Pepperstone Reviews and Ratings:

| Website | https://pepperstone.com/ |

| Live Chat | YES |

| Telephone | +613 9020 0155 |

| Broker Type | ECN |

| Regulations | ASIC, CMA and FCA |

| Min Deposit | $200.00 |

| Account Base Currency | USD, AUD, EUR, GBP, JPY, NZD,CHF, SGD, HKD |

| Max Leverage | 500:1 |

| Trading Platforms | Metatrader 4/5, cTrader, Webtrader, API Trading, MAM / PAMM |

| Markets | Forex, Index CFD Trading, Precious Metals, Energy, Bitcoin |

| Bonus Offered | None |

| Funding Options | Credit / Debit Card, PayPal, POLi, Union Pay, Bank Transfer, Bpay, Skrill, Neteller, Broker to Broker |

- Islamic Accounts

- Demo Account

- Copy Trading

- Cryptocurrency Trading

- MT4 Platform

- MT5 Platform

- cTrader

- Free Education

- Mobile Trading

- Web Trading

- Scalping Allowed

- Hedging Allowed

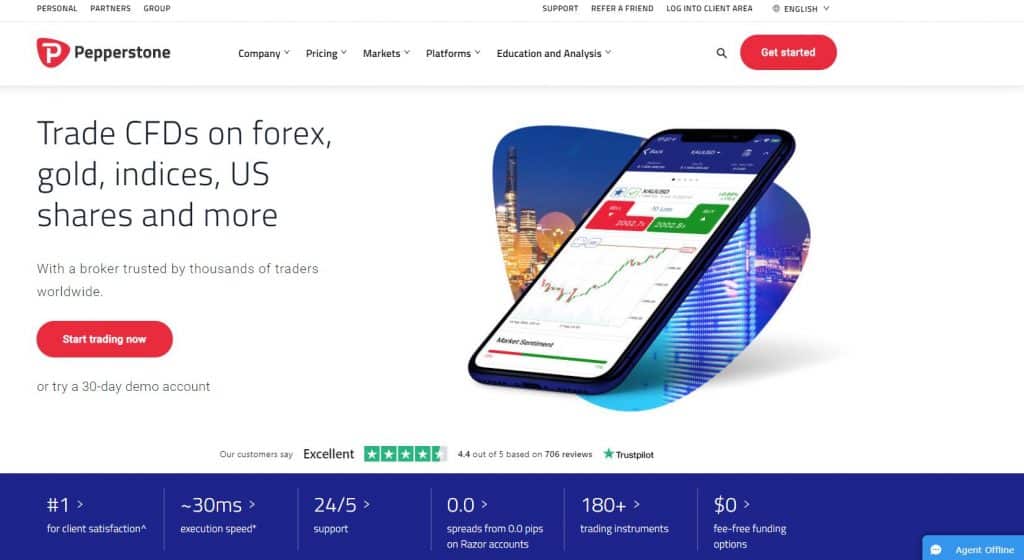

Pepperstone Review 2021

Overview

Founded in 2010, Award-winning Australian forex broker based in Melbourne and regulated by ASIC (Australia), CMA (Africa) and FCA (UK). They process on average $9.2 billion worth of trades each day, making them one of the biggest forex brokers, based by volume.

Clients funds are segregated with top tier 1 banks. Pepperstone is trusted by over 57,000 traders from around the world. Those who trade on Pepperstone will have an exciting experience with its superior technology, low-cost spreads, quick execution and excellent customer service. U.S. traders are not allowed.

Accounts

Pepperstone offers 2 different trading account types.

The first is their Standard account, where spreads start at 1.0 pips and average around 1.16 pips.

Theirs second account option is the Razor account, where you can expect spreads from 0.0 pips and average around 0.16 pips.

Islamic trader accounts, and high volume institutional accounts are available as well. Managed accounts also available. All funds are deposited in segregated accounts with National Australia Bank.

You can trade currencies (including cryptocurrency), commodities, and soft commodities like cocoa and sugar. You can create a demo account with MT4, MT5 and cTrader which is excellent for testing purposes.

Minimum deposit

$200

Maximum leverage

1:500

Features

Pepperstone gives you a total of 11 platforms to trade on, including MetaTrader4, mobile platforms, and cTrader.

The highlight is Pepperstone’s EDGE environment, which makes trading quick and efficient, with reduced spreads.

Clients labeled “Premium” have added benefits such as: priority support, rebates, invites to events, advanced trading tools, VPS and Market insights. To qualify as a premium client you must have trading volumes above 15 million USD per month.

In a volatile market, the PPI (Pepperstone Price Improvement) algorithm helps to automatically fill orders to the most favorable price as you’re placing your order. The brokers have joined the Equinix Financial eXchange network for access to bank liquidity sources and data straight from Wall Street.

There is also access to autotrading systems like Myfxbook, RoboX, Metatrader Signals and DupliTrade, and a web-based no-download platform called WebTrader.

Education

News, market reviews, an economic calendar and plenty of instructional articles by trading gurus will help you develop your strategy.

The brokers Education portion on their website feature sections on: Learn to trade Forex, Learn to trade CFDs, Trading Guides and Webinars.

Deposits/Withdrawals

More than ten funding methods are available, including bank transfers, credit and debit cards, Skrill, Neteller etc. for convenience.

Full list include: Credit / Debit Card, PayPal, POLi, Union Pay, Bank Transfer, Bpay, Skrill, Neteller, Broker to Broker.

Customer service

24/5 via online chat or email in multiply languages.

Local phone numbers in Melbourne and an international number can be called. They pride themselves as being #1 in customer satisfaction and support

There's More..

Pepperstone vs IC Markets which is the winner ?

Pepperstone and IC markets are both Aussie brokers. Both very similar but one is just a little better than the other and in our opinion, its Pepperstone that come out on top.

Pepperstone Canada – Do they allow Canadian residents ?

The answer is NO. A couple years back Pepperstone did allow Canadians to operate trading accounts with them. Sadly with strict regulation Pepperstone has since stopped services for Canadians.

Does Pepperstone Offer any Bonuses or promotional offers?

No they do not. Being regulated under ASIC and FCA, Broker are not allowed to offer such incentives.

Does Pepperstone Accept US clients ?

Strict US regulations forbids any US resident to operate a foreign Forex account. The plain answer is NO.

Does Pepperstone allow scalping and hedging ?

Yes. Pepperstone doesn’t have any issues with scalping or hedging positions.

Is Pepperstone reliable ?

We find them as one of the most reliable brokers out there. It is one of the reasons why they are at the top of our list.

Is Pepperstone regulated?

Yes they are. They are regulated by ASIC which stands for Australian Securities and Investments Commission & FCA which stands for Financial Conduct Authority in the UK.

Do the new ESMA regulations apply to Pepperstone?

Yes and no. This all depends if you live in a country that falls under the EU (European Union). Pepperstone operates in Australia and is regulated under ASIC and the FCA. ESMA rules apply to any client that resides in the EU.

So if you are a client that resides OUTSIDE the EU (European Union) you will fall under the ASIC regulator and the new ESMA rules would not apply to you.