Turning $100 to $1000 or More Trading Forex

To be a successful trader, you need to understand how leverage works. It is very essential. You’ll be in for a disaster if you trade ignorantly with leverage.

Trading far beyond the amount of money you can comfortably risk can lead you to a point of no return. Although, if the trade works to your favor, you can gain significantly. Also, be sure to check out our article on how to become a Forex millionaire.

- You must always remember not to invest or open trades beyond your risk limit.

- The amount of money you invest in forex must never be large enough that it will halt your life when things go wrong.

- Your forex trading capital or investment must not interfere with your day to day’s financial responsibilities.

This is not a get rich quick strategy. We are simply making the argument that its POSSIBLE to turn $100 to $1000 or more trading forex. Its “Possible” but not easy! and is always risky.

It is possible to turn $100 to $1000 or more trading forex, but it is important to note that it requires a high level of risk and skill. Many novice traders lose money in the forex market, so it is important to thoroughly educate yourself on the market and develop a solid trading strategy before investing any significant amount of money. Additionally, it is important to have realistic expectations and not to risk more than you can afford to lose.

Leverage is like a double-edged sword. It can potentially boost your profits considerably.

It can also boost your risks and plunge you down into the abyss. When the trade moves in the negative direction, leverage will magnify your potential losses.

Trading with a leverage of 100:1, allows you to enter a trade for up to $10,000 for every $100 in your account.

Again another example, with a leverage of 100:1, you can trade up to $100,000 when you have the margin of $1,000 in your account.

That means with the leverage you can earn profits equivalent to having as much as $100,000 in your trading account.

On the other hand, it also means the leverage exposes you to a loss equivalent to having $100,000 in your trading account.

Possibility Vs. Probability

In forex trading, theoretically, any pattern of gain or loss is almost possible.

If something is possible, doesn’t mean you need to implement it. That is why to always remain safe, you should be careful while trading with leverage.

In this article, we are going to illustrate how you can realistically turn 100 dollars into more than 1000 dollars trading forex long term.

How and why it is possible!

Almost all Forex brokers provide traders with a minimum leverage of 50:1.

This gives traders the opportunity to trade forex with funds up to 50 times the funds in their account.

100:1 = 100 times the funds in your account

200:1 = 200 times the funds in your account and so on..

Trading forex this way is referred to as trading on margin.

The funds you have in your account is referred to as margin, while the amount you trade in excess of what you have in your trading account is borrowed from your broker.

SOME forex brokers do not ask for a minimum deposit. Thus, if you have just 100 dollars in your account, you’ll be able to trade up to 5,000 units (with 50:1 leverage applied), which is more than sufficient to start trading forex profitably.

If you implement leverage on the EUR/USD currency pair, for instance, trading with 5,000 units is equivalent to trading with 5,000 dollars and every pip is equal to 0.50 dollars or 50 cents.

Although this may look small, if you are making a profit of 100 pips, it would be equivalent to $50 profit or a 50 percent increase!

However, you must remember that trading forex on leverage can boost your potential gain or loss.

If you trade with a 50:1 leverage, a loss of 100 pips would eliminate 50 percent of your trading account and leave you with only $50.

This is why trading with high leverage is one of the main reasons most forex traders lose their money.

The second reason forex traders lose their money is that they day-trade forex. There are reasons why day trading is not a sustainable strategy and may not be the best choice, but that’s beyond the scope of this article.

How to Turn $100 to $1000 or more

$100

$1000

Now, returning back to the topic at hand, there are a lot of things you must do to be successful as a forex trader. The key ones among them are:

- Trading with low leverage

- Engaging in long-term trading.

We are going to use a low leverage of 15:1 to illustrate that you can turn $100 into $1000 or more by trading long term.

If you are trading with a leverage of 50:1, trading with 30 percent of the money in your account as margin would be similar to trading the whole money in your account with a leverage of 15:1.

Initiating trade with just $100 would make your initial trade size equal to:

- 100 dollar x 15 = 1,500 units when you trade with 100 percent of the fund you have at 15:1 leverage.

On the other hand, when you trade with 30% of your entire fund with the leverage of 50:1, your trade size would be equivalent to:

- 30 dollars x 50 = 1,500 units (30 percent of your funds at 50:1 leverage)

This means trading the entire 100 dollars with leverage of 1:15 amounts to the same trade volume as trading 30 percent of 100 dollars with the leverage of 50:1.

If you are wondering how you can trade 1,500 units with standard lot sizes, you may need to use brokers that make that possible like OANDA, easyMArkets and XM.

If for instance, we make 10 pips daily, then our profit would average 200 pips monthly. At the end of each month, your total account size will be roughly $130.

- $0.15 per pip x 200 pips = $30 profit

By standard, forex brokers incorporate your non attained profit when estimating accessible margin. Thus, after one month, you’ll have 30 dollars utilized margin, 70 dollars non utilized margin, and an extra 30 dollars in non attained profit.

To the broker, it will seem that you have 100 dollars margin available. That is 70 dollars non-utilized margin plus 30 dollars non attained profit, which implies that you can make extra trades in a pyramid manner.

If you only have 100 dollars to start trade without the leverage offer, then your subsequent trade volume would be very small because it implies you’ll be using only 30% of your no attained profit for a subsequent trade:

- 30 dollars x 0.3 = 9 dollars

- 9 dollars x 50 = 450 units

This would be the case if the only thing you have is 30 dollars in non attained profit. That means your subsequent trade size will merely be using 9 dollars as margin.

But with the leverage, you’ll have for your first trade 1,500 units which returned 200 pips gain and you just added extra trade of 450 units.

This may not appear significant, but it actually means, you are currently attaining roughly a 30 percent boost monthly. This can help you turn $100 to over $1000 and may help you get to one million dollars in three years!

Again, assuming you had $10,000 to trade, your first trade size would be equivalent to 150,000 units at the rate of $15 per pip.

Thus, your first month of profit would be roughly $3,000, and your subsequent trade size would be 45,000 units at the rate of $4.50 per pip.

$100 to MORE THAN $1000 trading forex

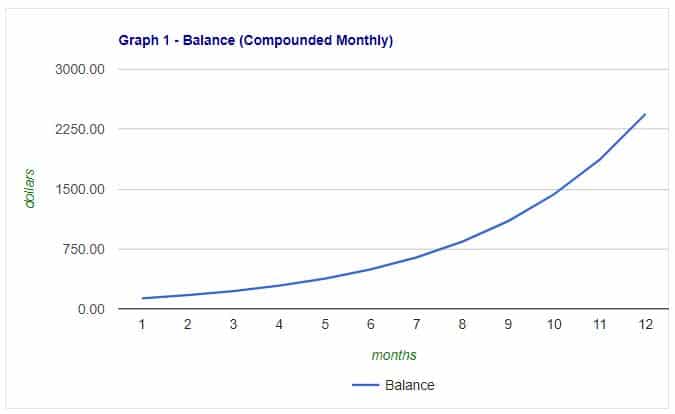

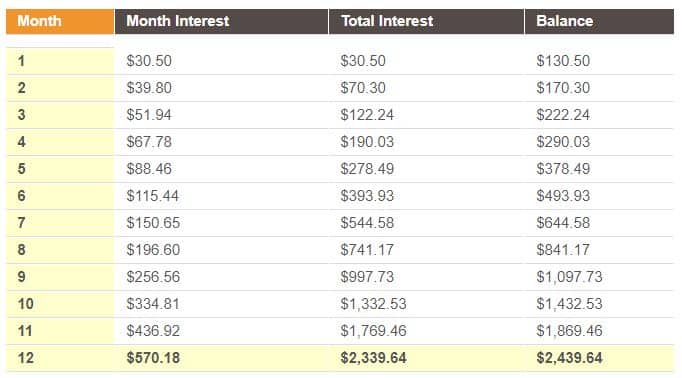

The charts below may be packed with too much information, but the chart on how to trade with 100 dollars for the first year, will make everything clearer to you.

In the first year, with a practical goal of making 30.5 percent increase every month, you can turn your 100 dollars to 1,800 dollars.

However, you may not see that as a great achievement till you’ve realized that it actually means you are making a 2,240 percent ROI (Return-On-Investment) in a single year.

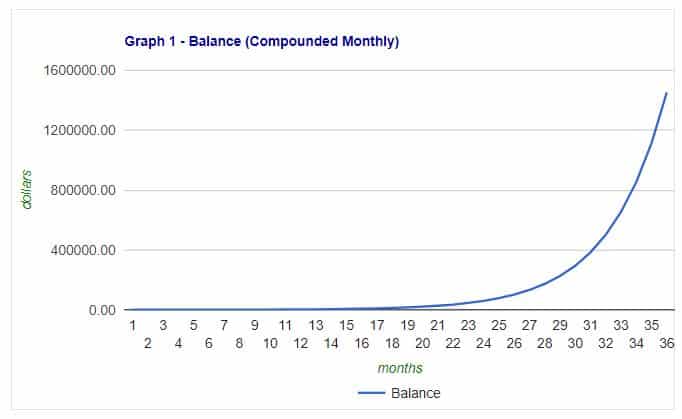

Long-term forex trading can be more reliable than day trading. You can trade with low leverage long-term and potentially turn $100 to $1 Million in 3 years. While this is relatively unheard of, it is mathematically possible.

Sure, there are many variables that could affect actual results, but the estimates we made here are based on pragmatic assumptions.

Most traders will not be able to increase their funds from $100 to one million in three years even when they follow this example completely.

They may probably want to withdraw some of their profit before the time. This illustration is based on the assumption that the trader would not withdraw the funds until he has achieved the goal of one million dollars in three years.

How Experts and Experienced Traders Trade Forex

Most experienced traders who trade with leverage implement proper risk management and limit their trades to a leverage of 5:1. They rarely move beyond a leverage of 3:1. This is one of the reasons why they are successful.

Another reason, experienced traders make profits trading forex is that they stabilize their finances and only trade with the funds they can put at risk.

Because they are financially stable, they capitalize their trading account properly.

This makes high leverage options less attractive to them. With a balanced and stable finances, they are less likely to trade with emotion and this minimizes their risk of avoidable mistakes and losses.

When you learn technical analysis, fundamental analysis, how to analyze market sentiments, generate trading systems and how to manage trading psychology; it is equally important you capitalize your account adequately and trade those funds with smart leverage.

Your possibility of failing as a trader is minimized greatly when you trade with a specific minimum starting capital. Small account sizes such as a 100 dollar account, expose you to the dangers of excessive use of leverage.

For these reasons, it is not advisable to open a small trading account and anticipate a huge or excessive return on investments.

Properly capitalizing your account and trading with low leverage help to limit your losses to the amount you can comfortably bear.

That means your night’s sleep would not be disturbed and you’ll have funds remaining to continue trading for a long time.

Conclusion

Never ever give into the claims of forex trading brokers that tell you, you can trade with 100 dollars and turn it into millions of dollars in a little while.

While it is possible to trade bigger on leverage as they advertise, what they wouldn’t tell you that the implication of engaging in such activities when the trade goes against you.

While it is theoretically possible to trade with $100 and turn it into $10,000 or more, when you break it down into rates of return, it shows that such a return is not only very difficult to accomplish but also irrational.

Forex trading companies that want to WOO you into believing that with so little money in your account, you would make a huge ROI in a short period of time, are just deceiving you and want to capitalize on your ignorance to “cheat” you out of your money.

Forex trading is not a get rich quick scheme.

To be successful, you need to know what you are doing, work hard and be smart while implementing trades.

You need to be wise when choosing a trading strategy.

You can try swing trading. Trading on higher time-frames, like H1 and H4, don’t normally consume much time and can generate numerous pips if you read charts on such time-frames.

Don’t be in a rush! Take your time. Select a strategy. Try it out on a demo account for a few weeks. If you’re successful and comfortable with it, continue with it, but if it is not yielding the desired results, drop it and choose a better / more suitable one.

Finding a fitting strategy is not an easy task. It may take you months of experimenting before you get to a successful and convenient trading strategy. As soon as you discover the right strategy, implement it. You will get better at it with more and more practice.

By implementing your successful strategy consistently for some months, you’ll improve your skills. This is the best way to succeed as a trader in the forex market.