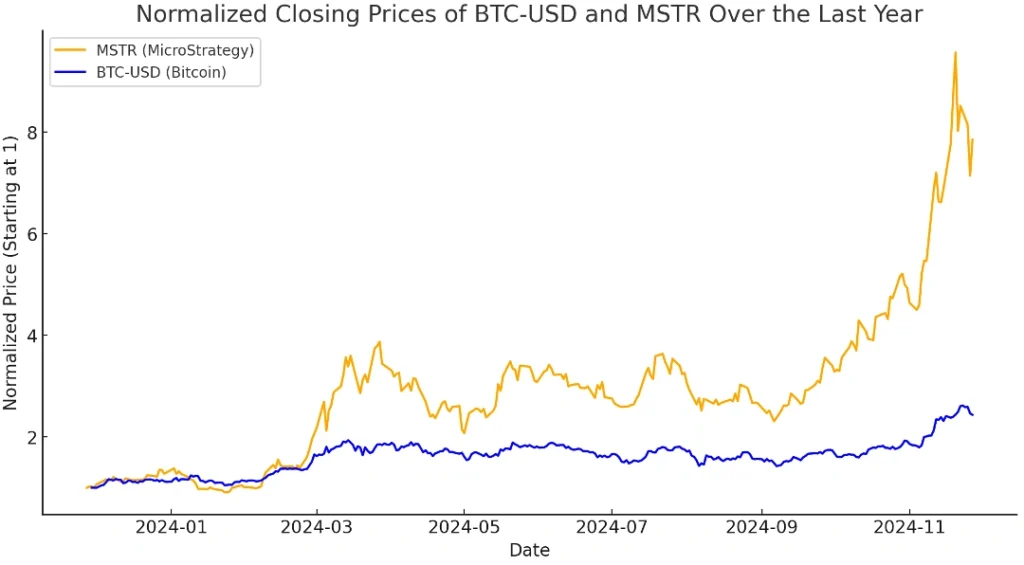

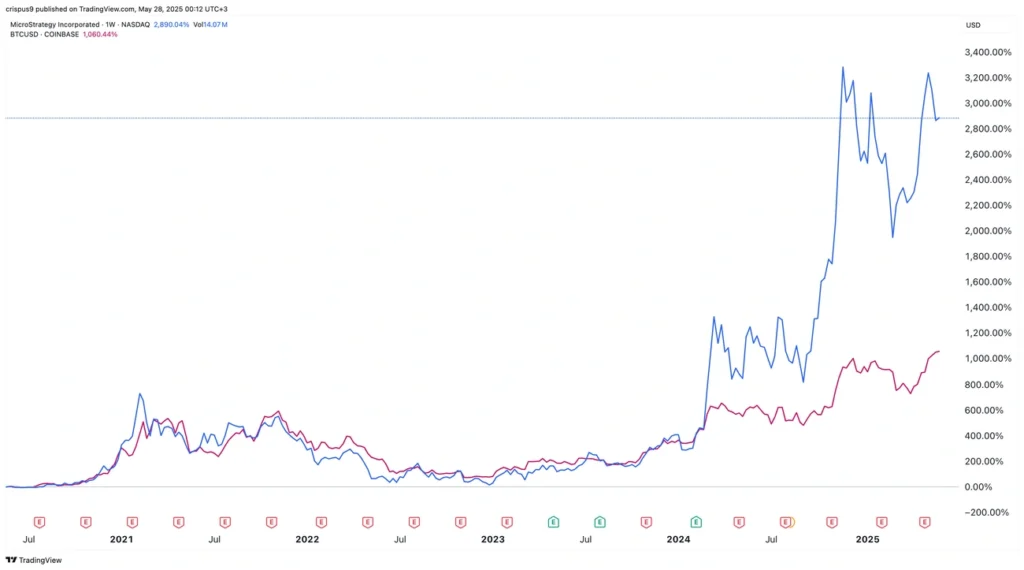

MSTR stock’s value has shot up by over 2,200% since August 2020. This growth started right after the company began investing in Bitcoin.

The stock’s incredible performance has grabbed investors’ attention worldwide. MicroStrategy—now known as Strategy—holds the title of largest corporate Bitcoin owner with Bitcoin worth about $60 billion. The impressive gains come with their share of ups and downs though. The company reported a $5.9 billion unrealized loss in Q1 2025 because of Bitcoin’s price swings.

Table of Contents

Our years of investment experience show MSTR stock’s price moves hand in hand with Bitcoin. This creates chances to profit but also brings risks to traders. Some smart trading methods with MSTR stock can bring in weekly income between $17,000 to $18,000 through covered calls and rolling trades. The decision to buy MSTR stock really comes down to how much risk you can handle and what you want from your investments. We’ll help you figure that out in this piece about making smart MSTR investment choices.

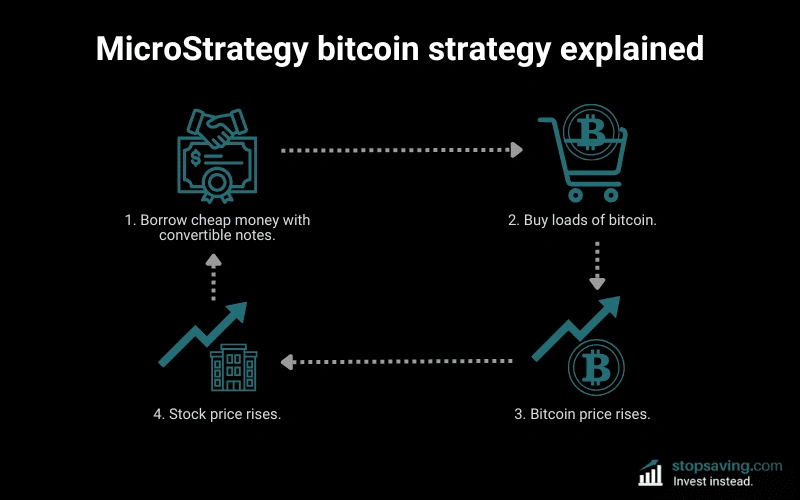

Understanding MSTR and Its Business Model

Image Source: Stopsaving.com

MicroStrategy started out far from the Bitcoin world that now shapes its public image. Michael J. Saylor, Sanju Bansal, and Thomas Spahr founded the company in 1989. They built it as a business intelligence (BI) and analytics provider [1]. The company grew steadily through the 1990s by securing data-mining contracts with major clients like McDonald’s. They went public in 1998 [2].

MicroStrategy’s software and analytics roots

The company’s core business was developing specialized software that helps organizations analyze internal and external data to make better business decisions [1]. Their main platform comes with several powerful features:

Interactive dashboards and scorecards

Automated report distribution

Ad hoc queries and data visualization tools

Thresholds and alerts for business monitoring

This technology base put MicroStrategy up against major players in the business intelligence space, including SAP AG Business Objects, IBM Cognos, and Oracle Corporation’s BI Platform [1]. The company almost went bankrupt from an accounting scandal in 2000. They bounced back and gradually moved toward cloud analytics [2].

Their software architecture stands out with its relational online analytical processing (ROLAP) approach. Users can “drill anywhere” in databases down to transaction-level details [3]. The system’s single common metadata streamlines maintenance and keeps reports consistent [3].

Bitcoin as a treasury asset

August 2020 changed everything. MicroStrategy announced they would invest $250 million of their cash reserves into Bitcoin [1]. This bold move, led by Saylor, kicked off an incredible transformation. They made this decision because of concerns about falling cash returns, a weakening dollar, and other economic factors [1].

MicroStrategy didn’t stop at one purchase. They kept buying Bitcoin aggressively. By December 2024, they owned 423,650 bitcoins worth about $42.43 billion, making them the largest corporate holder of the cryptocurrency [1]. Their position grew even more by June 2025, reaching around 582,000 bitcoins [4].

The company used an innovative financial approach to fund these massive purchases. They started with cash reserves and later issued billions in zero-coupon convertible notes and new equity [2]. This strategy turned MSTR stock into what Saylor calls a “leveraged bet on digital gold” [2].

They created the concept of “bitcoin yield” to show the increase in Bitcoin holdings per share over time [5]. This helps investors track how well the company grows its Bitcoin position compared to its share count [2].

Rebranding to Strategy and what it means

MicroStrategy made a big announcement on February 5, 2025. They would now do business under a new name: Strategy [6]. This wasn’t just a new logo – it showed how much the company had changed.

The announcement described them as “the world’s first and largest Bitcoin Treasury Company” [6]. They still develop and sell their Strategy One analytics suite with AI-powered business intelligence tools, but Bitcoin has become their main focus [2].

The new name shows a simpler, clearer company mission. Saylor explained it well: “Strategy is one of the most powerful and positive words in the human language. It represents a simplification of our company name to its most important, strategic core” [7].

This change has completely transformed how investors see MSTR stock. The company’s software business brings in about $463 million yearly, but that’s nowhere near their Bitcoin holdings of around $63 billion [2]. Many investors now see MSTR stock as a way to get Bitcoin exposure through traditional brokerage accounts [5].

MSTR’s stock price now moves closely with Bitcoin, while offering something different from direct cryptocurrency ownership. The company joined the Nasdaq-100 index on December 23, 2024, which confirmed its unique position as a bridge between traditional markets and cryptocurrency [1].

How to Buy MSTR Stock Step-by-Step

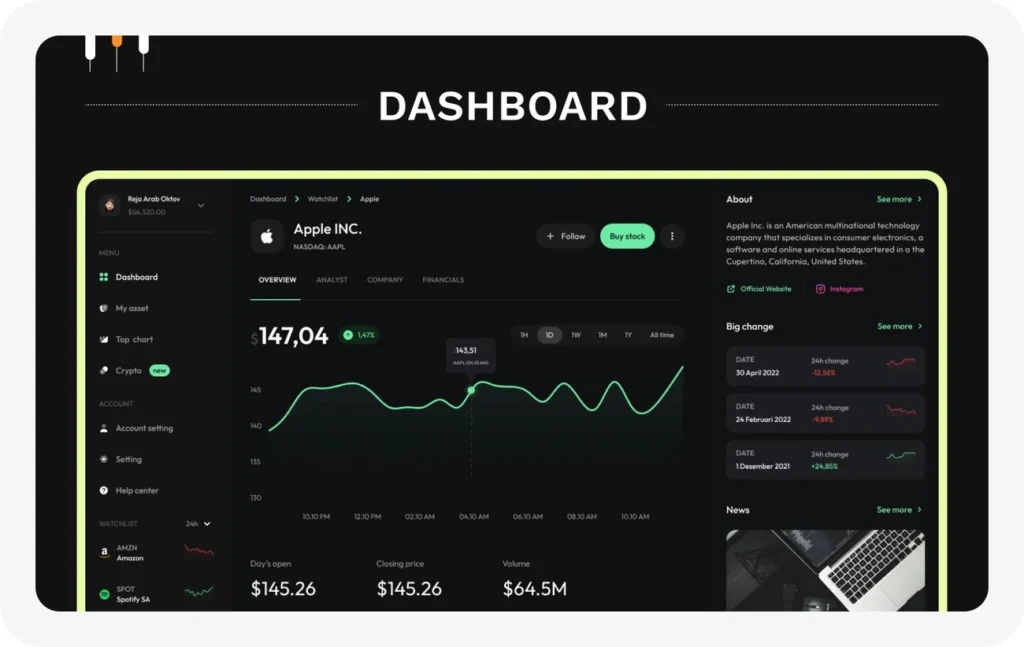

Image Source: Mind Studios

Buying MSTR stock is a simple process that works for most publicly traded companies. MSTR’s position as a Bitcoin treasury company makes it an attractive option for many investors. Here’s how you can buy the stock from start to finish.

Open a brokerage account

You’ll need a brokerage account with access to the NASDAQ market where Strategy (formerly MicroStrategy) is listed before buying any shares. Several online brokers provide this service with different features and fee structures.

These factors should guide your broker selection:

Trading fees (many now offer zero-commission trading)

Platform usability and mobile app quality

Research tools and educational resources

Customer service reputation

Account minimums and maintenance fees

The account opening process with your chosen broker includes:

Completing an online registration form with your personal information

Providing identification documents for verification purposes

Answering questions about your investment experience and financial situation

Setting up security credentials for your account

Most brokers can verify and approve your account within minutes, though sometimes it takes a few days [8].

Search for the MSTR ticker

Finding MSTR stock is straightforward once your brokerage account is ready and funded:

Log into your brokerage account

Go to the trading section of the platform

Look for a search bar at the top of the screen

Type in either “MSTR” (the stock’s ticker symbol) or “Strategy” (the company name)

The results will show MSTR’s current stock price and other vital information like daily price movement, volume, and market capitalization [9]. Many platforms display simple charts and analysis of MSTR stock forecast data on this page.

Choose order type and number of shares

This is where you make your key decisions about share quantity and order type.

Two main options exist for order types:

Market Order: Buys the stock right away at the best available current price. This option puts speed first over exact pricing and usually executes instantly [10].

Limit Order: Lets you set a maximum price for each share. The order executes only when MSTR’s price reaches or drops below your limit. This gives better control but might take longer to complete [11].

Your share quantity should reflect:

Your overall investment budget

MSTR’s desired portion in your portfolio

Your risk comfort level (considering MSTR’s link to Bitcoin’s volatility)

Modern brokers now offer fractional shares, so you can invest a specific dollar amount instead of whole shares [8].

Review and place your order

Take a final look at all details before completing your purchase:

Verify the stock symbol (MSTR) is correct

Double-check the order type (market or limit)

Confirm the quantity of shares or investment amount

Review any applicable fees

For limit orders, verify your price threshold

Submit your order after checking these details. Market orders typically confirm within seconds. Limit orders notify you once your price conditions are met and execute [9].

Keep track of your investment’s performance after buying MSTR stock. The company’s large Bitcoin holdings make it important to stay updated on both MSTR news and Bitcoin price movements for smart investment decisions.

MSTR’s stock price tends to move with Bitcoin’s performance, and understanding this relationship helps predict possible investment volatility.

What to Know Before You Invest

Image Source: Seeking Alpha

You need to know what makes MSTR stock unique before investing your money. This stock isn’t like others – it comes with special factors that could affect your investment returns.

Volatility due to Bitcoin exposure

The stock’s volatility numbers tell an interesting story. MSTR shows a 30-day historical volatility of about 113%, which is more than twice Bitcoin’s 55% [12]. These wild price swings happen because the company’s balance sheet is almost entirely Bitcoin – over 99.5% [5].

The company uses what experts call “torque” to Bitcoin price movements. This strategy makes gains and losses bigger than just holding Bitcoin. MSTR’s volatility makes up 87.5% of its total returns [12]. This makes it much riskier than typical investments.

Financial experts like Peter Schiff worry about bankruptcy risks if Bitcoin prices crash [13]. While this is a worst-case scenario, it shows how risky MSTR’s strategy can be. The company has built up enough assets compared to what it owes. Bitcoin would need to drop by about 80% for MSTR’s assets to fall below its debts [14].

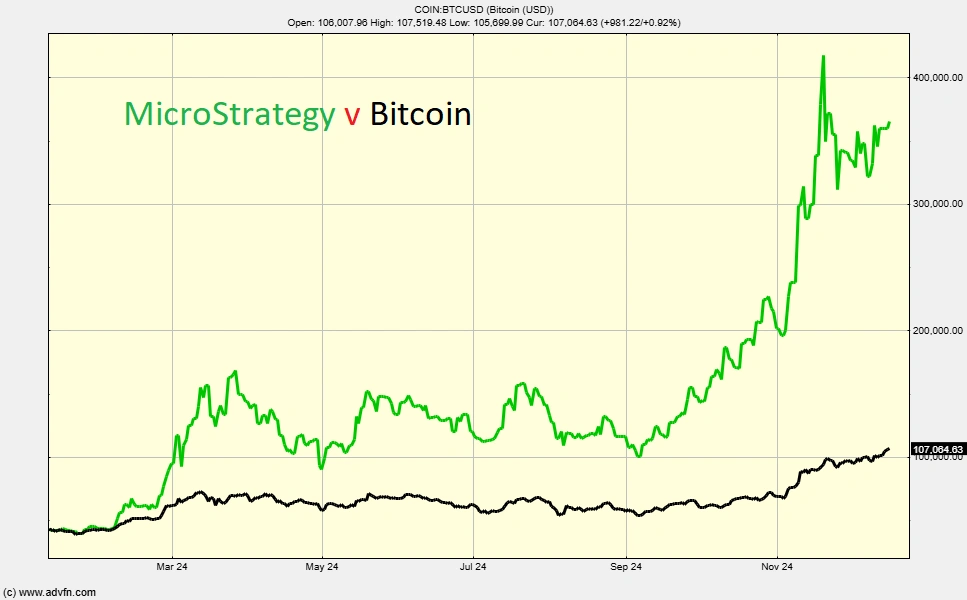

MSTR stock price correlation with BTC

The link between MSTR’s stock price and Bitcoin is complex but vital to understand. MSTR has kept a correlation of 0.52 to Bitcoin in the last year with a beta of about 1.77 [12]. When Bitcoin goes up, MSTR usually rises even more.

Different time periods show interesting patterns. The yearly correlation between MSTR and Bitcoin stays fairly steady at 0.6 to 0.69 [15]. Shorter periods show more changes. Quarterly numbers range from 0.5 to 0.75, while monthly figures swing between 0.3 and 0.9 [15].

Weekly numbers vary even more, going from -0.8 to almost 1.0 [15]. This explains why MSTR sometimes moves differently from Bitcoin. Investors who want Bitcoin exposure through regular markets should know about this imperfect relationship.

Recent data backs up this strong connection. MSTR and Bitcoin show a 0.77 correlation this year, but only 0.35 with the SPDR S&P Software and Services ETF [16]. Since late 2020, MSTR’s correlation with Bitcoin has reached 0.92 [16].

MSTR stock split history and implications

MSTR did a 10-for-1 stock split through a stock dividend on August 8, 2024 [17]. This was the company’s third split since going public in 1998 [1]. Here’s the full split history:

August 8, 2024: 10-for-1 forward split

July 31, 2002: 1-for-10 reverse split

January 27, 2000: 2-for-1 forward split [1]

One MSTR share bought before January 2000 equals two shares today [1].

The company wanted to make its stock more available to investors and employees with this recent split [3]. The stock price dropped from about $1,450 to $145 after the split, making it easier for smaller investors to buy [3].

The stock split doesn’t change what the company’s worth. As one analyst put it, “if a stock was trading at $1000 per share, a 10-for-1 stock split would make it trade for $100” [18]. Still, these splits often attract more retail investors who thought the previous price was too high.

Analyzing MSTR’s Financial Health

Image Source: Yahoo Finance

Perusing MSTR’s balance sheet shows a financial picture unlike any other publicly traded company. The shift from a pure software business to a Bitcoin treasury has completely changed how investors should analyze this stock.

Revenue from software vs. Bitcoin gains

MSTR’s core software business and Bitcoin holdings create an interesting financial profile. The software segment brings in about $463 million yearly revenue, which is just a small part of its total market value. The company’s Bitcoin holdings, worth around $63 billion, make up most of its market value.

This gap keeps growing as we focused mainly on Bitcoin acquisition. The quarterly reports now show two main revenue sources:

Enterprise software revenue ($134.2 million in Q4 2024)

Bitcoin impairment recovery ($24.3 million in Q4 2024)

The software segment grew about 10% year-over-year, giving the company a stable foundation. Yet this business makes up less than 1% of the company’s total assets. Traditional financial metrics like price-to-earnings ratios don’t mean much when evaluating MSTR stock anymore.

Recent earnings and losses

The earnings reports show how Bitcoin strategy brings extreme volatility. Q1 2025 saw an unrealized loss of $5.9 billion due to Bitcoin price changes. Other quarters brought multi-billion dollar gains when Bitcoin prices went up.

The financial statements now feature:

Traditional operating income/loss from software business

Bitcoin impairment charges (non-cash accounting losses)

Gains from Bitcoin sales (when applicable)

During 2024, quarterly changes exceeded $2 billion either way, mostly based on Bitcoin’s performance. Interest expenses from convertible notes used to buy Bitcoin reached about $200 million yearly, creating big fixed costs.

MSTR stock now trades mainly as a leveraged Bitcoin play instead of a software company. Quarterly results just reflect Bitcoin price moves, while the software business provides stable operations.

Is MSTR a good stock to buy?

Your point of view on Bitcoin’s future largely determines if MSTR is worth investing in. Investors bullish on Bitcoin might like MSTR because it offers:

Bitcoin exposure through traditional brokerage accounts

Potential tax advantages compared to direct cryptocurrency ownership

Professional management of the Bitcoin treasury

These benefits come with some trade-offs to think about. The leverage effect means MSTR’s stock price usually moves more than Bitcoin itself—both up and down. You’re also buying the underlying software business and its risks along with Bitcoin exposure.

MSTR trades at about 5-15% premium to its net asset value (Bitcoin holdings minus debt). This premium shows market confidence in Strategy’s management and future Bitcoin buying plans.

The choice to invest in MSTR stock should match your overall investment thesis on Bitcoin. If you think Bitcoin will rise a lot over time, MSTR could be an attractive option with extra upside from leverage. If you’re doubtful about Bitcoin’s future, MSTR amplifies those downside risks.

The company’s spot in the S&P 500 has brought more institutional investors, which might mean more stability than direct crypto investments. This comes with corporate governance factors and depends on management’s strategic choices.

Managing Risk and Setting Goals

MSTR stock investments require careful risk management because of its unique position as a Bitcoin proxy. You need thoughtful planning to protect your capital and benefit from growth opportunities due to its extraordinary volatility.

Broadening your portfolio

MSTR’s substantial Bitcoin investment has made its stock much more volatile. The stock now depends heavily on cryptocurrency market trends [19]. Broadening your investments becomes vital when you add MSTR to your portfolio. You should:

Keep your MSTR position size smaller than your typical stock allocations

Balance your portfolio with assets that have low correlation in multiple sectors

Add traditional stable investments to offset the risk of holding volatile technology stocks [20]

This strategy helps protect your overall portfolio from MSTR’s extreme price swings while you stay exposed to potential gains.

Understanding your risk tolerance

Take an honest look at how comfortable you are with volatility before buying MSTR stock. The stock shows both systematic (market) and unsystematic (company-specific) risks [21]. The stock suits investors with high risk tolerance best.

Other investment opportunities make more sense if you’re close to retirement or dislike risk [9]. However, if you can stomach substantial risk, adding a small portion of MSTR could make an interesting addition to a well-spread portfolio.

Setting long-term vs. short-term goals

Your investment timeframe shapes how you should handle MSTR stock. The shares typically need at least a decade of holding to maximize returns [22]. You might want to look at shorter alternatives if you’re not ready for the long haul.

Short-term traders should use strict stop losses because MSTR is highly volatile [20]. The stock has critical support levels at $296.86 and $250.51, with key resistance at $335.72 and $383.00 [19]. Price trends can change dramatically when movement goes beyond these points.

You should define your investment goals before making a purchase. Clear goals help you decide how much capital to invest and how long to hold. This clarity lets you ride out the inevitable volatility that comes with owning MSTR stock.

Tracking Performance and Forecasts

Image Source: BanklessTimes

MSTR stock requires careful monitoring of technical indicators and market sentiment. The stock’s unique connection with Bitcoin means traditional monitoring methods need adjustments for this volatile investment.

MSTR stock price prediction trends

MSTR price forecasts vary widely, with analyst targets between $175.00 and $650.00 [23]. Technical analysis suggests a “buy” rating, and the 1-week rating shows a “strong buy” signal [23]. The stock showed impressive returns of 32.20% year-to-date and 156.01% in the last 12 months [24].

MSTR’s historical performance catches the eye of long-term investors. The stock delivered an annualized return of 36.05% in the last decade, which is a big deal as it means that it outperformed the S&P 500’s standard of 11.05% [25]. This comes with its share of risks—MSTR has a 30-day volatility of 13.45% [25].

MSTR news and market sentiment

MSTR stock hit record levels of short interest, which signals bearish sentiment [6]. This high short interest could trigger increased volatility, especially if prices rise unexpectedly and cause a short squeeze [6].

The stock’s technical chart shows a “Cup and Handle” pattern—traders call it a bullish continuation signal [6]. Watch for resistance levels at $393.00, $404.00, and $416.00, as these could spark a breakout [6].

MSTR stock forecast from analysts

The 17 analysts covering MSTR give it a consensus “Buy” recommendation [7]. Their average target price sits at $527.20, suggesting room for growth from current levels [7]. The ratings break down to 12 “Buy,” 4 “Overweight,” and 1 “Sell” [7].

The positive analyst outlook comes despite MSTR’s latest quarterly earnings disappointment. The company reported earnings of -$16.49 per share against an estimate of -$2.44, missing expectations by -575.42% [23].

Conclusion

MSTR stock gives investors a unique chance to get Bitcoin exposure through traditional markets. The company’s journey from a software business to becoming the world’s largest corporate Bitcoin holder is remarkable. This radical alteration has created huge growth potential and major risks.

You won’t find anything quite like MSTR stock in the digital world. The company makes use of leverage to buy Bitcoin, which can lead to bigger returns than owning cryptocurrency directly. Getting Bitcoin exposure through regulated stock markets works better for traditional investors who aren’t comfortable with crypto exchanges.

All the same, you need to be ready for wild price swings. MSTR’s price changes are a big deal as it means that they go beyond Bitcoin’s own moves. This makes it a better fit for investors who can handle high risks. Smart investors should limit their position size and keep their portfolios well-diversified when adding MSTR.

Your investment timeline plays a key role in strategy. Long-term investors often see market dips as chances to buy more. Short-term traders need strict stop-loss orders to protect their money during sharp drops.

The real key to successful MSTR investing lies in understanding its dual nature – a small software operation plus a massive Bitcoin treasury. So you’ll need to track both Bitcoin prices and company news to make smart decisions.

MSTR’s place in your portfolio ended up depending on your risk tolerance, investment goals, and Bitcoin outlook. Past returns look great, but future results will stay closely tied to crypto markets. Take time to check your comfort with volatility and make sure MSTR fits your overall financial plan.

MSTR’s transformation stands out as one of the most interesting corporate changes in recent financial history. Whatever you decide about investing, watching this bold experiment will teach us more about how traditional markets and digital assets work together.

FAQs

Q1. How can I start trading MSTR stock as a beginner? To begin trading MSTR stock, open a brokerage account, search for the MSTR ticker, choose your order type and number of shares, then review and place your order. Start with small investments and gradually increase as you gain experience and understanding of the stock’s behavior.

Q2. What makes MSTR stock unique compared to other stocks? MSTR stock is unique due to its significant Bitcoin holdings. The company has transformed from a software business into the world’s largest corporate Bitcoin holder, making its stock price closely correlated with Bitcoin’s performance and more volatile than traditional stocks.

Q3. How does MSTR’s stock price correlate with Bitcoin? MSTR’s stock price shows a strong correlation with Bitcoin, typically exhibiting more dramatic movements than Bitcoin itself. The correlation coefficient between MSTR and Bitcoin has been as high as 0.92 since the end of 2020, making MSTR essentially a leveraged play on Bitcoin’s price.

Q4. What should I consider before investing in MSTR stock? Before investing in MSTR, consider your risk tolerance, as the stock is highly volatile. Understand the company’s business model, which now primarily revolves around Bitcoin holdings. Also, think about your investment timeframe and how MSTR fits into your overall portfolio diversification strategy.

Q5. How do analysts view MSTR stock’s future prospects? Analysts generally have a positive outlook on MSTR stock, with a consensus recommendation of “Buy”. The average target price represents significant upside potential from current levels. However, keep in mind that the stock’s performance is heavily tied to Bitcoin’s price movements and overall cryptocurrency market trends.

References

[1] – https://companiesmarketcap.com/microstrategy/stock-splits/

[2] – https://www.investopedia.com/what-does-strategy-formerly-microstrategy-do-11750239

[3] – https://www.nasdaq.com/articles/microstrategys-10-1-stock-split-imminent-10-things-you-need-know

[4] – https://www.nasdaq.com/articles/fundamental-problem-microstrategys-bitcoin-buying-plan

[5] – https://www.coindesk.com/opinion/2024/12/04/mstr-vs-btc

[6] – https://www.ainvest.com/news/strategy-mstr-stock-hits-record-short-interest-bearish-sentiment-potential-short-squeeze-2506/

[7] – https://www.marketwatch.com/investing/stock/mstr/analystestimates

[8] – https://brokerchooser.com/education/stocks/how-to-buy-microstrategy-shares

[9] – https://www.fool.com/investing/how-to-invest/stocks/how-to-invest-in-microstrategy-stock/

[10] – https://stockinvest.us/how-to-buy-microstrategyorporated-stock

[11] – https://coincodex.com/stocks/how-to-buy-MSTR/

[12] – https://www.vaneck.com/us/en/blogs/digital-assets/matthew-sigel-deconstructing-strategy-mstr-premium-leverage-and-capital-structure/

[13] – https://www.ainvest.com/news/microstrategy-faces-bankruptcy-risk-bitcoin-drops-50-2506/

[14] – https://bitwiseinvestments.eu/blog/crypto-research/is-micro-strategy-a-risk-for-bitcoin/

[15] – https://www.forbes.com/sites/digital-assets/2025/03/25/what-is-the-correlation-between-btc-and-mstr/

[16] – https://www.marketwatch.com/story/microstrategys-stock-surges-to-highest-price-this-year-as-bitcoin-regains-100k-418cd845

[17] – https://www.strategy.com/press/microstrategy-announces-10-for-1-stock-split_07-11-2024

[18] – https://www.axios.com/2024/07/12/microstrategy-s-stock-split-crypto

[19] – https://www.coinspeaker.com/guides/microstrategy-stock-price-analysis-and-forecast/

[20] – https://www.ig.com/en/news-and-trade-ideas/_a-lesson-in-fomo–microstrategy-stock-price-continues-to-soar-241121

[21] – https://www.macroaxis.com/invest/advice/MSTR

[22] – https://www.ig.com/uk/trading-strategies/how-to-buy-microstrategy-stock–an-investment-guide-250421

[23] – https://www.tradingview.com/symbols/NASDAQ-MSTR/

[24] – https://www.financecharts.com/stocks/MSTR/performance

[25] – https://portfolioslab.com/symbol/MSTR