If you have realized anything about forex trading or forex brokers, its that most offer an extreme amount of leverage. It is very common to see leverage of 50:1 to 500:1 or even more.

Brokers that offer its clients 500:1 or more leverage can be dangerous to unexperienced traders.

Leverage is a double edged sword, where profits are multiplied but losses are also proportionally magnified.

Some brokers prey on potential traders that can easily drain their accounts while trading with high leverage.

Doing our research on Forex brokers that offer 500:1 leverage, not all can be trusted and treated equally.

500:1 Leverage Broker List

| Broker | Leverage |

| BlackBull Markets | 500:1 |

| fibogroup | 500:1 |

| Fondex | 500:1 |

| fp markets | 500:1 |

| FX Pig | 500:1 |

| FxPro | 500:1 |

| FXTM | 500:1 |

| HYCM | 500:1 |

| IC Markets | 500:1 |

| OctaFX | 500:1 |

| Pepperstone | 500:1 |

| Skilling | 500:1 |

| ThinkMarkets | 500:1 |

| TickMill | 500:1 |

| XTB | 500:1 |

Recommened Brokers With 500:1 Leverage

| Broker Type | ECN |

| Regulations | ASIC, FSA, CySEC |

| Min Deposit | $200.00 |

| Account Base Currency | USD, AUD, EUR, GBP, CAD, JPY, NZD,CHF, SGD, HKD |

| Max Leverage | 500:1 |

| Trading Platforms | Metatrader 4/5, cTrader, Webtrader, API Trading, MAM / PAMM |

| Broker Type | ECN |

| Regulations | FSCL and FSPR |

| Min Deposit | $200.00 |

| Account Base Currency | USD EUR GBP AUD NZD SGD CAD JYP ZAR |

| Max Leverage | 500:1 |

| Trading Platforms | Metatrader 4/5 |

Understanding 500:1 Leverage

Before delving into the intricacies of 500:1 leverage, let’s comprehend the fundamental concept of leverage. Leverage in forex allows traders to control a larger position size with a relatively smaller amount of capital. It’s essentially a loan provided by the broker to enable traders to open larger positions than their account balance would normally allow.

50:1 Leverage

For instance, with 50:1 leverage, a trader can control a position of $50,000 with only $1,000 of their own capital. The ratio denotes the relationship between the trader’s own capital and the size of the position they can control.

500:1 Leverage

500:1 leverage takes this concept to an extreme, allowing traders to control positions 500 times larger than their invested capital. In theory, this means that with $1,000, a trader could control a position size of $500,000.

Is Trading 500:1 Leverage Safe?

Trading with high leverage is a double edged sword.

Most beginners underestimate the potentially high likelihood of how fast high leverage can eat away at your account balance.

Trading leverage of 500:1 can be safe if you know what you are doing. Experienced traders use high leverage only when the time is right.

Experienced traders also understand the risks involved trading with leverage.

Trading with 500:1 leverage can be safe when keeping your trade positions small (small trading lot size), using proper stop-loss triggers and not letting greed take over.

It is always advisable for beginner to test there trading skills on a demo account first.

Can I Trust Forex Brokers that Offer 500:1 Leverage?

Lets be blunt. There are many scammer forex brokers that only look for traders to blow through their account balance.

Mainly, these are unexperienced forex traders.

At the same time there are dozens of trust worthy and legitimate Forex brokers that offer 500:1 leverage.

The most trust worthy brokers will include:

- Offer some kind of trading education or programs that are free.

- Recommend lower leverage for less experienced traders.

- Will be regulated in their region and will be in good standing.

- Highly rated and ranked.

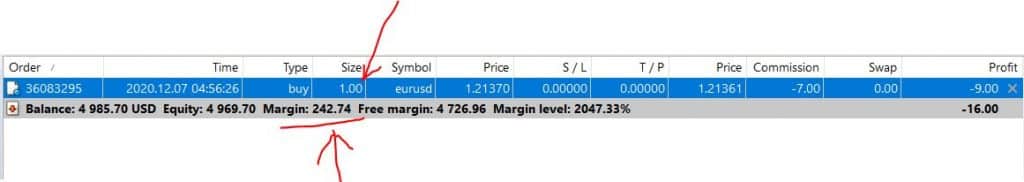

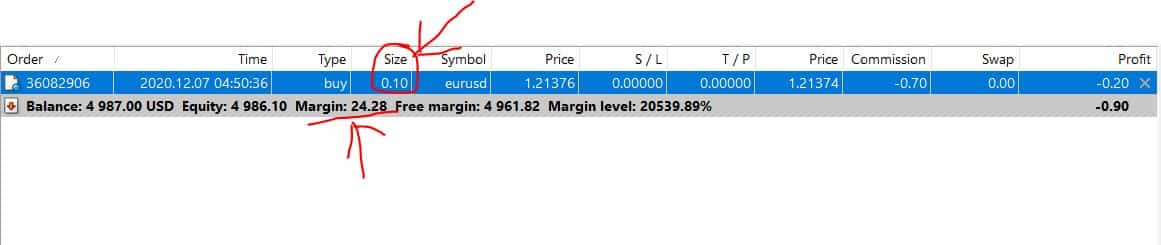

Example of 500:1 Leverage Trading

Trading on a \$5000.00 account with 500:1 leverage.

EUR/USD 1 lot at 500:1 leverage = $242 margin used, or the cost of the position. 1 pip of fluctuation in the price = $10.00

EUR/USD 0.10 lot at 500:1 leverage = $24 margin used, or the cost of the position. 1 pip of fluctuation in the price = $1.00

Its clear from our examples above that trading with high leverage of 500:1 can quickly put you in the red.

Ideally you should keep your lot positions as small as possible, that is proportional to your account balance and risk tolerance.

Higher account balance + Smaller lot sizes = Less risk.

Lower account balance + Bigger lot sizes = Higher risk.

Pros and Cons With 500:1 Leverage Trading

Potential for Substantial Profits:

Amplified Gains – The primary allure of high leverage is the potential for substantial profits. Small market movements can result in significant returns on the trader’s initial investment.

Increased Risk:

Magnified Losses – While the potential for profit is heightened, so is the risk. Just as gains can be amplified, so too can losses. A small adverse market movement could wipe out the trader’s entire invested capital.

Margin Calls:

Heightened Sensitivity – With 500:1 leverage, positions are highly sensitive to market fluctuations. Even a slight adverse movement could trigger a margin call, requiring the trader to either deposit additional funds or close the position.

Market Volatility Impact:

Risk During High Volatility – High leverage is particularly risky during times of market volatility when price movements can be swift and unpredictable.

Mitigating Risk While Using 500:1 Leverage

Given the risks associated with trading with 500:1 leverage, traders need to employ prudent risk management strategies like the ones below:

Use Stop-Loss Orders:

Define Risk Tolerance – Implement stop-loss orders to define the maximum amount you are willing to lose on a trade. This helps control potential losses.

Diversify Your Portfolio:

Spread Risk – Instead of concentrating your capital on a single trade, diversify your portfolio to spread risk across different assets.

Regularly Monitor Positions:

Stay Informed – Keep a close eye on your positions, especially during volatile market conditions. Be prepared to adjust or close positions as needed.

Understand Margin Requirements:

Know Your Limits – Be fully aware of the margin requirements and how they impact your trading. Understanding these details is crucial to avoiding margin calls.

Continuous Learning:

Educate Yourself – Stay informed about market trends, economic indicators, and global events. Continuous learning is key to making informed trading decisions.

Conclusion on 500:1 Leverage

While 500:1 leverage in forex trading offers the potential for substantial returns, it is a double-edged sword that demands careful navigation. Traders need to approach it with a clear understanding of the risks involved, employing effective risk management strategies to protect their capital. Leverage should be viewed as a powerful tool that requires skillful and responsible use. As with any trading strategy, thorough research, continuous education, and disciplined execution are paramount for success in the fast-paced world of forex trading.

About This Article

Author: Mark Prosz

Sources of information and credits for this post include: https://www.investopedia.com/articles/forex/092115/how-much-leverage-right-you-forex-trades.asp

MetaQuotes Software