direct exposure to physical gold.

MNT Historical Returns

MNT has demonstrated strong performance, with a year-to-date return of 27.9% as of September 30, 2024 [4]. The fund’s 1-year and 3-year annualized returns stood at 38.3% and 14.1%, respectively [4], highlighting its potential as a valuable addition to Canadian gold ETF portfolios.

Ninepoint Gold Bullion Fund (GLDE)

Image Source: Ninepoint Partners

The Ninepoint Gold Bullion Fund (GLDE) offers investors a secure way to hold gold. This Canadian gold ETF aims to track gold prices, providing a convenient alternative for those seeking exposure to the precious metal.

GLDE Fund Details

As of September 30, 2024, GLDE had total net assets of CAD 42.31 million [1]. The fund boasts competitive fees, with a management fee of 0.16% and a management expense ratio of 0.17% [2]. GLDE trades on the Toronto Stock Exchange under the ticker VALT.B [3].

GLDE Investment Strategy

GLDE primarily invests in unencumbered, fully allocated gold bullion and permitted gold certificates [4]. This strategy allows investors to gain exposure to physical gold without the hassle of personal storage.

GLDE Historical Returns

GLDE has demonstrated strong performance, with a year-to-date return of 29.49% as of September 30, 2024 [5]. The fund’s 1-year return stood at an impressive 40.70% [5], highlighting its potential as a valuable addition to Canadian gold ETF portfolios.

Harvest Gold Yield ETF (HGY)

Image Source: www.globalx.ca

The Harvest Gold Yield ETF (HGY) offers investors exposure to gold prices while providing monthly income through a covered call strategy. This Canadian gold ETF aims to mitigate downside risk and generate consistent returns.

HGY Fund Details

As of October 25, 2024, HGY had a net asset value of CAD 16.45 per unit and total net assets of CAD 74.95 million [1]. The fund has a management expense ratio of 0.89% [2].

HGY Investment Strategy

HGY invests in a portfolio of securities that provide exposure to gold bullion prices, hedged to the Canadian dollar [3]. The fund employs a covered call option writing strategy on approximately 33% of its holdings to generate income [4].

HGY Historical Returns

HGY has demonstrated strong performance, with a year-to-date return of 25.73% as of October 25, 2024 [5]. The fund’s 1-year and 3-year annualized returns stood at 30.32% and 11.12%, respectively [5].

Royal Canadian Mint Gold ETR (MNT)

Image Source: The Royal Canadian Mint

The Royal Canadian Mint Gold ETR (MNT) offers investors a unique way to gain exposure to gold prices. This exchange-traded receipt (ETR) represents direct beneficial ownership of gold bullion held at the Mint’s facilities in Ottawa.

MNT Fund Details

MNT trades on the Toronto Stock Exchange in both Canadian (MNT.TO) and US dollars (MNT.U.TO). As of October 25, 2024, MNT.TO closed at CAD 39.26 [1]. The fund charges a competitive annual service fee of 0.35% for management, storage, and custodial services [2].

MNT Investment Strategy

MNT invests in physical gold bullion, providing investors with a secure and convenient way to own gold without the need for personal storage. The gold represented by MNT comes from the excess stored in the Mint’s refinery and production operations [3].

MNT Historical Returns

While specific historical returns were not provided, MNT has accurately tracked the price of gold bullion since its inception in 2012 [4]. The fund has demonstrated stability during recent market turmoil, effectively mirroring gold price movements [4].

Conclusion

The exploration of Canadian gold ETFs reveals a diverse array of investment options for those seeking exposure to the precious metal. These funds offer varying strategies, from physical gold holdings to futures contracts and covered call options, catering to different investor preferences and risk appetites. The performance of these ETFs has been impressive, with many showing strong returns in recent years, highlighting their potential to enhance portfolio diversification and act as a hedge against economic uncertainties.

As investors consider adding gold ETFs to their portfolios, it’s crucial to weigh factors such as management fees, investment strategies, and historical performance. The Canadian gold ETF market provides ample opportunities to gain from gold price movements while benefiting from the stability of the Canadian financial system. By carefully evaluating these options, investors can make informed decisions to align their gold investments with their overall financial goals and risk tolerance.

FAQs

What are the top gold ETFs in Canada for 2024?

As of the second quarter of 2024, the Middlefield Innovation Dividend ETF and the BMO Equal Weight Global Gold Index ETF were among the top performers. Additionally, the BMO Clean Energy Index ETF and the BMO Junior Gold Index ETF showed strong performance in May 2024.

Which gold ETF should I consider for a long-term investment?

For long-term investments, selecting a gold ETF involves considering factors like the fund’s historical performance, investment strategy, and management fees. It’s recommended to review and compare these aspects to find the best fit for your investment goals.

What are the leading Canadian gold stocks in 2024?

As of October 10, 2024, notable Canadian gold stocks include Perpetua Resources (TSX:PPTA), Jaguar Mining (TSX:JAG), Orvana Minerals (TSX:ORV), G2 Goldfields (TSX:GTWO), and Caliber Mining (TSX:CXB). These companies were selected based on their market capitalizations being greater than CAD 69.40 million.

What is the best ETF for holding gold?

Choosing the best ETF for holding gold depends on various factors including the fund’s liquidity, storage security, and the underlying assets. Investors should consider ETFs that directly hold physical gold or those that invest in gold mining companies, depending on their risk tolerance and investment strategy.

References

[1] – https://www.theglobeandmail.com/investing/markets/stocks/ONEB-T/pressreleases/28814390/why-gold-and-silver-are-surging-and-the-best-canadian-etfs-to-ride-the-momentum/

[2] – https://www.bmogam.com/ca-en/products/exchange-traded-fund/bmo-gold-bullion-etf-zgld/

[3] – https://www.fool.ca/investing/top-canadian-gold-etfs/

[4] – https://www.theglobeandmail.com/investing/markets/stocks/SPRE-A/pressreleases/28814390/why-gold-and-silver-are-surging-and-the-best-canadian-etfs-to-ride-the-momentum/

[5] – https://www.reddit.com/r/CanadianInvestor/comments/1fg2wty/bestetffor_gold/

[6] – https://www.theglobeandmail.com/investing/markets/stocks/TSM/pressreleases/28814918/top-5-etfs-to-own-now-and-into-2025/

[7] – https://www.morningstar.ca/ca/news/245170/3-great-canadian-etfs-for-2024-and-beyond.aspx