Making Money with Crypto In 2023

Cryptos are certainly in the news a lot lately. It is not unheard of to see yearly increases of thousands or even millions of percent. We have compiled a list on how to make money with cryptocurrency and blockchain. Updated for 2023.

Article Summary – 8 Ways To Make Money In Cryptocurrency:

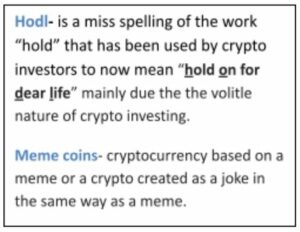

- Investing (HODL)

- Day Trading Crypto

- Cryptocurrency Mining

- Staking and Lending

- Non Fungible Tokens (NFTs)

- Social Media for Cryptos

- Forks and Airdrops

- Accepting Crypto as Payment

The three top cryptos have seen one-year returns of:

- 320.97% Bitcoin

- 937.31% Ethereum

- 2311.33% Binance Coin

With these kinds of returns possible even for the top trading coins, fortunes and success stories are being made. Let’s be honest, the majority are getting into the crypto field to make money, but not all are doing that. Many are making bets in the crypto casino; they are not investors but gamblers.

Gamblers are not following sound investing principles; they are buying cryptos that they know nothing about except that it is in the news, falling into a FOMO (fear of missing out ) trap, or worse yet, attempting to trade cryptos when they don’t know what they are doing.

With this article, we wanted to present some of the best ways to make money from cryptos. Crypto is still a market in its infancy, with coins being introduced every day.

Some coins are worthwhile, while others have the moniker “Sh*tcoin” for a reason. Don’t be the man or woman that bets everything and loses, there are many ways you make money, so let’s get on with it.

The four main crypto investing types with their own subtypes

- Investing and Trading in a crypto exchange market. There are several services available to buy cryptos which are much like stocks, futures, and forex services.

- Mining of new coins- Some blockchains produce new coins through a process of “mining.” Miners will set up specialized computer systems that attempt to solve problems in order to win rewards for their work on the system.

- Staking and loaning coins that you already own. Several of the coins are used by their networks for conducting different kinds of transactions, this requires owners of coins to “stake” their possessed coins, and for this, they will be rewarded for work done on the system.

- Additional Investing Avenues- there are other investments and ways to make money tied to blockchain technology and cryptos that can be lucrative gaining new coins.

These four mechanisms make up the strategies for building wealth with cryptos. Let’s go a bit deeper into how to make money with cryptocurrency and the many investment possibilities.

8 Ways On Making Money With Cryptocurrency in 2023

1. Investing (HODL)

Investing is the long-term strategy for making money with crypto. Quite simply, buying a crypto an investor believes has the potential to rise in value.

The most common way to make money with cryptocurrency: You buy a coin at a low price and hold onto it until its value increases, then sell it at a higher price to make a profit.

Many crypto assets are well suited for a buy-and-hold strategy(as you can see from the top 3 cryptos above). They are, however, highly volatile in the short term (20% swings in a day) but have tremendous long-term potential for growth.

Investing should not be in a single coin but identifying multiple stable assets likely to stand the test of time. The top three investments above likely fit this category, and most of the non-meme coins in the top ten market cap have potential.

There are also new ETFs and mutual funds opening up for cryptos which is an easy way to get into the market while letting a professional trader do all the research and make the hard decisions.

For those just wanting to dip their foot into the crypto waters, these may be a good option.

We advise you to look at all crypto and blockchain investing the same way as any other investing.

You must understand what you are buying; do research into a project, if they are doing something that is unique or different to the rest of the industry, have a strong team behind them that is regularly progressing, has a decent liquidity and market cap, and has not already seen a considerable price spike you might have a winner.

You should have a reason for buying it at the price you are paying (especially if you are purchasing a meme coin). If there are some other coins that have promise, these can be added as a small portion of a portfolio as more risky bets.

A portfolio should be reevaluated regularly to move assets if needed, and where possible, stop losses should be set to prevent significant losses in market downturns.

2. Day Trading Crypto

While investing involves the long-term buy-and-hold strategy, trading exploits short-term opportunities. Because the crypto market is volatile, asset prices can increase and decrease dramatically over the short term.

A successful crypto day trader needs to have proper analytical and technical skills, analyzing their listed crypto’s market chart performance and then making accurate predictions about price increases or decreases.

Traders can take long or short positions, depending on their expectations; long if they expect the price to rise and short if they think it will fall, which allows them to profit in an up or down market.

Day trading in cryptos is often a more wild ride than any other type of trading due to its volatility.

If the trader is adding in leverage (buying on margin) to their trading, they can make both enormous gains but also expose themselves to enormous losses. With any financial trading, sound principles are warranted;

- have a trading plan

- have a reason for any trade

- have a defined exit point strategy on the high and low end (setting stop losses is key)

- never risk in one trade more than you can afford to lose

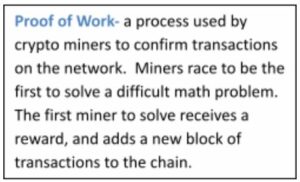

3. Cryptocurrency Mining

Mining is the process that creates many new cryptocurrencies. Bitcoin has the most famous mining system, but it is highly competitive and requires hardware that can be costly.

Mining is the crucial component of the Proof of Work mechanism. Newly minted crypto is provided to the winning miner increasing the total supply available.

Mining requires technical expertise with upfront and ongoing investment in specialized hardware.

The same hardware can often be used for different coins so once a bitcoin rig is no longer suitable for bitcoin mining, it can be moved to another coin that requires less capability and the miner can still make profits.

The most popular cryptocurrencies to mine are:

- Bitcoin

- Ethereum

- LiteCoin

- Dogecoin

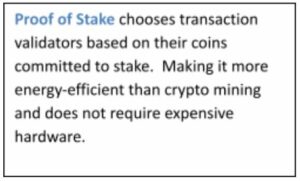

4. Staking and Lending

Staking

Staking is a second way for crypto transactions to be validated. A “staker” is the owner of coins but will not spend/trade them; they lend them to the network for use, locking them for a defined period of time.

A Proof of Stake (PoS) network uses the coins and some computing power supplied by the staker to keep the network secure and running, and for their staking, the staker will receive rewards.

Ethereum is moving to a PoS system, and a staker must provide 32ETH to participate, this is currently over $150,000 (other coins require much less for staking). Smaller investors can still participate in “staking pools,” combining funds with other investors to reach the needed 32ETH.

The reward received for a Staker is similar to a bank’s interest rate, but also gaining from any coin price increase.

Some examples of proof-of-stake cryptocurrencies you can consider:

- Cardano (ADA)

- Solana (SOL)

- Polkadot (DOT)

- Terra (LUNA)

- Tezos (XTZ)

Lending

Coins of nearly any type can also be lent to other investors (usually for short sales and leverage), the original owner generates interest on their loan to the other investor.

There are many platforms facilitating crypto lending.

Some cryptocurrency lending platform examples:

- Blockfi

- Celsius

- AAVE

- Compound

- MakerDAO

- CoinLoan

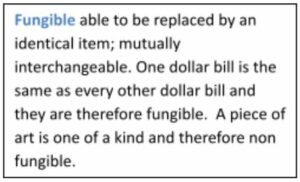

5. Non Fungible Tokens (NFTs)

Non Fungible Tokens (NFTs) are one-of-a-kind digital assets. They have become a hot item in the past year, with collectors willing to pay millions of dollars for them.

While any bitcoin has the same value as any other bitcoin, NFTs are of a different sort. They are potentially one of a kind, unique, can have a chosen number of copies, say 500 or just a few, or there can be millions of similar coins.

They are comparable to digital baseball cards or art for the modern world. What makes NFTs so interesting is that they can have rules and attributes written into their code.

So not only do you have digital text, picture, gif, or video.

But you can also program in rules for their exchange, such as the original maker will get a percentage of every transfer of the NFT going forward.

Esports, professional wrestling, and other entertainment groups are getting in on the NFT act with the NBA leading the march.

The NBA/WNBA has created video NFTs, which are called digital Moment™ Collectibles that range in common to very rare. The rare NFT owner may have one of 499(or less), and these can be individually numbered too, making specific numbers more desirable.

Serial number 1 of the above Kevin Durant Dunk NFT sold for $19,999 recently, and this is not the most expensive NFT by a long shot.

The art industry seems to demand and get the highest prices for NFTs, with a recently famous NFT being the following….

Yes REALLY!

CryptoPunk was a bit of a publicity stunt where the original artist sold it to himself in a circular transaction, making it the most expensive NFT and any type of art ever sold.

There are real buyers for art NFTs . Beeple, Everydays—The First 5000 Days was sold by Christies’s for $69 million, in March 2021.

If you are interested in making NFTs there are several services that can help you create them and have markets for selling NFTs created.

One Popular NFT marketplace is called OpenSea. You can also find and trade NFTs for just about anything you can imagine, but they may or may not have any current or future value.

Just like any other collectible, the NFT market can be very volatile, and those that are experienced and know what to buy can be successful.

The worry is that NFTs are just a fad and that the market will disappear overnight. Those willing to trade in these assets are warned to be very careful.

6. Social Media For Cryptocurrency

There are several blockchain-based social media platforms that will reward users for creating and curating social media content. Your work will often be rewarded with the native coin of the platform. Of these, the most well known is SOLA,

Think Tinder meets Instagram. Sola is a decentralized social network using the SOL token, a Crypto that is earned for creating content on the platform.

For influencers that have a large following, this can be a lucrative additional income stream, if the coin becomes a hit, even better. This could also be a good place for those new to the influencer market not to have as much competition.

7. Forks and Airdrops

A blockchain will fork because of changes or upgrades in its protocol that creates new coins. If you hold coins from the original chain when the chain forks, you will typically get free tokens on the new network.

A fork can be much like a stock that announces a dividend for current shareholders; you get a free coin just by being in the right place at the right time.

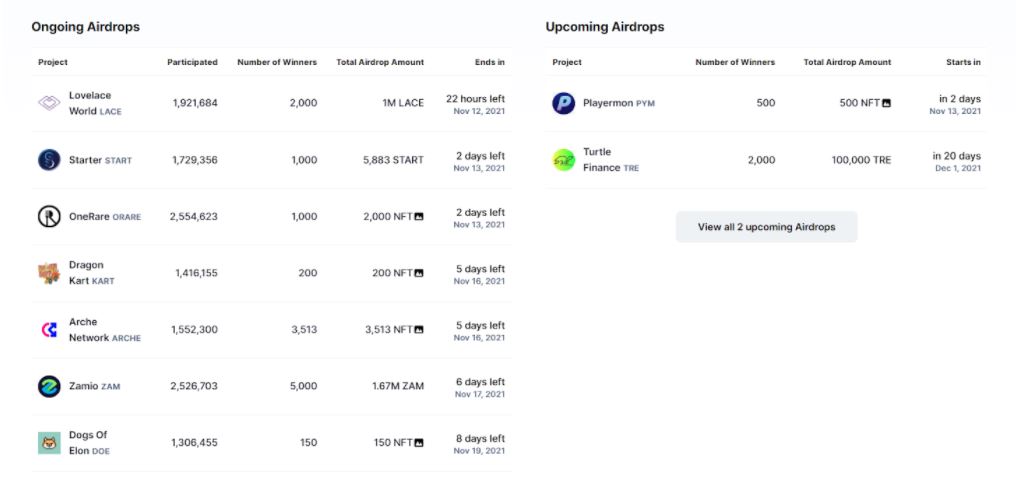

Airdrops and free tokens are often distributed to generate awareness for the project. An exchange like coinmarketcap.com might also do an airdrop creating a large user base for a project.

Being part of an airdrop gets you a free coin, which you can then use to buy something, invest, or trade.

8. Accepting Crypto As Payment

Accepting cryptocurrency as payment: If you own a business, you can accept cryptocurrency as payment for goods or services. Many business are not accepting Cryptocurrencies as payment. There are pros and cons to this.

One Pro is that all transaction are final once the payment has been received. The sender cannot reverse the payment like with a credit card.

One Con is, the value of cryptocurrency can fluctuate significantly, so you may need to convert it to your local currency to determine its value and that the value could drop before you convert the crypto to a local currency adding more risk to your business.

Summary

All of the above methods for making money with cryptos and blockchain technology are potential avenues to success. While some of them may appear “easy,” you should not be fooled into believing this is so. Some of the above methods to make money in cryptocurrency are complex and risky. Just because a crypto or NFT has gained in value over a million percent the past year does not mean it will continue or that another crypto will. Be careful, have a plan, stick to it, and you too can be successful.

About This Article

Author: Mark Prosz

Sources of information and credits for this post include:

https://coinmarketcap.com/airdrop/

https://opensea.io/