Bitcoin ETFs have become the preferred investment vehicle that amplifies returns as Bitcoin crossed the $120,000 mark for the first time. The cryptocurrency, created in 2009 by the mysterious Satoshi Nakamoto, continues its remarkable growth. Bitcoin ETFs have accumulated $50.1 billion in total inflows since their launch.

These specialized ETFs present a compelling case for investors who want to maximize their exposure. A 2x leveraged Bitcoin ETF delivers twice the daily return of Bitcoin. When Bitcoin gains 3% in a day, the ETF targets a 6% return. The same amplification works for losses – a 3% Bitcoin decline leads to approximately 6% ETF loss. The SEC’s approval of the first physical Bitcoin ETFs in January 2024 sparked institutional interest. Bitcoin ETFs gathered $7.1 billion in just five trading sessions.

Table of Contents

Bitcoin’s volatility through 2025 shows impressive growth. The cryptocurrency broke above $100,000 in December 2024 and reached $115,000 in July. This piece examines the top leveraged Bitcoin ETFs available today. Investors see potential for further price appreciation with only 19 million of the maximum 21 million Bitcoins mined so far. Let’s analyze the seven best leveraged BTC ETFs to think about for potentially higher returns in 2025.

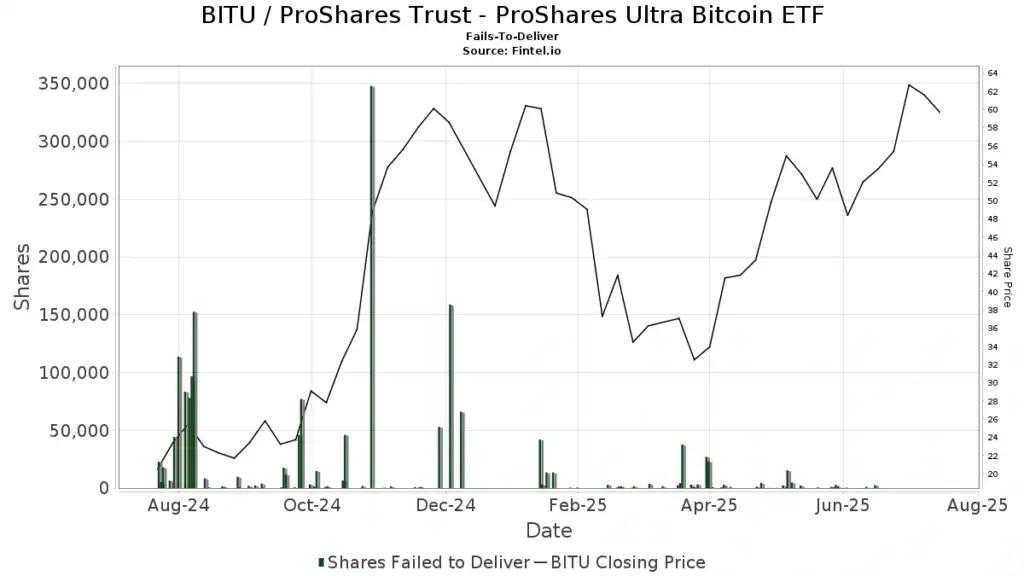

ProShares Ultra Bitcoin ETF (BITU)

Image Source: Fintel

The ProShares Ultra Bitcoin ETF (BITU) leads the pack of leveraged Bitcoin ETFs and gives investors a powerful tool to increase their cryptocurrency exposure. This fund, just since April 1, 2024, has become a major force in the digital asset ETF space.

BITU key features

BITU aims for twice (2x) the daily performance of the Bloomberg Bitcoin Index before fees and expenses [1]. The ETF doesn’t buy Bitcoin directly – it uses futures and swaps to achieve its leveraged exposure [2].

You’ll find that the fund puts at least 80% of its assets into financial instruments that ProShare Advisors believes will match its daily target [1]. This strategy lets investors:

Get magnified exposure to Bitcoin price movements

Tap into leveraged Bitcoin exposure without the huge costs you’d typically see with direct leveraged crypto investments

Buy and sell through regular brokerage accounts instead of specialized crypto exchanges

The fund also offers options trading, which opens up more sophisticated investment strategies [3]. All the same, investors should know that while BITU multiplies gains when Bitcoin prices climb, it also doubles down on losses during market drops [3].

BITU performance in 2025

BITU has shown impressive results throughout 2025, proving what leveraged Bitcoin exposure can do. Recent performance data shows:

A second-quarter 2025 return of 57.57% (NAV) and 57.30% (Market Price) [2]

Year-to-date returns of 10.62% (NAV) and 10.52% (Market Price) as of Q2 2025 [2]

One-year returns of 105.30% (NAV) and 104.68% (Market Price) [2]

The total return in the last year including dividends hit 204.64% [4]. The average annual return since the fund started stands at 54.14% [4].

The fund’s metrics show it tracks its underlying index closely, with a correlation of 1.00 and a beta of 2.04 in Q2 2025 [2]. This tells us BITU delivers on its promise of 2x daily Bitcoin returns.

Period | BITU (NAV) | BITU (Market Price) | Bitcoin Index |

Q2 2025 | 57.57% | 57.30% | 30.36% |

YTD | 10.62% | 10.52% | 15.16% |

1 Year | 105.30% | 104.68% | 79.03% |

BITU pricing and fees

The fund keeps a competitive 0.95% expense ratio [1][3], which is impressive given how complex it is to maintain a leveraged position. BITU has grown to manage about $1.18 billion in assets [4], with 21.93 million shares outstanding [4].

As of August 8, 2025, BITU traded at:

The fund pays monthly dividends with a recent $0.9662 dividend declared on August 1, 2025 [5]. The twelve-month trailing dividend is $3.73, yielding about 6.43% [4].

Active traders will appreciate BITU’s liquidity – it averages about 2.03 million shares traded daily over a 10-day period [5]. The 30-day median bid-ask spread sits at just 0.03% [3], which means tight trading conditions and lower transaction costs.

While BITU offers great opportunities, you should know that leveraged ETFs work best for short-term trading rather than long-term holding. The daily reset means returns over longer periods might not match the simple multiple of index returns, especially when markets get volatile [2].

Volatility Shares 2x Bitcoin Strategy ETF (BITX)

BITX made history as a groundbreaking force in cryptocurrency investment on June 27, 2023. The Volatility Shares 2x Bitcoin Strategy ETF became the first ETF to offer leveraged exposure to cryptocurrency in the United States [1]. This fund has proven to be a great way to get amplified Bitcoin returns.

BITX key features

BITX works as a 2x leveraged, daily resetting Exchange-Traded Fund with a clear goal: to deliver twice the daily performance of Bitcoin [1]. The fund uses a sophisticated futures-based approach to achieve this leveraged exposure:

Daily rolling of Bitcoin futures from the front-month (M1) contract to the second-month (M2) contract [1]

Daily adjustment of holdings to maintain consistent 2x exposure [1]

Addition or subtraction of futures contracts to accommodate new investments or redemptions [1]

BITX is registered under the U.S. Investment Company Act of 1940, unlike direct cryptocurrency investments. This gives investors familiar regulatory protections [1]. The structure comes with several benefits:

Reports gains and losses via standard IRS 1099 forms

No K-1 issuance requirement

Not subject to non-resident withholding on publicly traded partnerships [1]

The fund utilizes cash-settled Bitcoin futures contracts traded on CFTC-registered exchanges, currently the Chicago Mercantile Exchange [6]. Cash, cash-like instruments, and high-quality securities serve as collateral to complement these positions [6].

BITX performance in 2025

BITX has rewarded investors who predicted Bitcoin’s upward trajectory throughout 2025. The fund’s performance explains:

Period | Total Return | Category Average |

YTD (as of Aug 2025) | 8.03% [6] | |

1-Month | 15.00% [6] | 14.95% [6] |

3-Month | 43.74% [6] | 39.10% [6] |

1-Year | 101.32% [6] | 35.71% [6] |

The second quarter of 2025 stood out with BITX posting a stunning 57.10% return [6]. This success followed an exceptional first quarter of 2024, when the fund surged 133.96% [6].

Patient investors who held BITX through volatile periods saw substantial rewards. The fund has delivered an average annual return of 109.57% [7] since its inception, outpacing its category average and traditional investment vehicles by a lot.

BITX pricing and fees

BITX now manages about $2.85 billion in assets [6], making it one of the largest leveraged cryptocurrency ETFs accessible to more people. The fund’s key metrics as of August 8, 2025, include:

Share price: $60.88 [8]

52-week range: $20.91 – $72.80 [8]

Shares outstanding: 46.32 million [8]

NAV (Net Asset Value): $61.58 [8]

The fund charges an annual fee of 1.85% [1], which comes out of the fund’s assets daily (about 0.005%). All costs included bring the total expense ratio to 2.38% [6].

BITX offers monthly dividend distributions with strong income potential. The trailing twelve-month dividend is $5.93 [7], yielding an impressive 9.74% [7]. Recent distributions show:

Keep in mind that BITX works best as a short-term trading vehicle rather than a long-term investment [6]. The fund’s daily reset feature means returns over periods longer than one day might vary by a lot from simply doubling Bitcoin’s performance, especially during highly volatile periods [6]. This requires active management and regular position monitoring [6].

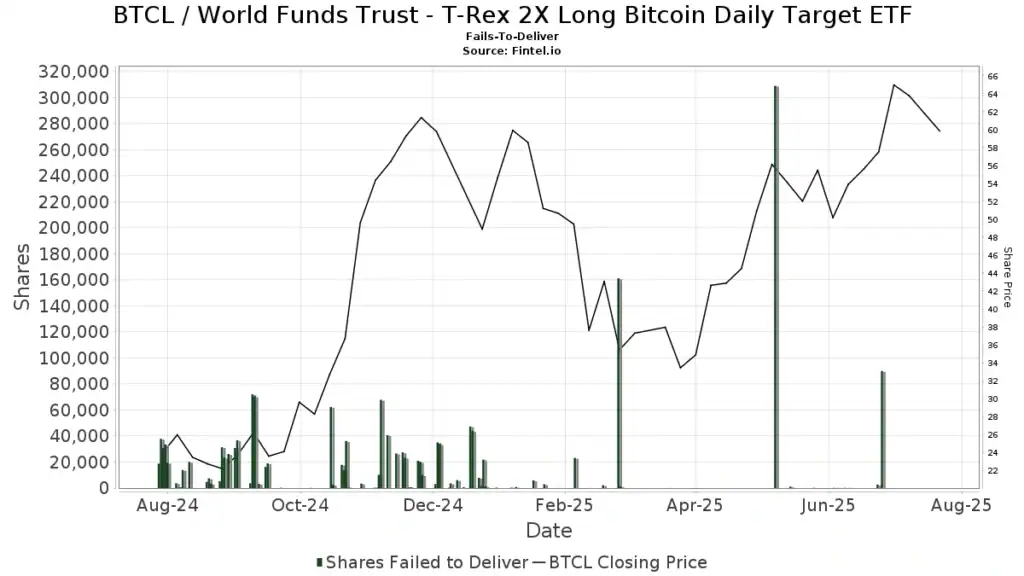

T-Rex 2X Long Bitcoin Daily Target ETF (BTCL)

Image Source: Fintel

The T-Rex 2X Long Bitcoin Daily Target ETF (BTCL) launched on July 10, 2024, and quickly became a strong player in the growing world of leveraged Bitcoin ETFs [4]. This new fund gives investors another way to double their Bitcoin exposure through a regulated investment vehicle.

BTCL key features

T-Rex 2X Long Bitcoin Daily Target ETF wants to provide daily investment results that match twice (200%) the daily performance of spot Bitcoin, before fees and expenses [9]. The fund uses these strategies to reach its goals:

Invests in swap agreements with major global financial institutions that provide 200% daily exposure to Bitcoin [3]

Allocates at least 80% of its net assets to these swap agreements [9]

The core team manages a focused portfolio with only 9 holdings to efficiently handle its leveraged exposure [2]

Tuttle Capital Management created BTCL for knowledgeable investors who understand the potential risks of seeking daily leveraged returns [2]. The fund clearly states it doesn’t try to achieve its investment objective beyond a single trading day [4].

The biggest challenge with BTCL lies in its significant risks. The fund will lose money if Bitcoin stays flat for longer than a day [4]. On top of that, investors could lose their entire principal in just one day if Bitcoin drops more than 50% [4].

BTCL performance in 2025

BTCL delivered impressive results in 2025 for investors who predicted Bitcoin’s upward movement correctly. Here are the fund’s performance metrics:

Period | Return |

1 Month | 11.71% [3] |

6 Month | 23.00% [3] |

YTD | 25.13% [5] |

1 Year | 148.57% [5] |

The fund’s total return in the last year, including dividends, reached an exceptional 202.03% [2]. Since its launch, BTCL managed to keep an average annual return of 134.38% [2], showing its potential to generate substantial gains during bullish Bitcoin markets.

BTCL reached its 52-week high of $69.81 on December 17, 2024 [5], when Bitcoin surged above $100,000. The fund hit its 52-week low of $18.91 on September 6, 2024 [5], which shows how volatile leveraged cryptocurrency investments can be.

BTCL pricing and fees

BTCL traded at $60.85 on August 8, 2025, with a 2.25% daily drop [3]. Here are the fund’s key metrics:

Assets under management: $51.47 million [2]

Shares outstanding: 1.05 million [2]

Daily trading range: $60.53 – $61.90 [5]

10-day average trading volume: 66,625 shares [2]

The fund’s expense ratio of 0.95% [2] makes it one of the more budget-friendly options among leveraged Bitcoin ETFs. This competitive fee structure helps investors maximize their returns while keeping costs low.

BTCL also provides income through dividends. The fund announced a $2.12 per share dividend for 2025, which will be paid on December 26, 2025, with an ex-dividend date of December 24, 2025 [4]. This creates a yield of about 3.48% [5], giving investors both growth potential and income.

The fund’s holdings show 120.55% of assets in its top 10 investments [4], which reflects its focused approach and use of derivatives to achieve leverage. This concentration helps with efficient management but increases certain risks compared to more diverse funds.

BTCL works best for short-term traders rather than long-term investors because of its leveraged nature. The daily reset feature means long-term performance might not simply double Bitcoin’s returns [4]. Investors need to actively manage and monitor their positions regularly.

CoinShares Valkyrie Bitcoin Futures Leveraged Strategy ETF (BTFX)

CoinShares Valkyrie Bitcoin Futures Leveraged Strategy ETF (BTFX) has grown faster than expected since its launch on February 21, 2024. This ETF is a chance for investors to maximize returns in the volatile cryptocurrency market through its unique Bitcoin futures leverage approach.

BTFX key features

BTFX stands out with its simple yet effective investment strategy. The fund wants to deliver twice (2x) the daily performance of the S&P CME Bitcoin Futures Excess Return Index [1]. BTFX doesn’t buy Bitcoin directly but tries to profit from price increases in Bitcoin Futures Contracts each day [1].

The fund’s investment strategy has these core elements:

We invested mainly in cash-settled bitcoin futures contracts that trade only on CFTC-registered exchanges (currently CME) [1]

The team manages to keep at least 80% of net assets in Bitcoin Futures Contracts [10]

They employ cash, cash-like instruments, and high-quality securities as collateral [1]

A team with expertise in both traditional and digital assets actively manages the strategy [1]

The fund clearly states it doesn’t try to meet its investment goals beyond a single day [1]. This makes BTFX better suited for short-term trading instead of long-term investment.

BTFX performance in 2025

BTFX showed remarkable results in 2025 and beat its category average across several timeframes:

Period | BTFX Return | Category Average |

YTD | 17.32% | 8.03% |

1-Month | 17.75% | 14.95% |

3-Month | 46.21% | 39.10% |

1-Year | 105.19% | 35.71% |

Source: [10]

The fund’s total return in the last year with dividends reached 199.39% [11]. Since its launch, BTFX has managed to keep an average annual return of 83.78% [11]. These numbers show strong performance during Bitcoin’s bull runs.

BTFX reached its 52-week peak at $72.53 on December 17, 2024 [6], right when Bitcoin crossed $100,000. The fund hit its 52-week bottom at $18.62 on September 6, 2024 [6]. These swings show how volatile leveraged crypto investments can be.

BTFX pricing and fees

BTFX traded at $61.46 on August 8, 2025, down 1.17% for the day [10]. Here are the fund’s key numbers:

Assets under management: $17.10 million [10]

NAV (Net Asset Value): $62.81 [1]

52-week trading range: $18.62 – $72.53 [6]

Shares outstanding: 265,000 [12]

10-day average trading volume: 10,000 shares [6]

The fund has a total expense ratio of 1.86% [1], which puts it in the middle range for leveraged Bitcoin ETFs. This fee reflects how complex it is to maintain leveraged positions through futures contracts.

BTFX’s portfolio on August 7, 2025 showed this mix:

101.57% in Bitcoin Future Aug 25 (about $32 million) [13]

46.70% in deposits with broker for short positions [13]

45.49% in additional deposits with broker [13]

6.06% in First American Treasury Obligations [13]

3.17% in US Dollars [13]

-102.99% in Cash Offset [13]

New investors should know that leveraged ETFs like BTFX are riskier than regular funds. This fund is only for investors who understand what it means to seek daily leveraged returns [1]. You could lose your entire investment in just one day [1], so careful risk management is crucial when trading BTFX.

Direxion Daily Bitcoin 2x Shares ETF (BITD)

Image Source: ACCESS Newswire

Investors looking for doubled cryptocurrency exposure can now turn to the Direxion Daily Bitcoin 2x Shares ETF (BITD). This 2-year old ETF provider offers a structured way to invest in cryptocurrency with twice the daily Bitcoin performance.

BITD key features

BITD aims to double the daily performance of the S&P CME Bitcoin Futures Index [7]. The fund uses Bitcoin futures contracts instead of holding physical Bitcoin. This makes it better suited for active traders than long-term investors.

The fund’s main features include:

A daily reset system that fine-tunes leverage levels each trading day

Short-term magnified returns instead of long-term investment goals

A focused portfolio structure with heavy exposure to Bitcoin futures [7]

The fund works best for sophisticated investors who understand the risks of leverage. The prospectus states that traders should actively watch and adjust their portfolios [7]. Rafferty Asset Management keeps the fund’s daily gains or losses under 90% of its net asset value [7].

BITD performance in 2025

BITD showed remarkable wealth-building potential during favorable market conditions in 2025. The fund delivered strong returns as Bitcoin reached new highs:

Period | Return |

YTD (as of Aug 2025) | +47.26% [8] |

1-Year | +47.26% [8] |

The original months saw high volatility matching Bitcoin’s price movements. The fund typically doubled Bitcoin’s daily gains, minus fees and tracking differences. During Bitcoin’s downturns, losses doubled too – something investors should think about carefully.

BITD pricing and fees

BITD managed about $5.99 million in assets by July 31, 2025 [8]. This makes it smaller than other leveraged Bitcoin ETFs. Here are the key numbers:

The 1.00% expense ratio stands competitive among similar ETFs [8]. This fee covers the complex work of maintaining leveraged exposure through futures while staying available to traders seeking doubled Bitcoin returns.

Smart investors know BITD works best as a tactical trading tool. The fund clearly explains that returns over multiple days will likely differ from twice Bitcoin futures’ performance due to daily return compounding [7]. This makes BITD ideal for short-term trades rather than long-term investments.

Grayscale 2x Bitcoin Trust (GBTCX)

The Grayscale Bitcoin Trust, a 10-year old fund, made history as the first publicly-traded Bitcoin fund in the US [14]. This flagship offering gives institutional-grade exposure to Bitcoin through a familiar ETF structure, though it’s not explicitly a 2x leveraged product.

GBTCX key features

The Bitcoin offering from Grayscale invests solely and passively in Bitcoin. The trust aims to mirror the value of its Bitcoin holdings, minus expenses and other liabilities [14]. These features make it stand out:

Grayscale, one of the world’s leading crypto asset managers, brings over a decade of expertise as the sponsor

The US market saw this product as its first spot Bitcoin exchange-traded offering

Coinbase Custody Trust Company provides secure storage for the underlying Bitcoin

Investors can trade during standard market hours (9:30am – 4:00pm EST)

The trust owned roughly 194,186.5228 Bitcoins in early 2025. Each share represents about 0.00079089 Bitcoins [15]. Investors who buy shares get a slice of this pooled Bitcoin without managing digital wallets.

GBTCX performance in 2025

The trust’s market price reached $91.58 on August 8, 2025, showing strong performance metrics [14]. Recent returns show:

Period | Return |

1 Day | -0.93% [14] |

1 Month | +3.97% [16] |

3 Month | +12.41% [16] |

YTD | +23.72% [16] |

1 Year | +89.18% [16] |

The trust delivered exceptional long-term results with a 68.35% compound annual return during its analyzed period [17]. Notwithstanding that, investors should note the extreme volatility. A maximum drawdown of -84.08% took 42 months to recover [17].

GBTCX pricing and fees

Grayscale’s annual management fee stands at 1.50%. This covers all administration and Bitcoin safekeeping costs [14]. Competing products charge less, with some fees as low as 0.24% to 0.30% [18].

Current trading metrics reveal:

Net Asset Value (NAV) per share: $91.57 [14]

Daily trading volume: 1.63 million shares [14]

30-day median bid/ask spread: 0.01% [14]

Total assets under management: $21.05 billion [14]

The trust offers a convenient way to access Bitcoin through traditional brokerages. Investors avoid cryptocurrency exchanges and digital wallet management [19]. The competitive Bitcoin ETF landscape presents lower-cost options, so investors should weigh the convenience against higher fees.

Hashdex Bitcoin Futures 2x ETF (HBTF)

The Hashdex Bitcoin Futures ETF (DEFI) completes our review of top Bitcoin ETFs. This fund trades on NYSE Arca and gives investors a way to gain enhanced cryptocurrency exposure. Since its launch on September 15, 2022, it has become a notable choice for investors who want amplified Bitcoin returns.

HBTF key features

The Hashdex Bitcoin Futures ETF tracks the daily changes of the Nasdaq Bitcoin Reference Price – Settlement (“Benchmark”) minus operational expenses [4]. The fund went through a transformation on March 27, 2024. It changed its investment strategy to include spot Bitcoin holdings [4]. The fund now maximizes physical Bitcoin exposure with:

At least 95% of assets invested directly in spot Bitcoin [4]

Up to 5% allocated to CME-traded Bitcoin futures contracts and cash equivalents [4]

Tidal Investments LLC sponsors this fund that operates as a commodity pool under Commodity Futures Trading Commission regulation [4]. Hashdex Asset Management Ltd. provides specialized digital asset advisory services with research and investment analysis of Bitcoin markets [4].

HBTF performance in 2025

HBTF has shown impressive returns across different time periods in 2025:

Period | Return |

1 Month | +3.95% [3] |

3 Month | +13.07% [3] |

YTD | +24.02% [3] |

1 Year | +93.69% [3] |

The fund hit its 52-week high of $137.16 on July 14, 2025 [3] when Bitcoin moved toward new all-time highs. The 52-week low was $60.65 on September 6, 2024 [3], which shows Bitcoin investments’ volatile nature.

HBTF pricing and fees

HBTF traded at $131.73 on August 8, 2025, with a 0.97% daily decrease [3]. Recent trading metrics show:

Opening price: $131.79 [3]

Daily range: $131.73 – $131.79 [3]

Average daily volume: Currently limited data available

Assets under management: $2.10 million [20]

HBTF’s expense ratio stands at 1.03% [3], placing it in the middle range of Bitcoin ETFs. This rate is lower than the category’s average expense ratio of 1.10% [21]. Investors looking for Bitcoin futures exposure through regulated ETFs will find HBTF a professionally managed option with tax benefits compared to direct cryptocurrency ownership.

Comparison Table

ETF Name | Expense Ratio | AUM | YTD Return (2025) | Launch Date | Investment Strategy | Current Price (Aug 2025) |

ProShares Ultra Bitcoin ETF (BITU) | 0.95% | $1.18B | 10.62% | April 1, 2024 | Leverages futures and swaps to achieve 2x daily Bitcoin exposure | $57.96 |

Volatility Shares 2x Bitcoin Strategy ETF (BITX) | 1.85% | $2.85B | 24.58% | June 27, 2023 | Daily Bitcoin futures contract rolling to maintain 2x exposure | $60.88 |

T-Rex 2X Long Bitcoin Daily Target ETF (BTCL) | 0.95% | $51.47M | 25.13% | July 10, 2024 | Swap agreements provide 2x daily Bitcoin exposure | $60.85 |

CoinShares Valkyrie Bitcoin Futures ETF (BTFX) | 1.86% | $17.10M | 17.32% | Feb 21, 2024 | Bitcoin futures contracts deliver 2x daily exposure | $61.46 |

Direxion Daily Bitcoin 2x Shares ETF (BITD) | 1.00% | $5.99M | 47.26% | Not mentioned | Bitcoin futures deliver 2x daily exposure | $25.28 |

Grayscale 2x Bitcoin Trust (GBTCX) | 1.50% | $21.05B | 23.72% | 2013 | Direct Bitcoin holdings | $91.58 |

Hashdex Bitcoin Futures 2x ETF (HBTF) | 1.03% | $2.10M | 24.02% | Sept 15, 2022 | Combines 95% spot Bitcoin with 5% futures | $131.73 |

Conclusion

Bitcoin ETFs now offer powerful tools for investors who want doubled cryptocurrency exposure as Bitcoin continues its remarkable trip past $120,000. This piece looks at seven leading options that give roughly double the daily returns of Bitcoin through different methods – futures contracts, swaps, or direct holdings.

ProShares Ultra Bitcoin ETF leads the pack with $1.18 billion in assets and a competitive 0.95% expense ratio. Volatility Shares 2x Bitcoin Strategy ETF has the longest track record as the first leveraged crypto ETF in the US. T-Rex and CoinShares products deliver similar 2x exposure through different underlying methods.

These instruments just need careful thought. Daily reset features mean long-term performance will be nowhere near double Bitcoin’s returns over extended periods. It also means the same mechanism that amplifies gains will equally magnify losses during downturns – maybe even devastating for unprepared investors.

Expense ratios vary a lot from 0.95% to 1.86%. Fee awareness matters when picking between similar products. Trading volumes and assets under management also vary by a lot, which affects liquidity and bid-ask spreads for active traders.

Without doubt, Bitcoin’s lack factor – with all but one million of these 21 million coins mined – keeps driving institutional interest. The staggering $50.1 billion in total ETF inflows proves this. This creates perfect conditions for leveraged products during bullish phases.

A complete comparison of these seven options helps match your specific needs with the right vehicle. Note that these products work best as tactical trading tools rather than strategic investments. Your investment timeline, risk tolerance, and market outlook should guide your choice among these leveraged Bitcoin ETFs.

The digital world changes faster each day. These leveraged ETFs give regulated access to amplified Bitcoin exposure without specialized crypto exchanges or digital wallets. This accessibility makes them valuable tools in the modern investor’s toolkit as Bitcoin matures as an asset class.

Key Takeaways

Leveraged Bitcoin ETFs offer sophisticated investors the opportunity to amplify their cryptocurrency exposure through regulated investment vehicles as Bitcoin continues its historic surge past $120,000.

• Leveraged ETFs double daily Bitcoin returns but reset daily – These funds target 2x Bitcoin’s daily performance, meaning a 3% Bitcoin gain becomes a 6% ETF gain, but the same amplification applies to losses.

• Expense ratios vary significantly from 0.95% to 1.86% – ProShares Ultra Bitcoin ETF (BITU) and T-Rex (BTCL) offer the lowest fees at 0.95%, while others charge nearly double.

• These are tactical trading tools, not long-term investments – Daily reset mechanisms mean performance over periods longer than one day will differ significantly from simply doubling Bitcoin’s returns due to compounding effects.

• Assets under management range from $2.10M to $21.05B – Larger funds like Grayscale ($21.05B) and Volatility Shares ($2.85B) offer better liquidity and tighter bid-ask spreads for active traders.

• Risk management is essential as you could lose 100% in one day – If Bitcoin drops more than 50% in a single trading session, leveraged ETF investors could face total principal loss.

The cryptocurrency market’s institutional adoption continues accelerating with $50.1 billion in total Bitcoin ETF inflows, creating opportunities for amplified exposure through these specialized instruments. However, success requires active monitoring, proper position sizing, and clear understanding of leverage mechanics before investing.

FAQs

Q1. What are the top-performing leveraged Bitcoin ETFs for 2025? Some of the best-performing leveraged Bitcoin ETFs in 2025 include ProShares Ultra Bitcoin ETF (BITU), Volatility Shares 2x Bitcoin Strategy ETF (BITX), and T-Rex 2X Long Bitcoin Daily Target ETF (BTCL). These funds aim to deliver twice the daily performance of Bitcoin and have shown strong returns in the current market.

Q2. How do leveraged Bitcoin ETFs work? Leveraged Bitcoin ETFs aim to deliver multiples (usually 2x) of Bitcoin’s daily performance using futures contracts, swaps, or other financial instruments. They reset daily, meaning they target this leveraged return for single trading days, not longer periods. This can lead to different long-term results than simply doubling Bitcoin’s returns over time.

Q3. What are the risks associated with leveraged Bitcoin ETFs? The main risks include amplified losses during market downturns, potential for significant deviation from long-term Bitcoin performance due to daily resets, and the possibility of losing your entire investment if Bitcoin drops more than 50% in a single day. These products are designed for short-term trading rather than long-term holding.

Q4. How do expense ratios compare among leveraged Bitcoin ETFs? Expense ratios for leveraged Bitcoin ETFs vary widely, ranging from 0.95% for funds like ProShares Ultra Bitcoin ETF (BITU) and T-Rex 2X Long Bitcoin Daily Target ETF (BTCL) to as high as 1.86% for others. It’s important to consider these fees when comparing different options.

Q5. Are leveraged Bitcoin ETFs suitable for long-term investors? Leveraged Bitcoin ETFs are generally not recommended for long-term investors. They are designed as short-term trading tools due to their daily reset feature. Over longer periods, their performance can significantly diverge from simply doubling Bitcoin’s returns, especially during periods of high volatility. Active management and consistent monitoring are essential when using these products.

References

[1] – https://coinshares.com/us/etf/btfx/

[2] – https://stockanalysis.com/etf/btcl/

[3] – https://www.cnbc.com/quotes/DEFI

[4] – https://www.hashdex-etfs.com/defi

[5] – https://www.cnbc.com/quotes/BTCL

[6] – https://www.cnbc.com/quotes/BTFX

[7] – https://www.sec.gov/Archives/edgar/data/1424958/000119312523097969/d484465d485apos.htm

[8] – https://markets.ft.com/data/etfs/tearsheet/summary?s=LMBO:PCQ:USD

[9] – https://www.marketwatch.com/investing/fund/btcl

[10] – https://finance.yahoo.com/quote/BTFX/performance/

[11] – https://stockanalysis.com/etf/btfx/

[12] – https://www.marketwatch.com/investing/fund/btfx

[13] – https://www.morningstar.com/etfs/xnas/btfx/quote

[14] – https://etfs.grayscale.com/gbtc

[15] – https://www.fool.com/investing/how-to-invest/etfs/how-to-invest-in-gbtc-etf/

[16] – https://www.cnbc.com/quotes/GBTC

[17] – https://www.lazyportfolioetf.com/etf/grayscale-bitcoin-trust-btc-gbtc/

[18] – https://www.bloomberg.com/news/articles/2024-01-08/grayscale-s-1-5-fee-for-gbtc-would-be-highest-among-proposed-spot-bitcoin-etfs

[19] – https://seekingalpha.com/article/4802320-gbtc-access-to-bitcoin-anywhere

[20] – https://finance.yahoo.com/news/5-etfs-forefront-bitcoins-thrilling-145300824.html

[21] – https://www.aaii.com/etf/ticker/DEFI?via=emailsignup-readmore