12 Critical Signs of Growing Institutional Bitcoin Investor Interest

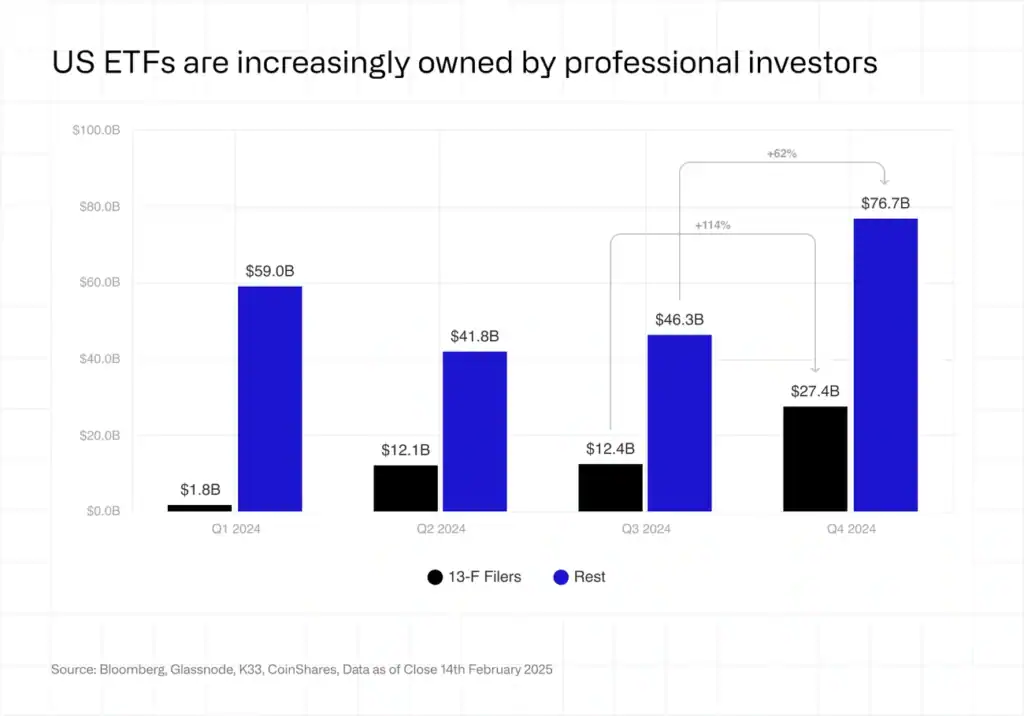

Professional Bitcoin investors now control an impressive $27.4 billion in Bitcoin ETFs during Q4 2024. This represents a 114% jump from the previous quarter. Traditional finance’s view of cryptocurrency has transformed dramatically.

Bitcoin BTC adoption numbers tell a compelling story. Professional investors’ share of Bitcoin ETF assets has climbed to 26.3% from 21.1% in Q3 2024. Bitcoin dominates the global cryptocurrency market with a 54% share of the $3.7 trillion total. Portfolio allocations remain below 1%, which suggests substantial growth potential for institutional crypto investors.

Several forces power this remarkable growth. Regulatory progress and strategies to protect against inflation have sparked institutional interest. This piece will get into 12 key indicators that show institutions are embracing Bitcoin faster than ever before. These insights reveal what this means to cryptocurrency’s future as an asset class.

Table of Contents

Surging Institutional Holdings in Bitcoin ETFs

Professional money managers have radically changed their Bitcoin ETF positions in the last two quarters. This reveals a complex picture of institutional adoption. After an explosive surge in Q4 2024, Q1 2025 saw the first quarter-over-quarter decline in professional holdings since US spot bitcoin ETFs launched in January 2024 [1].

Surging Institutional Holdings in Bitcoin ETFs overview

Bitcoin ETF institutional investment shows rapid growth and strategic repositioning:

Q4 2024: Professional investors managing more than $100 million held $27.40 billion worth of Bitcoin ETFs. This marked a 114% increase from Q3 2024 [2].

Q1 2025: Holdings fell to $21.20 billion, showing a 23% decline from the previous quarter [1].

Market dynamics drove this change. Institutional investors’ share of total Bitcoin ETF AUM dropped from 26.3% in Q4 2024 [2] to 22.9% in Q1 2025 [1]. This reflects evolving strategies among different institutional players rather than a simple withdrawal.

Why Surging Institutional Holdings in Bitcoin ETFs matter

Raw numbers tell only part of the story. These holdings carry deeper significance for several reasons:

Market legitimization: ETFs create expandable solutions bridging traditional finance and Bitcoin. This broadens access for mainstream investors [3].

Structural adoption: Bitcoin’s role in institutional portfolios has changed from speculative to structural as regulatory clarity grows [2].

Liquidity boost: The market becomes more liquid and price-transparent when institutions participate [3].

Q1’s decline hasn’t changed the core trend. Financial professionals now see Bitcoin as a legitimate asset class rather than a passing trend.

How Surging Institutional Holdings in Bitcoin ETFs reflect adoption

The mix of institutional investors tells a compelling adoption story:

Institution Type | Q4 2024 Share | Q1 2025 Share | Trend |

|---|---|---|---|

Hedge Funds | 41% | 32% | ↓ |

Investment Advisors | 41% | 50% | ↑ |

Hedge funds cut their exposure by nearly one-third in Q1 2025 [1]. Investment advisors increased their Bitcoin-denominated holdings at the same time. Hedge funds took profits after Bitcoin hit $100,000, while advisors kept steadily moving client portfolios toward Bitcoin exposure [1].

Q1 2025 data points to a healthy market adjustment within a positive long-term adoption trend [1]. Institutional portfolios still average less than 1% Bitcoin exposure [1]. This leaves substantial room for growth as regulatory frameworks become standard and oversight committees give approval [1].

Abu Dhabi’s Mubadala started a $408.50 million position [4]. This sovereign wealth fund’s entry shows Bitcoin’s institutional footprint now reaches beyond traditional financial players.

Dominance of IBIT, FBTC, and GBTC in Institutional Portfolios

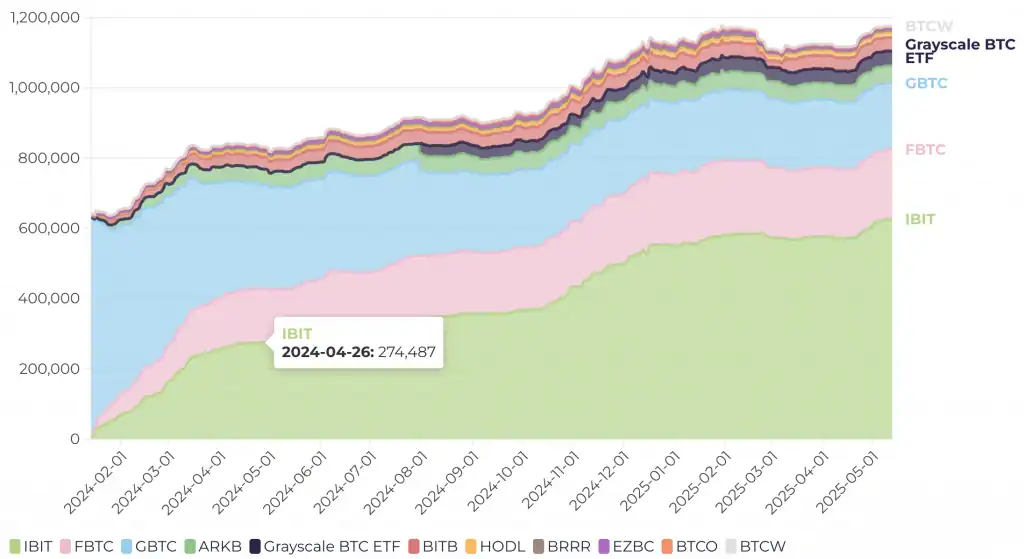

Three major ETFs have become the life-blood of institutional Bitcoin investment strategies. IBIT, FBTC, and GBTC now make up 86% of the U.S. bitcoin ETF market [link_1]. This shows how institutional investors clearly prefer these trusted offerings [5].

IBIT, FBTC, and GBTC key stats

BlackRock’s iShares Bitcoin Trust (IBIT) leads the pack. Institutions hold 306 million shares, which is 31.5% of its AUM at $16.30 billion [5]. The ETF saw its 13-F ownership jump 196% from last quarter [5]. IBIT now handles 71.3% of average Bitcoin ETF trading volume, up from 47.6% when it started [1].

Fidelity’s FBTC takes second place. Institutions own 59 million shares (25.5% of AUM) with a 72% increase in 13-F ownership from last quarter [5]. The fund manages about $8.66 billion [6] and makes up 10.5% of Bitcoin ETF trading volume [1].

Grayscale’s GBTC market share dropped from 22.8% at launch to 7.7% today [1], even though it came first. Institutions hold 34 million GBTC shares, which is 13.1% of AUM [5].

ETF | Institutional Ownership | % of Trading Volume | Quarterly Growth |

|---|---|---|---|

IBIT | 31.5% | 71.3% | 196% |

FBTC | 25.5% | 10.5% | 72% |

GBTC | 13.1% | 7.7% | 43% |

Why institutions prefer IBIT, FBTC, and GBTC

Expense ratios play a big role in what institutions choose. IBIT and FBTC charge competitive 0.25% fees [6]. GBTC costs more at 1.5% [6], which explains why its market share keeps falling despite being the oldest.

IBIT stands out for liquidity. It became the first fund to reach $1 billion in trading volume [1]. Major financial firms have backed these ETFs heavily. Goldman Sachs holds $2.34 billion in Bitcoin spot ETFs, with IBIT making up 83.7% [7]. Millennium has $2.62 billion invested (60.5% in IBIT and 26.5% in FBTC) [7]. Brevan Howard put $1.38 billion into IBIT [7].

Impact of IBIT, FBTC, and GBTC on bitcoin adoption chart

These three ETFs have changed Bitcoin’s market structure completely. Research shows they control price discovery over bitcoin spot 85% of the time [1]. Power has moved from crypto exchanges to traditional finance venues.

Traditional investors can now buy bitcoin through their regular brokerage accounts instead of crypto exchanges [1]. This easier access has helped adoption grow. BlackRock’s Strategic Income Opportunities Portfolio increased its IBIT holdings from 1.69 million to 2.12 million shares between December 2024 and March 2025 [3]. Portfolio managers are slowly adding more Bitcoin to their mix.

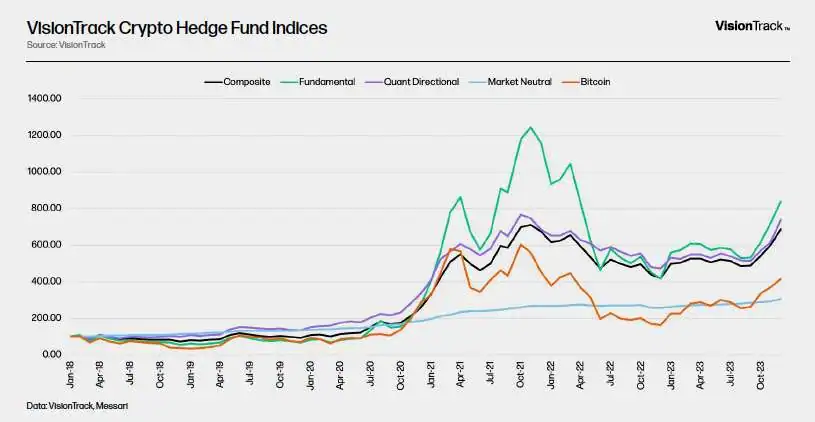

Hedge Funds Leading the Institutional Bitcoin Charge

Image Source: Galaxy

Hedge funds lead the charge in institutional Bitcoin adoption. Research from investment firm River shows that more than 50% of America’s largest hedge funds now hold Bitcoin positions [4]. Their early support changes how traditional financial institutions see cryptocurrency as an asset class.

Top hedge fund bitcoin holders

These market leaders have made big Bitcoin investments:

Hedge Fund | Bitcoin Holdings | Approximate Value |

|---|---|---|

Millennium Management | 27,263 BTC | $1.69 billion [8] |

Schonfeld Strategic Advisors | 6,734 BTC | $415+ million [4] |

Point72 Asset Management | 1,089 BTC | $67+ million [4] |

Millennium Management’s Bitcoin position makes up about 2.5% of its $67.70 billion assets under management [4]. Tudor Investment Corporation doubled its iShares Bitcoin Trust holdings in Q4 2024 to 8 million shares worth $426.90 million [8].

Why hedge funds are adopting bitcoin

Several strategic reasons drive hedge funds to include Bitcoin. These firms want to diversify beyond traditional markets. CoinEx CEO Haipo Yang puts it simply: “Traditional assets show great market efficiency, which makes it harder to earn excess returns through conventional types of assets” [5].

The cryptocurrency market offers great arbitrage opportunities because of its volatility and market inefficiencies [5]. The bitcoin basis trade—buying spot bitcoin while shorting bitcoin futures—saw yearly spreads hit 17% after the 2024 U.S. election [8].

Bitcoin’s extraordinary returns stand out compared to traditional strategies. Wall Street’s conventional approaches have yielded almost 0% alpha versus the S&P 500 over most of the last decade. Bitcoin, however, has delivered an average yearly ROI of 1,576% [5].

How hedge funds influence institutional crypto investors

Hedge funds pave the way for broader institutional adoption through various channels. Aaro Capital’s CEO Peter Habermacher explains: “The potential for outsized risk-adjusted returns from effective active management is much larger than in traditional asset classes” [5]. Crypto funds have outperformed the market by over 100% since 2015 with a third less volatility—data that other institutions find compelling [5].

These early adopters set operational best practices. Many hedge funds improved their counterparty risk management after the FTX collapse, creating stronger frameworks for institutional participation [5].

Their growing presence validates crypto investments for other institutional players. The 2023 Global Crypto Hedge Fund Report reveals that 47% of traditional hedge funds now have digital asset exposure, up from 29% in 2023 and 37% in 2022 [9]. This upward trend shows growing confidence despite regulatory uncertainties.

Investment Advisors and Brokerages Expanding Exposure

Investment advisors have quickly become the dominant institutional force in Bitcoin markets. They have surpassed hedge funds to become the largest holders of spot Bitcoin ETFs. These advisors hold over $10.28 billion in Bitcoin ETF assets, representing approximately 124,753 BTC as of mid-2025 [10].

Role of advisors in bitcoin adoption

Financial advisors serve as key players in Bitcoin adoption because they manage trillions in client assets. Recent data reveals advisors now represent nearly half of all institutional crypto ETF holdings [10]. Bloomberg ETF analyst Eric Balchunas notes they’ve become “number one by a mile” [10].

Client interest drives this trend, with 96% of advisors receiving client questions about crypto [6]. The numbers tell a compelling story – 99% of advisors who already allocate to crypto plan to maintain or increase their exposure [6]. One-fifth of advisors now recommend crypto to their clients, which is double the percentage from last quarter [11].

Brokerage participation in bitcoin ETFs

Brokerages hold the third position in institutional Bitcoin ETF holdings, right after investment advisors and hedge funds [10]. Access remains limited at major firms though. Only 35% of advisors can purchase crypto in client accounts [6]. Many large wirehouses still maintain strict compliance controls.

Major brokerages are learning about adding Bitcoin to portfolio models. VanEck’s director of digital assets believes “it will be a game changer” once this happens [12]. Bitcoin allocations could double after wirehouses enable model portfolios with Bitcoin exposure [12].

Institutional bitcoin investors list from advisory firms

Leading investment advisors continue to increase their Bitcoin exposure:

Advisory Category | Bitcoin ETF Holdings | ETH ETF Holdings |

|---|---|---|

Investment Advisors | $10.28 billion (124,753 BTC) | $582 million (320,089 ETH) |

Hedge Funds | $6.90 billion (83,934 BTC) | $244 million (134,469 ETH) |

Brokerages | Third largest holder | Data unavailable |

Institutions filing 13F forms represent about 20% of total spot Bitcoin ETF assets. This number could reach 35-40% as traditional finance accepts these products more widely [10]. Most advisors keep conservative allocations. Half of them recommend 5% or less of portfolio assets [11], which suggests room for substantial growth.

Entry of Sovereign Wealth Funds and Governments

Image Source: CryptoSlate

Sovereign wealth funds (SWFs) are quietly building their Bitcoin positions, signaling a new chapter in institutional adoption. These government-controlled investment vehicles manage around $8 trillion in assets globally, representing a significant source of potential capital for the cryptocurrency market [13].

First government bitcoin ETF filings

Abu Dhabi’s Mubadala Investment Company leads the pack with a $408.50 million stake in BlackRock’s iShares Bitcoin Trust (IBIT), according to a recent 13F filing [1]. The fund now holds 8,726,972 IBIT shares as of March 31, 2025, up from 8,235,533 shares at the end of 2024 [1]. This growing investment aligns with ongoing discussions between US crypto policy leaders and UAE officials [1].

The State of Wisconsin Investment Board (SWIB) broke new ground as the first US state sovereign fund to buy Bitcoin ETFs, though it later sold its $321.50 million position in early 2025 [13][14]. Meanwhile, Bhutan’s sovereign fund, Druk Holding and Investments, has built up a position of 10,635 BTC (worth over $1 billion) as of February 2025 [14].

Why sovereigns are adopting bitcoin

Several key factors push sovereign interest in Bitcoin:

Traditional reserve assets politicization – Gold and the US dollar have become deeply tied to geopolitics, pushing nations to seek more monetary independence [15]

Diversification imperative – Bitcoin exposure helps many countries reduce their reliance on dollar-based reserves while preparing for a digital financial future [15]

Inflation protection – Bitwise’s head of European research explains that Bitcoin serves as “a hedge against inflation… political turmoil, political instability, acts of God, hurricanes, fires, floods, tornadoes” [1]

These sovereign wealth funds are entering at a time when the global landscape is shifting. The US has announced plans for a Strategic Bitcoin Reserve [3], which sparked similar discussions in other nations like the Czech Republic [3].

Implications for institutional bitcoin

This wave of sovereign adoption brings significant changes:

Legitimization effect – Government support elevates Bitcoin from a speculative asset to a credible, strategic investment [15]

Supply-side impact – Bitcoin’s fixed supply of 21 million means even small purchases by nations could create supply pressure [15]

Market stabilization – Growing official reserves could lead to lower volatility and better integration with regulated financial systems [15]

Bitwise predicts Bitcoin could reach $1 million by 2029, matching gold’s market cap [7]. This target seems more achievable as sovereign funds join other institutional investors in the Bitcoin ecosystem.

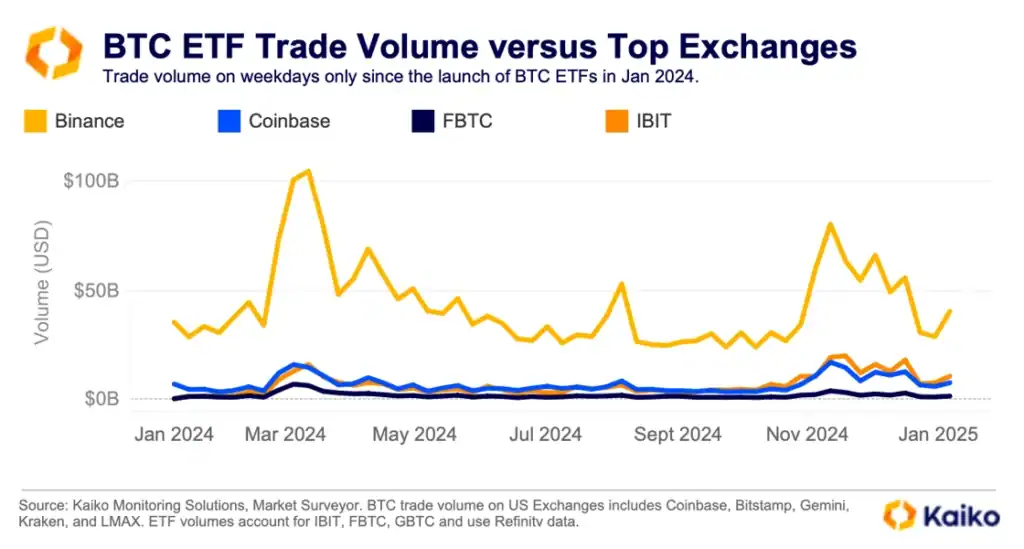

Bitcoin ETF Market Growth and Liquidity Trends

Image Source: Kaiko – Research

Bitcoin ETFs have become a major financial force since their spot launch in January 2024. These products now give unprecedented access to Bitcoin through traditional investment vehicles. The market has completely changed as institutional players now see these products as vital portfolio components.

Bitcoin ETF market size

U.S. Bitcoin ETF assets under management have reached $104.10 billion in Q4 2024. This represents a 77% quarter-over-quarter growth [2]. IBIT ranks among the top 10 biggest asset ETF launches of the decade [16]. ETFs now hold about 869,000 BTC, which equals 4% of Bitcoin’s circulating supply [17].

The market has shown remarkable strength despite price swings. Bitcoin’s price fell 12% in Q1 2025, yet institutional interest stayed strong. Abu Dhabi’s Mubadala sovereign wealth fund even increased its IBIT position to 8.7 million shares [4].

ETF Market Metric | Value | Growth Rate |

|---|---|---|

Total AUM | $104.10B | 77% QoQ |

Institutional Ownership | $27.40B | 114% QoQ |

BTC Held by ETFs | 869,000 | ~4% of Supply |

Liquidity improvements

Daily trading volumes now reach $2.00 billion, which makes up about 3% of total Bitcoin market activity [17]. This percentage might seem small but shows the early stages of what analysts believe will become a much bigger market segment.

Trading patterns have changed significantly. There’s more activity between 3pm and 4pm New York time when ETF issuers calculate net asset values [16]. The regulated structure and shorter market hours help reduce weekend selling pressures [16].

The expanding ETF market has improved the underlying bitcoin futures market. ETF asset managers’ trading position on the long side jumped from 8% to about 50% after the first Bitcoin ETF launched [18].

How this supports institutional bitcoin investors

Institutional bitcoin investors gain several key advantages from these market developments. ETFs remove the need to manage private keys or complex custody arrangements—two barriers that kept large investors away [19].

The creation-redemption mechanism lets “authorized participants” manage price discrepancies efficiently and improves price discovery [16]. This better market structure helps institutions look at their asset allocations and risk with an all-encompassing approach [20].

Liquid markets now support complex strategies like the basis trade, where hedge funds can earn annual yields near 15% [4]. Bernstein suggests these trades could lead to net long positions as ETF market liquidity grows, which would speed up institutional adoption [17].

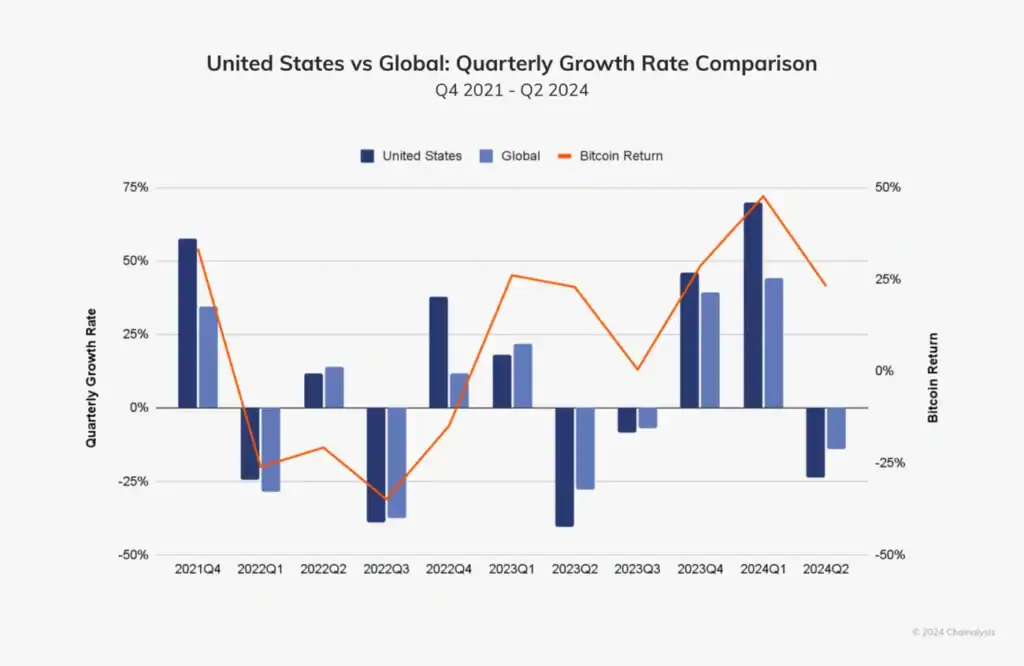

Regulatory Clarity Driving Institutional Confidence

Image Source: Chainalysis

Regulatory clarity has become the life-blood of institutional Bitcoin investment. 88% of institutional investors now feel less concerned about major market scandals [21]. This represents a significant improvement from mid-2023 when only 75% believed market risks were declining [21].

Recent regulatory developments

The regulatory scene has changed dramatically in the last year:

Regulatory Body | Recent Action | Impact |

|---|---|---|

Federal Reserve | Rescinded 2022-2023 crypto guidance [22] | Banking organizations no longer need prior approval for crypto activities [23] |

FDIC | Withdrew requirement for prior notification [24] | Banks can participate in permissible crypto activities without approval [24] |

EU | Implemented MiCA regulation (fully applicable since Dec 2024) [5] | Created unified framework across member states [5] |

SEC | Approved 11 spot Bitcoin ETPs (January 2024) [5] | Provided regulated avenues for traditional institutions [5] |

The SEC also increased its Crypto Assets and Cyber Unit by 66% in 2022. The team expanded from 30 to 50 officials [25], which shows increased regulatory attention to the space.

Why regulation matters to institutions

Regulatory frameworks play a vital role in institutional decision-making. About 93% of investors say regulatory efforts influence their investment decisions [21]. This mainly comes from institutions’ need for risk management and compliance certainty.

Clear regulations help protect investors from fraud and market manipulation – concerns that kept many institutions away [9]. Regulatory compliance also improves cryptocurrency’s legitimacy as an asset class [9]. This allows institutions to explain these investments to stakeholders and oversight committees.

How regulation affects bitcoin btc adoption

Regulatory clarity and Bitcoin adoption show a strong connection. About 93% of investors believe the SEC works well in handling the sector [21]. This highlights growing confidence in regulatory oversight.

It’s worth noting that institutions now extend their investment time horizons as regulations become clearer. Most organizations plan to scale investments over the next two to three years [13]. This shows a move from opportunistic to strategic allocation.

Financial regulation compliance gives institutions access to regulated markets they need for crypto trading and investing [26]. Institutions steadily increase their Bitcoin allocations as regulatory uncertainties decrease. This growth trend should continue through 2025 [13].

Shift from Speculative to Structural Allocation

Image Source: CoinRabbit

Traditional financial institutions are transforming their approach from speculative bitcoin trading to well-laid-out, long-term allocation strategies. This change shows how traditional finance now views cryptocurrencies with greater maturity.

What structural allocation means

Structural allocation happens when institutions systematically add bitcoin to their portfolios based on strategic investment principles rather than opportunistic trading. Research shows 35% of institutional respondents now put 1-5% into digital assets. The numbers are compelling – 60% of institutions allocate more than 1% of their portfolio to digital assets or related products [13]. Large institutions with over $500 billion in assets demonstrate significant commitment, as 45% allocate more than 1% of their portfolio [13].

Why institutions are changing strategies

Several key factors explain this strategic change:

Long-term value recognition – Most institutions now believe in the lasting benefits of crypto/digital assets [13]. They see bitcoin as a legitimate portfolio component rather than just speculation.

Inflation protection – Bitcoin serves as a hedge against inflation and monetary expansion [9]. This becomes more important during global economic uncertainty.

Extended investment horizons – Investment timeframes now stretch longer. Organizations plan to grow their investments over two to three years [13] instead of chasing quick profits.

Institutional Approach | Before 2023 | 2024-2025 |

|---|---|---|

Allocation Percentage | <1% | 5-10% |

Investment Horizon | Short-term | 2-3 years |

Portfolio Role | Speculative | Strategic |

Impact on long-term bitcoin adoption

This new approach will significantly shape bitcoin’s future. Most institutional portfolios will include digital assets by early 2025, with bitcoin leading the pack [8]. These aren’t token investments – institutions commit substantial capital to broaden their portfolios and protect against traditional market risks [8].

Without doubt, this change supports price stability. The surge of institutional money has changed bitcoin’s volatility profile [8]. As institutions maintain a long-term point of view, bitcoin price predictions for 2025-2026 have become more ambitious yet evidence-based. The consensus suggests potential prices between $200,000 and $210,000 [8].

Low Portfolio Weighting Signals Room for Growth

Image Source: Outerlands Capital

Bitcoin attracts growing institutional interest, yet actual allocation percentages remain modest. The gap between enthusiasm and real investment levels offers a compelling signal of future growth potential.

Current average institutional allocation

Institutional investors maintain surprisingly conservative Bitcoin positions. The average institutional portfolio weighting remains below 1% [27], which suggests substantial capital stays on the sidelines. A closer look at specific investor categories reveals:

35% of institutional asset managers allocate between 1-5% to digital assets [13]

60% of respondents allocate more than 1% of their portfolio to digital assets [13]

Only 45% of institutions with over $500 billion in AUM allocate more than 1% [13]

Hedge funds prove exceptional, with 36% allocating above 5% of their portfolios to cryptocurrency [13]. Traditional institutions’ control over trillions in assets means even these modest percentages represent substantial capital commitments.

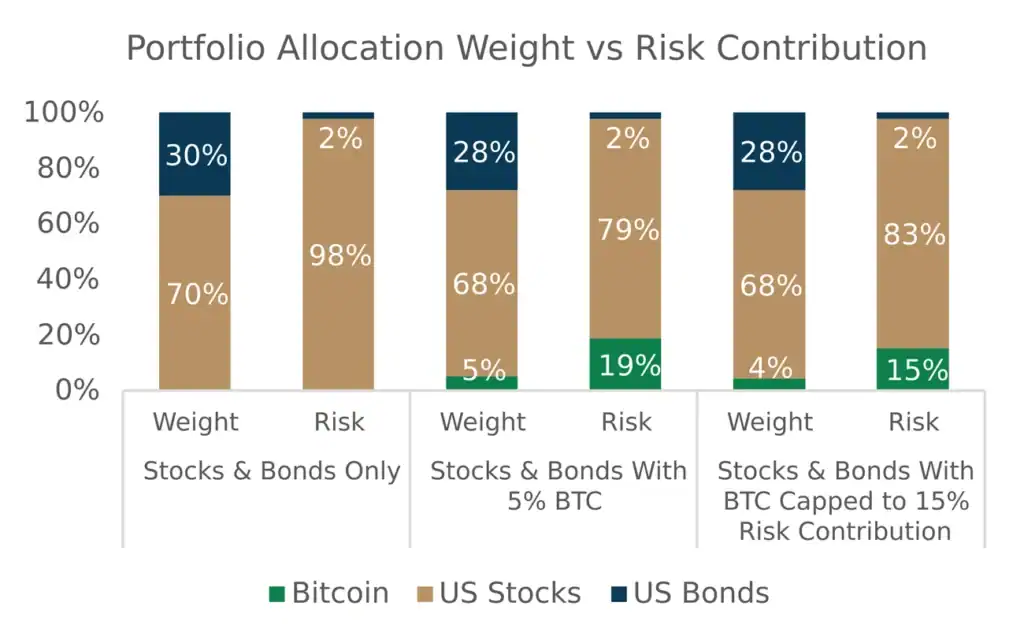

Why low weighting matters

These conservative allocations reveal significant insights. Institutional Bitcoin adoption remains in its early stages. BlackRock’s observation that “a little bit can go a long way” [28] shows even small allocations significantly affect portfolio dynamics.

Research reveals a 1% or 2% Bitcoin allocation contributes roughly 3% and 7% of total portfolio risk respectively [28]. Bitcoin’s 5% allocation contributes over 20% of portfolio risk while raising volatility by approximately 16% compared to a traditional 60/40 portfolio [28].

Risk management frameworks make institutional caution understandable. This creates substantial room for growth as comfort with the asset class grows.

Future potential for increased exposure

Growth seems inevitable. EY-Parthenon’s survey of 352 institutional investors shows:

83% plan to increase allocations to digital assets in 2025 [12]

59% plan to allocate more than 5% of AUM to cryptocurrencies in 2025 [12]

Nearly 60% of all respondents will increase crypto allocations over the next three years [11]

BlackRock, which manages approximately $11.5 trillion, considers 1-2% “a reasonable range for a Bitcoin exposure” [29]. This could set a measure for other major institutions to follow. Maturing regulatory frameworks and potentially moderating volatility through broader adoption mean even modest percentage increases would bring enormous capital inflows to the Bitcoin ecosystem.

Bitcoin as a Hedge Against Fiat and Inflation

Image Source: LinkedIn

Recent evidence shows that institutions are turning to Bitcoin mainly because they see it as a shield against currency debasement and inflation. Bitcoin’s unique features make it an appealing choice, especially now when traditional currencies face unprecedented challenges.

Bitcoin’s role as a dollar hedge

The U.S. national debt continues to climb at an alarming rate. Interest payments will reach $1.40 trillion by 2025, surpassing both defense and healthcare spending [30]. This reality has led institutions to question the stability of fiat currency, and many now view Bitcoin as a strategic shield against potential debt spirals [30]. The global financial community sees Bitcoin as “a neutral, state-free, and central bank-free monetary technology” [3] that could protect against currency uncertainties.

Bitcoin’s negative correlation with USD exchange rates [31] offers valuable portfolio diversification benefits. Jim Iuorio from TJM Institutional Services points out that major financial players like BlackRock, Fidelity, and Vanguard have strengthened Bitcoin’s position as a reliable currency hedge [30].

Why institutions see bitcoin as a store of value

Bitcoin’s life-blood as a store of value comes from its built-in lack of supply—all but one of these bitcoins that will ever exist is capped at 21 million [32]. Bitcoin’s yearly inflation rate sits at roughly 1.8% and will keep dropping [32]. This stands in sharp contrast to fiat currencies that can be printed without limits.

Big-name investors like Paul Tudor Jones and Stanley Druckenmiller have highlighted Bitcoin’s strength as a value keeper [32]. Tudor Investment Corporation’s 2020 investor letter “The Great Monetary Inflation” ranked various assets on store-of-value traits. Bitcoin scored 60% of what financial assets achieved, despite having just 1/1200th of their market value [33].

How macro trends support bitcoin adoption

Bitcoin’s institutional appeal links directly to several macro factors—inflation, currency risks, and geopolitical tensions [3]. Bitcoin hit record highs on November 10, 2021, right after October CPI data showed a 6.2% year-over-year jump [32]. This proved its responsive nature during inflationary times.

Institutions now suggest a 5% Bitcoin allocation to combat inflation [34]. They see Bitcoin as an “asymmetric upside” chance [33] combined with inflation defense. Michael Lie of Flow Traders suggests that lower U.S. rates, strong economic indicators, and higher risk tolerance could push Bitcoin prices even higher [30].

Spot Bitcoin ETF Approval as a Turning Point

Image Source: Chainalysis

The U.S. Securities and Exchange Commission’s approval of spot Bitcoin ETFs on January 10, 2024 changed the landscape of cryptocurrency in traditional finance. This groundbreaking regulatory decision concluded a decade-long effort that revolutionized institutional Bitcoin investments.

Timeline of ETF approvals

The Winklevoss twins started this journey in 2013 with the first application [35]. Many attempts failed until BlackRock’s application in June 2023 sparked a wave of similar filings [35]. The federal appeals court ruled against the SEC in the Grayscale case in August 2023, which built momentum toward the final approval [35]. The SEC’s compromised X account created confusion with a premature announcement on January 9, 2024 [10]. The SEC officially approved 11 spot Bitcoin ETFs on January 10, 2024, and trading began the next day [10].

Why spot ETFs matter

Spot Bitcoin ETFs hold the cryptocurrency directly, which makes them better at tracking price movements than futures-based products [6]. This structure gives institutions significant advantages. They can trade Bitcoin on traditional exchanges without dealing with private keys or complex custody arrangements [36]. The system alleviates fraud and market manipulation risks through regulatory oversight [6]. These ETFs are available through regular brokerage accounts, which helps portfolio managers take an all-encompassing approach to asset allocations and risk [20].

Effect on institutional crypto investors

Institutional adoption has seen remarkable growth. Daily ETF volumes reached almost $10 billion in March 2024 [6]. This is a big deal as it means that the first gold ETF’s inflation-adjusted flows from 2005 [6]. Large institutional transfers over $1 million grew significantly and peaked in March 2024 [6]. These ETFs have earned the title “the most popular ETF of all time” [6]. Experts project they could reach $100 billion over time [37]. This regulatory milestone has fundamentally changed how institutions participate in Bitcoin.

Growing Institutional Infrastructure and Tools

Image Source: LinkedIn

Professional investors rely on specialized financial infrastructure that forms the foundation of institutional Bitcoin adoption. The years 2024-2025 saw major capital investments flow into flexible platforms that help institutions overcome their unique digital asset challenges.

Custody and trading platforms

Modern institutional-grade custody solutions tackle the technical challenges of secure digital asset storage. These platforms employ offline “cold storage” systems that combine multi-signature technology, role-based governance protocols, and layered biometric access controls [20]. Fidelity Digital Assets and other leading providers maintain SOC 1 Type 2 audits and SOC 2 Type 2 reports from “Big Four” accounting firms [38]. These reports set vital trust standards for institutional participants.

Trading capabilities have grown to meet what institutions need:

Platform Feature | Institutional Benefit |

|---|---|

Smart order routing | Accesses multiple liquidity venues for best execution [38] |

API/FIX integration | Enables sophisticated trading systems connection [39] |

Cross-collateralization | Improves capital efficiency across trading strategies [39] |

OTC execution | Aids large orders off public exchanges [40] |

Advanced tools for institutions

Modern platforms offer complete toolsets that go beyond simple trading and custody. Up-to-the-minute data analysis APIs give instant access to market movements and enable complex strategies like DEX-CEX arbitrage [1]. Coinbase Prime’s advanced algorithmic orders support automated strategies that reduce manual work in large-scale trading [1].

Financial products have grown with the infrastructure. Staking services let institutions earn rewards through network validation [40]. Lending services also allow institutions to borrow cash with digital assets as collateral [38]. This improves capital efficiency without the need to liquidate positions.

How infrastructure supports adoption

Better infrastructure speeds up institutional participation by removing operational roadblocks. BlackRock points out that substantial investment in crypto infrastructure has “helped bolster custody, transparency, and security—critical infrastructure given the unique security challenges associated with digitally native bearer assets” [20].

Institutions plan to increase their allocations, with steady growth expected through 2025 [13]. This measured optimism matches infrastructure development timelines as investment horizons expand to include proper safeguards [13].

Comparison Table

Sign/Indicator | Current Status/Value | Key Growth Metric | Significance/Impact |

|---|---|---|---|

Surging ETF Holdings | $27.4B institutional holdings | 114% increase QoQ | 26.3% of total Bitcoin ETF AUM |

IBIT, FBTC, GBTC Dominance | 86% of US Bitcoin ETF market | IBIT: 196% growth in ownership | Controls 85% of price discovery |

Hedge Fund Leadership | 50%+ of largest US hedge funds hold Bitcoin | Millennium: $1.69B position | Leading early institutional adoption |

Investment Advisor Growth | $10.28B in Bitcoin ETF assets | 96% report client questions | Largest institutional holder category |

Sovereign Wealth Entry | Mubadala: $408.5M stake | Growing from 8.2M to 8.7M shares | First major sovereign fund entry |

ETF Market Growth | $104.1B total AUM | 77% QoQ growth | 869,000 BTC held (4% of supply) |

Regulatory Clarity | 88% reduced market concerns | 93% influenced by regulations | Boosted institutional confidence |

Asset Allocation | 35% allocate 1-5% to digital assets | 60% allocate >1% of portfolio | Change from speculative to structural |

Portfolio Weighting | <1% average allocation | 83% plan increases in 2025 | Room for substantial growth |

Inflation Hedge | $1.4T annual interest payments | 1.8% BTC inflation rate | Growing macro hedge adoption |

Spot ETF Effect | 11 ETFs approved | $10B daily volumes | Major institutional access point |

Infrastructure Growth | Multiple custody solutions | SOC 1 & 2 compliance | Boosted security and access |

Conclusion

The Unmistakable Institutional Bitcoin Wave

Traditional finance has embraced cryptocurrency at unprecedented levels. Multiple indicators paint a clear picture that institutional Bitcoin adoption has hit a turning point. Twelve distinct markers show how this adoption has transformed the landscape.

Bitcoin ETFs now hold $27.4 billion from professional investors – a massive 114% jump from last quarter. Without doubt, this surge shows a fundamental change rather than a temporary trend. IBIT, FBTC, and GBTC control 86% of the U.S. Bitcoin ETF market, which shows how quickly institutional priorities have settled around proven offerings.

America’s largest hedge funds started this trend, with over 50% now holding Bitcoin positions. Investment advisors soon became the key players and now hold over $10.28 billion in Bitcoin ETF assets. The market has seen sovereign wealth funds join in too, as shown by Abu Dhabi’s Mubadala $408.5 million investment.

The Bitcoin ETF market has grown to $104.1 billion, and daily trading hits $2 billion. Investor confidence has grown as 88% report fewer concerns about market scandals. This boost in trust has helped investors move from speculation to long-term allocation strategies.

All the same, most institutions keep their Bitcoin allocations below 1% – quite conservative by any measure. This careful approach actually shows huge room for growth, especially since 83% plan to increase their holdings by 2025.

Bitcoin’s value as an inflation shield becomes clearer as government debt and fiat currency pressures rise. The spot ETF approval in January 2024 changed everything by creating regulated access for traditional finance. The institutional framework has grown faster, and better custody solutions and trading platforms have removed old obstacles.

These trends mark just the start of Bitcoin’s integration into institutional finance. While early allocations remain careful, all signs point to Bitcoin playing a bigger role in institutional portfolios soon. This mainstream acceptance shows Bitcoin’s evolution from a speculative asset to an established financial tool – a change that will reshape both traditional finance and the crypto ecosystem.

FAQs

Q1. How much would a $1000 investment in Bitcoin from 10 years ago be worth today? If you had invested $1000 in Bitcoin in 2015, that investment would be worth over $420,000 today. The astronomical growth in Bitcoin’s value over the past decade demonstrates why many institutions are now viewing it as a potentially lucrative long-term investment.

Q2. Why are institutional investors increasingly allocating funds to Bitcoin? Institutional investors are turning to Bitcoin for several reasons, including portfolio diversification, inflation hedging, and potential for high returns. Many see it as a store of value in uncertain economic times and a way to gain exposure to the growing digital asset ecosystem.

Q3. Is Bitcoin still considered a purely speculative asset? While Bitcoin was once viewed as purely speculative, it is increasingly being seen as a legitimate asset class by institutional investors. However, it still carries significant volatility and risk. Many institutions are now incorporating Bitcoin as part of a broader, strategic asset allocation rather than for short-term speculation.

Q4. What are some key characteristics of Bitcoin that appeal to institutional investors? Bitcoin’s key characteristics that appeal to institutional investors include its fixed supply (capped at 21 million coins), decentralized nature, potential as an inflation hedge, and growing acceptance in traditional finance. Its digital nature also allows for easier transfer and storage compared to physical assets like gold.

Q5. How has the approval of spot Bitcoin ETFs impacted institutional adoption? The approval of spot Bitcoin ETFs in January 2024 marked a significant turning point for institutional adoption. It provided a regulated, familiar investment vehicle for traditional finance to gain Bitcoin exposure. This has led to billions of dollars in inflows and increased participation from investment advisors, hedge funds, and even sovereign wealth funds.

References

[1] – https://blog.amberdata.io/investment-strategies-for-the-institutional-crypto-trader

[2] – https://coinshares.com/us/insights/research-data/us-bitcoin-etfs-institutional-adoption-continues-in-q4-2024/

[3] – https://www.samara-ag.com/market-insights/institutional-bitcoin-adoption

[4] – https://www.reuters.com/business/institutional-investors-juggle-bitcoin-etf-holdings-us-filings-show-2025-05-15/

[5] – https://www.ulam.io/blog/institutional-adoption-of-cryptocurrency

[6] – https://www.chainalysis.com/blog/spot-bitcoin-etfs/

[7] – https://cointelegraph.com/news/bitcoin-etfs-gov-t-adoption-btc-1-m-by-2029-finance-redefined

[8] – https://pinnacledigest.com/blog/institutional-bitcoin-investment-2025-sentiment-trends-market-impact

[9] – https://osl.com/academy/article/institutional-adoption-of-cryptocurrency-trends-and-opportunities

[10] – https://cryptopotato.com/heres-a-timeline-of-events-leading-to-spot-bitcoin-etf-approval-in-the-us/

[11] – https://www.coinbase.com/institutional/research-insights/resources/education/2023-institutional-investor-digital-assets-outlook-survey

[12] – https://www.cfo.com/news/big-investors-increase-their-allocations-to-crypto-bitcoin-ethereum-stablecoins-cfo/746082/

[13] – https://www.ey.com/en_us/insights/financial-services/how-institutions-are-investing-in-digital-assets

[14] – https://coinshares.com/us/insights/knowledge/sovereign-funds-a-new-class-of-investors-for-crypto-/

[15] – https://www.chainalysis.com/blog/bitcoin-strategic-reserves/

[16] – https://research.kaiko.com/insights/how-btc-etfs-reshaped-crypto

[17] – https://www.coindesk.com/markets/2024/10/14/liquidity-and-options-pave-the-way-for-bitcoin-etf-market-expansion

[18] – https://www.sciencedirect.com/science/article/abs/pii/S1057521924007427

[19] – https://coinrabbit.io/blog/why-institutional-investors-are-pouring-billions-into-bitcoin-etfs/

[20] – https://www.blackrock.com/institutions/en-axj/insights/bitcoin-etfs-a-new-era-of-access

[21] – https://fundstech.com/confidence-grows-in-crypto-regulation-research-shows/

[22] – https://www.jonesday.com/en/insights/2025/04/federal-reserve-withdraws-cryptorelated-guidance-including-notification-requirements-for-banking-organizations

[23] – https://www.federalreserve.gov/newsevents/pressreleases/bcreg20250424a.htm

[24] – https://www.fdic.gov/news/financial-institution-letters/2025/fdic-clarifies-process-banks-engage-crypto-related

[25] – https://www.investopedia.com/news/how-sec-regs-will-change-cryptocurrency-markets/

[26] – https://www.fideum.com/blog/why-compliance-is-crucial-for-institutional-crypto-adoption

[27] – https://etfdb.com/coinshares-channel/advisors-up-bitcoin-exposure-1q-2025/

[28] – https://www.morningstar.com/portfolios/how-much-bitcoin-is-too-much

[29] – https://cointelegraph.com/news/blackrock-1-2-percent-reasonable-bitcoin-portfolio-allocation

[30] – https://www.cmegroup.com/openmarkets/equity-index/2025/Growing-Adoption-is-Taking-Bitcoin-to-New-Heights.html

[31] – https://link.springer.com/article/10.1007/s10479-024-05884-y

[32] – https://www.texpers.org/index.php?option=com_dailyplanetblog&view=entry&year=2021&month=12&day=20&id=80:bitcoin-s-evolution-as-an-inflation-hedge-and-currency

[33] – https://www.fidelitydigitalassets.com/sites/g/files/djuvja3256/files/acquiadam/1125481.2.0 – FDA Bitcoin as an Aspirational Store of Value Revisited V2.pdf

[34] – https://kavinoky.com/2024/08/bitcoin-hedge-against-inflation-institutional-investors/

[35] – https://www.reuters.com/technology/decade-long-journey-us-spot-bitcoin-etf-2024-01-10/

[36] – https://www.gemini.com/spot-bitcoin-etf

[37] – https://www.investopedia.com/spot-bitcoin-etfs-are-approved-by-sec-cleared-to-start-trading-thursday-8357670

[38] – https://www.fidelitydigitalassets.com/trading-custody

[39] – https://www.gemini.com/institutions/institutional-investors

[40] – https://www.kraken.com/institutions