Table of Contents

Spot Ethereum ETFs made their market debut on July 23, 2024, after receiving SEC approval . These funds grabbed attention quickly and racked up more than $1 billion in combined trading volume on day one .

The arrival of Ethereum ETFs creates fresh opportunities for investors, especially those who manage retirement accounts. This matters because Americans’ retirement accounts total nearly $40 trillion, and many of these accounts don’t allow direct crypto trading . Spot Ether ETFs let investors track Ethereum’s performance without dealing with crypto wallets or exchanges. Ethereum’s value has jumped more than 60% since February 2024, which makes these ETFs look appealing as investment options . The recent performance tells a mixed story though – Ethereum gained 7% while the S&P 500 climbed 18% during that time .

Let me walk you through the 7 best Ethereum ETFs to think over in 2025. The current frontrunner, iShares Ethereum Trust, leads the pack with the highest assets under management and claims 42% of AUM inflows in the past month .

iShares Ethereum Trust (ETHA)

Image Source: iShares

BlackRock’s iShares Ethereum Trust (ETHA) leads the Ethereum ETF market with net assets exceeding $15.35 billion as of August 15, 2025 [1]. The fund launched on June 24, 2024, and quickly made history as the first spot Ether ETF to pull in over $1 billion by August 2024 [2]. ETHA helps investors get exposure to the world’s second-largest cryptocurrency without owning it directly.

iShares Ethereum Trust key features

The trust tracks Ethereum’s price through a traditional investment vehicle [2]. The fund follows the CME CF Ether-Dollar Reference Rate – New York Variant, which gives investors a familiar path into digital assets [1].

ETHA brings several unique benefits:

-

You can track Ethereum’s performance through your regular brokerage account [3]

-

You don’t face the hassles of owning cryptocurrency directly [3]

-

Trading costs less and tax reporting becomes simpler [3]

-

Coinbase Prime securely holds all assets [2]

The fund’s technology sets it apart. ETHA makes use of a multi-year tech integration with Coinbase Prime, which safeguards all the ETH in the fund [2]. This partnership strengthens security since Coinbase Prime ranks as the largest institutional digital asset custodian globally [3].

iShares Ethereum Trust pros and cons

Pros:

-

Largest assets under management among Ethereum ETFs, which helps create market stability [3]

-

Better liquidity than competitors, so trading feels safer with more stable prices [3]

-

BlackRock’s backing brings stability from the world’s biggest asset manager [3]

-

Strong growth with 42% of AUM flowing in last month [3]

-

BlackRock’s solid ETF track record adds credibility [3]

Cons:

-

Different rules apply since it’s not registered under the Investment Company Act of 1940 [3]

-

Ethereum’s price swings affect the fund directly [1]

-

Management fees stay competitive but aren’t the lowest available [3]

-

Private keys could get lost, stolen, or compromised [1]

-

Success depends on market acceptance and industry changes [1]

-

Ongoing expenses gradually reduce share value [1]

iShares Ethereum Trust pricing

The trust charges a competitive 0.25% expense ratio [1]. This means you’ll pay about $25 yearly for every $10,000 invested.

BlackRock wants to attract early investors with special pricing. From July 23, 2024, they’re cutting the sponsor’s fee to 0.12% for the first $2.5 billion in assets for 12 months [1]. After hitting this mark or when the promotion ends, everything moves to the standard 0.25% fee [1].

While Grayscale’s ETH fund charges less at 0.15%, ETHA’s pricing makes sense given its superior liquidity and institutional backing [3].

iShares Ethereum Trust best for

Several types of investors will find ETHA particularly appealing:

The trust works great for people who want to invest in Ethereum but don’t want to deal with crypto exchanges, wallets, or private keys. Traders who need lots of liquidity will appreciate that ETHA trades more than any other Ethereum ETF [3].

The fund attracts investors who value BlackRock’s stability and reputation [3]. This matters a lot with volatile crypto investments.

Retirement account holders can’t buy crypto directly in their tax-advantaged accounts, but ETHA gives them a regulated way to invest.

Recent results show the fund’s strength. The price jumped 37.84% last month and 64.43% over the year [2]. NAV returns look even better, with a 52% boost last month and 79.77% growth over three months [2].

Grayscale Ethereum Mini Trust (ETH)

Image Source: Grayscale Investments

Grayscale Ethereum Mini Trust (ETH) gives investors a fresh way to get Ethereum exposure through budget-friendly, fractional shares built for retail investors. The fund launched on July 23, 2024, among other products like its full-sized version. ETH has grown into a major player in the spot Ethereum ETF market with about $3.1 billion in assets under management as of August 15, 2025 [2].

Grayscale Ethereum Mini Trust key features

ETH stands out from its competitors with several unique features:

ETH invests only in Ether and takes a passive approach. The fund’s goal is to mirror Ethereum’s value, minus costs and obligations [2]. Real Ether is stored through Coinbase Custody instead of using derivatives or futures contracts [2].

The fund lets investors buy smaller portions compared to the larger Grayscale Ethereum Trust (ETHE). This makes it more available to investors with smaller budgets [4]. Investors can now get Ethereum exposure without creating cryptocurrency accounts or dealing with digital wallets [2].

ETH started with a large asset base after getting 10% (about $1.02 billion) of ETHE’s assets [5]. This smart seeding helped ETH broaden its investor base right from the start [5].

The fund uses the CoinDesk Ether Price Index [2] to track performance. Investors can now get Ethereum exposure through a familiar investment tool. Each share equals about 0.00941509 ETH [2].

Grayscale Ethereum Mini Trust pros and cons

Pros:

-

Market’s lowest fees at 0.15%, with initial fee waiver [2] [6]

-

High trading volume exceeding 8.5 million shares daily [2]

-

Support from Grayscale, a 10-year-old crypto asset manager [2]

-

Stable $3.1 billion AUM base [2]

-

Strong 48.46% return in the last month [3]

Cons:

-

High cryptocurrency market volatility [5]

-

Not covered by Investment Company Act of 1940 [2]

-

Market interest could affect liquidity [2]

-

Smart contracts might face technical problems [2]

-

Depends on outside service providers [2]

-

Success tied to Ethereum’s growth [2]

Grayscale Ethereum Mini Trust pricing

ETH keeps its fees competitive with a yearly management fee of 0.15% (15 basis points) [2] [4]. This makes it the cheapest option among Ethereum ETFs [6].

Grayscale wants to attract early investors by waiving all fees for six months after launch or until reaching $2 billion in assets, whichever comes first [2] [6]. The standard 0.15% fee kicks in after this promotion ends [2].

Investors pay nothing during the initial period and minimal fees afterward. A $10,000 investment costs just $15 yearly after the waiver ends.

ETH shares traded at $41.29 on August 15, 2025 [2], with about 75 million shares in circulation [2]. The fund’s market price stays close to its NAV that indicates smooth trading without big premiums or discounts [2].

Grayscale Ethereum Mini Trust best for

ETH works great for retail investors who want budget-friendly Ethereum exposure [5]. Its lower share price compared to ETHE makes it perfect for smaller portfolios [5].

The fund appeals to investors who watch their costs. ETH’s 0.15% expense ratio and initial fee waiver make it the quickest way to invest in Ethereum ETFs [6] [7].

Traditional investors can now get into digital assets without dealing with cryptocurrency technicalities [5]. They can buy shares through their regular brokerage accounts [2].

ETH’s performance speaks for itself. The fund’s 70.44% one-year return beat its category average of 35.71% by a lot [3]. Its three-month return hit 109.15%, showing strong momentum [3].

ETH brings together availability, affordability, and great returns. This makes it attractive to investors who want Ethereum exposure through regulated channels.

Bitwise Ethereum ETF (ETHW)

Image Source: Bitwise

The Bitwise Ethereum ETF (ETHW) made its debut on July 22, 2024. This ETF became the first to pledge 10% of its profits toward supporting Ethereum’s open-source developers [2]. The fund manages assets worth $593.6 million [4] and marks Bitwise’s eighth publicly traded crypto offering from their detailed suite of 20 crypto products [2].

Bitwise Ethereum ETF key features

ETHW holds ether (ETH), the second-largest cryptocurrency that powers the Ethereum blockchain [2]. The fund shows its public wallet addresses, giving investors unmatched transparency about their holdings [2].

ETHW sets itself apart from other funds through its developer funding commitment. The fund gives 10% of all profits to two organizations: Protocol Guild, which supports over 170 core Ethereum Layer 1 contributors, and PBS Foundation, a nonprofit funding Ethereum block relays research [2]. This strengthens the technology that investors believe in.

Investors can track Ethereum’s price without dealing with direct cryptocurrency ownership. Bitwise CIO Matt Hougan explains, “Ethereum is the world’s most exciting crypto asset” that powers everything from decentralized finance to non-fungible tokens [8]. The core team of over 100 crypto specialists at Bitwise offers evidence-based research and expertise [4].

Bitwise Ethereum ETF pros and cons

Pros:

-

0.20% fees with an initial fee waiver [4]

-

Ground-breaking 10% profit donation to Ethereum’s development [2]

-

Daily trading exceeds 2.2 million shares [4]

-

Published wallet addresses for full transparency [2]

-

Support from America’s largest crypto index fund manager managing $15 billion [8]

Cons:

-

Not under Investment Company Act of 1940 protection [2]

-

Cryptocurrency market volatility affects performance [6]

-

Risks include theft, loss, or restricted ETH access [6]

-

Share value decreases due to ongoing expenses [6]

-

New fund with limited performance history [6]

Bitwise Ethereum ETF pricing

The fund charges a 0.20% management fee [2]. Bitwise waives fees on the first $500 million in assets for six months after launch (until January 22, 2025) [4]. This means early investors pay no management fees on initial assets.

The standard 0.20% fee kicks in after the waiver period [4]. A $10,000 investment costs about $20 annually.

Recent data shows shares trading at $31.40 [7], with 18.83 million shares outstanding [4]. The daily trading volume stays strong at over 2.2 million shares [4], offering enough liquidity for most investors.

Bitwise Ethereum ETF best for

This fund works well for investors who care about Ethereum’s long-term success. The developer donation program helps advance the technology [2].

Cost-conscious investors benefit from competitive fees during the six-month waiver period [4]. The fund’s expert management team offers specialized knowledge about this complex asset [4].

Transparency-focused investors appreciate Bitwise’s published wallet addresses [2]. This lets them verify their ETH holdings easily.

The fund appeals to investors who prefer crypto-focused firms over traditional financial institutions. Bitwise brings seven years of crypto experience and a nationwide team of 100+ specialists dedicated to digital asset investments [8].

ETHW combines affordable pricing, expert knowledge, and a state-of-the-art approach to supporting Ethereum’s development. This makes it stand out among the best ETH ETFs for investors who want both performance and technological advancement.

Fidelity Ethereum Fund (FETH)

Image Source: Reddit

The Fidelity Ethereum Fund (FETH) stands out as a major player in the Ethereum ETF space. It blends a traditional investment structure with exposure to the world’s second-largest cryptocurrency. The fund tracks ether’s performance and gives investors a regulated way to gain exposure without dealing with direct cryptocurrency ownership [5].

Fidelity Ethereum Fund key features

FETH tracks ether’s price movements through a passive investment approach. The fund follows the Fidelity Ethereum Reference Rate and holds 100% ether instead of derivatives or futures contracts [5].

Fidelity Digital Assets handles the custody of the underlying ether with strong operational, cyber, and physical controls [5]. This custody solution removes a major worry for potential cryptocurrency investors who don’t want to manage private keys or digital wallets.

FETH stands out because none of its underlying ether is staked [5]. The fund doesn’t pay dividends or distributions since it focuses only on price exposure rather than generating yield [5].

You can buy FETH through many account types, including brokerage, trust, and tax-advantaged accounts like IRAs [5]. This makes the fund available to investors of all types who want to broaden their retirement portfolios.

Fidelity Ethereum Fund pros and cons

Pros:

-

Fidelity’s management brings trusted expertise in digital assets [9]

-

Direct exposure to Ethereum without cryptocurrency wallets [9]

-

Easy trading through traditional brokerage accounts [9]

-

No security risks of holding cryptocurrencies directly [9]

-

Strong performance with 51.27% NAV growth last month [3]

Cons:

-

High volatility in cryptocurrency markets [5]

-

Trading limited to traditional market hours despite 24/7 crypto markets [5]

-

ETF price might not perfectly match actual ether price [5]

-

Risks from Ethereum network upgrades and governance [5]

-

Investors must sign Fidelity’s Designated Investments Agreement [5]

Fidelity Ethereum Fund pricing

The fund’s expense ratio sits at 25 basis points (0.25%) as of January 1, 2025 [5]. Investors pay about $25 yearly for every $10,000 invested.

FETH’s price history shows typical cryptocurrency volatility. Recent results look impressive with a 109.65% increase over three months and 14.52% over one year [3]. The fund carries a high volatility rating that investors should note [3].

Like other ETH ETFs, FETH’s share value slowly decreases over time due to ongoing expenses while the underlying ether price moves up and down [5].

Fidelity Ethereum Fund best for

Investors who trust Fidelity’s reliable infrastructure and reputation will find FETH appealing. The company started researching bitcoin and developing blockchain solutions in 2014 [10], which shows their cryptocurrency expertise.

The fund works great for retirement-focused investors since it fits into tax-advantaged accounts that usually don’t allow direct cryptocurrency purchases [5]. This opens Ethereum exposure to much of the $40 trillion in American retirement accounts.

Traditional investors who want simplicity will appreciate FETH. The fund’s familiar structure, standard reporting, and clear pricing blend easily into existing portfolios without needing special cryptocurrency knowledge [10].

FETH suits investors with aggressive goals. Fidelity requires accounts holding FETH to be classified as “Most Aggressive” [5].

VanEck Ethereum Trust (ETHV)

Image Source: Reuters

VanEck, a 20-year old ETF issuer with deep crypto experience, launched the VanEck Ethereum Trust (ETHV) in the Ethereum market. The fund started on June 25, 2024, and now manages assets worth $272.19 million as of August 15, 2025 [7].

VanEck Ethereum Trust key features

ETHV works as a passive investment vehicle that tracks Ethereum’s price performance minus operational expenses [2]. The fund sticks to ETH price tracking without any active investment strategies [7].

ETHV stands out because of its strong asset security approach. Qualified custodians – Gemini Trust Company and Coinbase Custody Trust handle the Ethereum in cold storage [11]. This storage method keeps private keys offline and protects assets from cyber threats [12].

On top of that, ETHV brings three core benefits:

-

Simplicity: A cost-efficient way to invest in Ethereum through a familiar exchange-traded product [7]

-

Secure custody: Assets backed by real ether and stored safely offline [7]

-

Credibility: A trusted ETF issuer’s expertise manages your investments [7]

VanEck Ethereum Trust pros and cons

Pros:

-

0.20% competitive expense ratio [7]

-

No fees for first year on the original $1.50 billion in assets [11]

-

Top-tier custody through Gemini and Coinbase [12]

-

Strong YTD returns of 31.48% as of August 15, 2025 [7]

-

$2 billion in crypto-linked assets managed globally shows deep market experience [4]

Cons:

-

Not under Investment Company Act of 1940 registration [2]

-

Ethereum market’s extreme volatility affects performance [2]

-

Market price might face liquidity issues [2]

-

Expense payments reduce trust shares’ value over time [2]

-

Less protection than traditional investments [2]

VanEck Ethereum Trust pricing

ETHV keeps its fee structure simple with a 0.20% annual expense ratio [7]. Investors pay $20 yearly for every $10,000 they invest.

VanEck removed all fees from July 23, 2024, through July 22, 2025, for the first $1.50 billion in assets [11]. The standard 0.20% fee returns after this period or threshold [11].

You can trade the fund on Cboe BZX Exchange as ETHV [4]. Buy shares through your regular brokerage account just like stocks [7].

VanEck Ethereum Trust best for

ETHV works best especially when you have to get simple Ethereum exposure without dealing with cryptocurrency directly [11]. You won’t need to worry about private keys, digital wallets, or crypto exchanges.

The fund attracts investors who value strong institutional support. VanEck’s expertise in digital assets and $2 billion crypto-linked product portfolio [4] gives you access to specialized market knowledge.

ETHV helps cost-conscious investors save money during the no-fee period [11]. The competitive pricing makes it an economical choice to invest in Ethereum through regulated channels.

The trust offers a simple way for traditional investors to vary their portfolios with digital assets while leveraging VanEck’s solid ETF reputation.

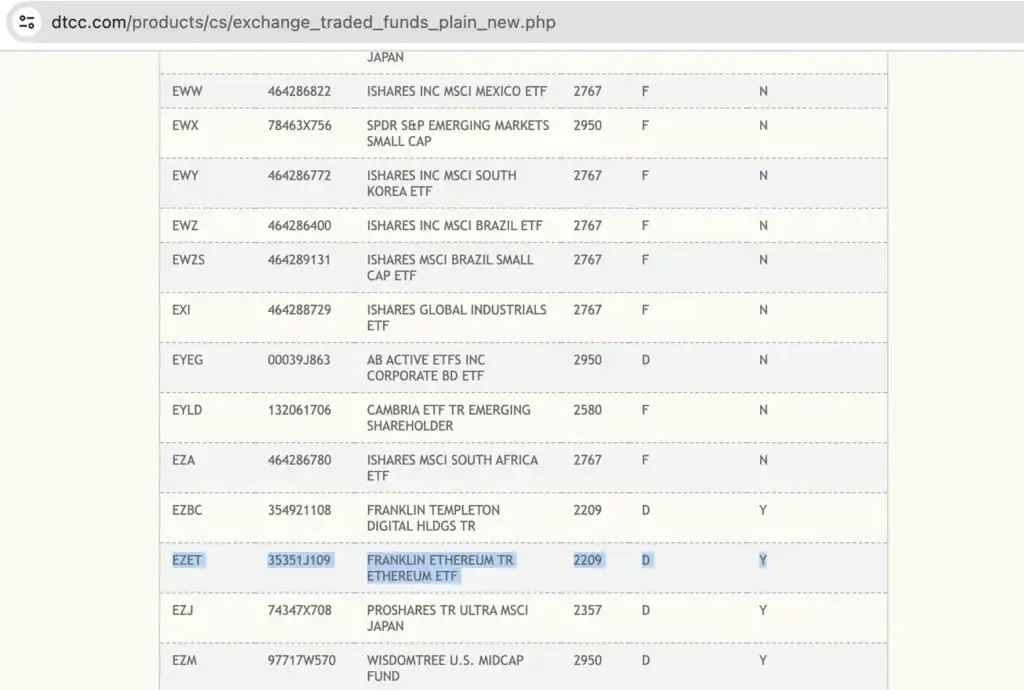

Franklin Ethereum Trust (EZET)

Image Source: Mitrade

Franklin Templeton has entered the Ethereum ETF market with their Franklin Ethereum Trust (EZET). This new fund gives investors another way to invest in the world’s second-largest cryptocurrency. The trust manages assets worth $75.54 million as of August 15, 2025 [13].

Franklin Ethereum Trust key features

The trust aims to mirror Ethereum’s price performance before expenses [8]. Coinbase Custody Trust Company acts as the main custodian and stores ether in cold storage [14].

EZET stands out because of its simple approach and strong institutional support. Franklin Templeton brings 75 years of experience as a trusted financial partner [8]. This helps investors access the crypto market through a regulated investment vehicle easily.

This passive investment vehicle doesn’t try to time Ethereum price movements [8]. The fund simply tracks ether’s performance, which makes it perfect for investors who want direct exposure to this digital asset.

Franklin Ethereum Trust pros and cons

Pros:

-

Low fees at 0.19% [15]

-

No fees until January 31, 2025, for the first $10 billion in assets [16]

-

Franklin Templeton’s strong reputation backs the fund

-

Easy way to invest in Ethereum without crypto wallet hassles

-

Strong returns of 28.84% YTD [13]

Cons:

-

Not registered under the Investment Company Act of 1940 [8]

-

Subject to Ethereum’s price swings

-

No staking rewards from held ether [8]

-

Fund value drops over time due to costs [8]

-

Fund only holds ether and cash [16]

Franklin Ethereum Trust pricing

The fund charges a simple 0.19% fee [15]. In spite of that, Franklin Templeton won’t charge any fees until January 31, 2025, for the first $10 billion in assets [17]. The regular 0.19% fee kicks in after this period or threshold.

Shares cost around $33.46 [13], which makes it easy for investors to get started with Ethereum.

Franklin Ethereum Trust best for

EZET works great for investors who want professional-grade exposure to Ethereum’s ecosystem. Franklin Templeton believes that “Ethereum is a novel, growing business model with a large addressable market and strong network effects” [8].

Traditional investors who want simple crypto access without technical headaches will find this fund appealing. Franklin Templeton’s blockchain expertise since 2018 [17] makes EZET attractive to investors who value experience in the digital asset space.

21Shares Core Ethereum ETF (CETH)

Image Source: 21Shares

The 21Shares Core Ethereum ETF (CETH) stands out as a strong choice in the spot Ethereum ETF market. The fund manages about $56.2 million in assets as of August 14, 2025 [6]. Launched on July 22, 2024, CETH aims to track Ethereum’s performance through the CME CF Ether-Dollar Reference Rate – New York Variant [6].

21Shares Core Ethereum ETF key features

CETH gives investors direct access to spot Ethereum stored in cold storage by one of the largest cryptocurrency custodians [18]. This security setup provides better protection against online threats than individual custody options [18].

The fund’s YTD return stands at 31.50% [6], making it appealing to investors who want Ethereum exposure. CETH keeps 100% of its portfolio in Ethereum [19], which gives pure exposure to the cryptocurrency’s performance.

21Shares Core Ethereum ETF pros and cons

Pros:

-

Competitive 0.21% expense ratio [6]

-

Complete fee waiver until January 2025 or first $500 million in assets [20]

-

Better security through professional cold storage custody [18]

-

Direct exposure to spot Ethereum [21]

-

Access through traditional brokerage accounts [21]

Cons:

-

No staking rewards compared to direct ETH ownership [20]

-

Fewer lending options than direct ETH holders [20]

-

Not registered under the Investment Company Act of 1940 [22]

-

Affected by cryptocurrency market volatility [21]

-

Trading restricted to exchange hours unlike 24/7 cryptocurrency markets [21]

21Shares Core Ethereum ETF pricing

CETH comes with a 0.21% expense ratio [6], making it one of the most affordable options in the Ethereum ETF market. 21Shares waives this fee completely until January 31, 2025, or until the fund reaches $500 million in assets [20][18].

21Shares Core Ethereum ETF best for

CETH works great for budget-conscious investors looking for temporary fee benefits. The fund appeals to people who want to tap into Ethereum’s growth potential without managing digital wallets or cryptocurrency exchanges [21]. Investors who value security will appreciate the professional cold storage custody that protects against online threats [18].

Comparison Table

|

ETF Name |

AUM (as of Aug 2025) |

Expense Ratio |

Fee Waiver Details |

Custodian |

YTD Performance |

Launch Date |

|

iShares Ethereum Trust (ETHA) |

$15.35B |

0.25% |

0.12% until Jul 2025 on first $2.5B |

Coinbase Prime |

Not mentioned |

Jun 24, 2024 |

|

Grayscale Ethereum Mini Trust (ETH) |

$3.1B |

0.15% |

No fees on first $2B for initial 6 months |

Coinbase Custody |

Not mentioned |

Jul 23, 2024 |

|

Bitwise Ethereum ETF (ETHW) |

$593.6M |

0.20% |

No fees on first $500M for initial 6 months |

Not mentioned |

Not mentioned |

Jul 22, 2024 |

|

Fidelity Ethereum Fund (FETH) |

Not mentioned |

0.25% |

Not mentioned |

Fidelity Digital Assets |

Not mentioned |

Not mentioned |

|

VanEck Ethereum Trust (ETHV) |

$272.19M |

0.20% |

No fees on first $1.5B for first year |

Gemini Trust & Coinbase Custody |

31.48% |

Jun 25, 2024 |

|

Franklin Ethereum Trust (EZET) |

$75.54M |

0.19% |

No fees on first $10B until Jan 31, 2025 |

Coinbase Custody |

28.84% |

Not mentioned |

|

21Shares Core Ethereum ETF (CETH) |

$56.2M |

0.21% |

No fees on first $500M until Jan 2025 |

Not mentioned |

31.50% |

Jul 22, 2024 |

Conclusion

Ethereum ETFs have changed how traditional investors access the second-largest cryptocurrency market. These seven options each bring unique advantages based on your investment priorities.

BlackRock’s iShares Ethereum Trust leads the pack with over $15 billion in assets. This makes it the most liquid option for investors who care about trading stability. Grayscale’s ETH Mini Trust catches attention with the lowest expense ratio at 0.15% – a great pick for investors who want the best value for their money.

Bitwise takes a different approach by putting 10% of profits into open-source development, which appeals to investors who support Ethereum’s future. Big names like Fidelity, Franklin Templeton, and VanEck offer comfort to those who prefer established institutions.

The fee structure needs a close look before you invest. All seven ETFs charge competitive rates between 0.15-0.25%. Most of them waive fees during their launch period. This gives early investors a rare chance to track Ethereum’s performance without paying fees.

Three key factors should guide your choice. Look at expense ratios and fee waiver periods if costs matter most to you. The trading volume and liquidity become crucial for bigger investments. The security of the underlying ETH depends on custodial arrangements – a vital aspect for any crypto investment.

Spot Ethereum ETFs mark a turning point for crypto adoption. Retirement accounts that couldn’t touch this asset class now have a way in. While Ethereum’s performance has been mixed compared to broader markets lately, these regulated products make it easier to invest in blockchain’s potential without dealing with technical details.

The best choice comes down to your investment goals, timeline, and risk tolerance. These products have bridged the gap between traditional finance and Ethereum’s potential to change the future.

Key Takeaways

Here are the essential insights for investors considering Ethereum ETFs in 2025:

• iShares Ethereum Trust (ETHA) leads with $15.35B in assets, offering superior liquidity and BlackRock’s institutional backing at 0.25% expense ratio

• Grayscale Ethereum Mini Trust (ETH) provides the lowest fees at 0.15%, making it ideal for cost-conscious investors seeking affordable Ethereum exposure

• Most ETFs offer temporary fee waivers during launch periods, creating opportunities for essentially free Ethereum exposure in early investment phases

• All seven ETFs eliminate cryptocurrency complexity by providing regulated access through traditional brokerage accounts without wallets or private keys

• Ethereum ETFs unlock retirement account access to cryptocurrency markets, tapping into America’s $40 trillion in retirement assets previously excluded from crypto

• Choose based on priorities: liquidity (ETHA), cost (ETH), or innovation (ETHW’s developer funding) while considering custodial security and trading volume

These spot Ethereum ETFs represent a watershed moment for cryptocurrency adoption, finally bridging traditional finance with blockchain technology through familiar, regulated investment vehicles that eliminate technical barriers while maintaining exposure to Ethereum’s growth potential.

FAQs

Q1. What are the key advantages of investing in Ethereum ETFs? Ethereum ETFs offer simplified exposure to Ethereum’s performance without the need to manage cryptocurrency wallets or exchanges. They provide regulated investment vehicles, easier integration with traditional portfolios, and potential access through retirement accounts.

Q2. How do Ethereum ETF fees compare to direct cryptocurrency investments? Ethereum ETF fees typically range from 0.15% to 0.25% annually, which is competitive compared to cryptocurrency exchange fees. Many ETFs also offer initial fee waivers, potentially providing fee-free exposure for early investors.

Q3. Are Ethereum ETFs suitable for retirement accounts? Yes, Ethereum ETFs are particularly beneficial for retirement accounts as they allow exposure to cryptocurrency markets through regulated investment vehicles. This opens up Ethereum investment opportunities for the estimated $40 trillion held in American retirement accounts.

Q4. How do Ethereum ETFs address security concerns? Ethereum ETFs typically use institutional-grade custody solutions, often storing the underlying Ethereum in cold storage. This approach helps mitigate risks associated with hacking, theft, or loss of private keys that can occur with direct cryptocurrency ownership.

Q5. What factors should investors consider when choosing an Ethereum ETF? Key factors to consider include expense ratios, trading volume and liquidity, assets under management, the reputation of the issuer, custody arrangements, and any unique features like developer funding commitments. Your choice should align with your investment goals, risk tolerance, and cost sensitivity.

References

[1] – https://www.ishares.com/us/literature/fact-sheet/etha-ishares-ethereum-trust-etf-fund-fact-sheet-en-us.pdf

[2] – https://www.vaneck.com/us/en/investments/ethereum-etf-ethv/fact-sheet/

[3] – https://www.fidelity.ca/en/products/etfs/feth/

[4] – https://etfgi.com/news/stories/2024/07/vaneck-launches-ethv-ethereum-etf-providing-spot-ether-exposure

[5] – https://www.fidelity.com/etfs/crypto-funds

[6] – https://www.21shares.com/en-us/products-us/ceth

[7] – https://www.vaneck.com/us/en/investments/ethereum-etf-ethv/

[8] – https://www.franklintempleton.com/investments/options/exchange-traded-funds/products/40521/SINGLCLASS/franklin-ethereum-etf/EZET

[9] – https://sumgrowth.com/etf-profile/invest-in-FETH-etf.html

[10] – https://institutional.fidelity.com/advisors/investment-solutions/asset-classes/alternatives/fidelity-ethereum-fund

[11] – https://www.vaneck.com/us/en/blogs/digital-assets/ethv-etf-question-and-answer/

[12] – https://www.vaneck.com/us/en/investments/ethereum-etf-ethv/ethv-fund-faq.pdf

[13] – https://finance.yahoo.com/quote/EZET/

[14] – https://www.sec.gov/Archives/edgar/data/2011535/000113743924001166/fets1a07172024.htm

[15] – https://www.nerdwallet.com/article/investing/ethereum-etfs

[16] – https://www.franklintempleton.com/strategies/franklin-ethereum-etf-ezet

[17] – https://investors.franklinresources.com/news-center/press-releases/press-release-details/2024/Franklin-Templeton-Launches-Franklin-Ethereum-ETF-EZET-4bbe5ee76/default.aspx

[18] – https://hellostake.com/au/blog/trending/best-ethereum-etfs-to-watch

[19] – https://www.morningstar.com/etfs/bats/ceth/quote

[20] – https://archlending.com/blog/best-ethereum-etfs

[21] – https://www.ledger.com/th/academy/topics/economics-and-regulation/guide-to-what-ethereum-spot-etfs-are

[22] – https://www.sec.gov/Archives/edgar/data/1992508/000121390024054719/ea0205580-04.htm