74-89% of retail CFD traders lose money, and yet some brokers consistently maintain excellent customer satisfaction. Our Fusion Markets Canada review shows why traders have given this broker an impressive 4.5 out of 5 Trustpilot rating.

Since launching in 2019, Fusion Markets has quickly captured attention with its competitive pricing. The broker offers spreads starting at 0.0 pips and commissions as low as $2.25 per lot. Traders can start without any minimum deposit requirements.

Table of Contents

Traders get access to more than 250 trading instruments. These include 90+ forex pairs, indices, commodities, cryptocurrencies, and U.S. share CFDs. The platform selection covers popular options like MetaTrader 4, MetaTrader 5, TradingView, and cTrader.

Canadian traders need to consider that Fusion Markets operates under ASIC (Australian Securities and Investments Commission) regulation. The broker doesn’t provide local investor protection through Canadian regulatory bodies. Let’s get into whether this broker’s features align with your trading needs and experience.

Fusion Markets Ratings

Feature | Fusion Markets Details |

|---|---|

Website | |

Live Chat | YES: Available 24/7 via the Client Hub or website |

Telephone | YES: Available 24/7 (+61 3 8376 2706) |

Broker Type | ECN/Market Maker Hybrid |

Regulations | Australian Securities & Investments Commission (ASIC: 385620), Vanuatu Financial Services Commission (VFSC: 40256), Seychelles Financial Services Authority (FSA-S) |

Min Deposit | $0 (no minimum deposit requirement; average client deposit is $1,500) |

Account Base Currency | USD, AUD, EUR, GBP, CAD, JPY, SGD, THB, NOK, SEK, CZK, HUF, CHF, DKK |

Max Leverage | 1:500 (Forex & Metals), 1:100 (Index CFDs), 1:10 (Cryptocurrencies); varies by region and asset class (e.g., 1:30 under ASIC for retail clients) |

Trading Platforms | MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, TradingView |

Markets | Forex (90+ currency pairs), CFDs (indices, US stocks, precious metals, energy, cryptocurrencies) |

Bonus Offered | None |

Funding Options | Bank Wire Transfer (SWIFT), Credit/Debit Cards (Visa, MasterCard), PayPal, Skrill, Neteller, Interac, Jeton, SticPay, ZotaPay, FasaPay, PerfectMoney, MiFinity, AstroPay, BinancePay, DragonPay, VNPay, VAPay, XPay, DuitNow, DurianPay, FPX, Pix, MPESA, UPI, Cryptocurrencies (Bitcoin, Ethereum, others), Local Bank Transfers (e.g., Indonesia, Malaysia, Philippines, Thailand, Vietnam) |

What Is Fusion Markets and Is It Available in Canada?

Fusion Markets stepped into the brokerage industry in November 2017, but started its trading services in June 20199. A team of forex industry veterans with 50 years of combined experience created the company with one goal: to drastically cut down what traders pay for forex, CFDs, and other financial products28.

Company Background and Founding

CEO and founder Phil Horner leads Fusion Markets. He started the company to give traders lower costs, friendly customer service, and innovative technology that boosts the trading experience29. The company runs from its Melbourne headquarters in Australia and has offices in Vanuatu and Seychelles9.

The company’s vision shows what they believe in: “to provide access to the world’s markets easily, quickly, and at radically lower costs than what exists in the market today”28. This laser focus on reducing costs has made Fusion Markets an innovator in the brokerage space, especially for cost-conscious traders.

Fusion Markets might be new to the industry but has made great strides in this competitive market through its dedication to keeping costs low. Experienced professionals from Australia’s forex industry own and run the company completely9, which gives it a strong base despite being relatively new to the market.

Regulatory Status for Canadian Traders

Canadian traders will be happy to know that Fusion Markets accepts clients from Canada22. Canadian citizens and tax residents can open accounts without any restrictions. In spite of that, the broker isn’t registered with Canadian regulatory bodies like the Ontario Securities Commission (OSC), British Columbia Securities Commission (BCSC), or Alberta Securities Commission (ASC)14.

Fusion Markets operates under these regulatory frameworks:

- Australian Securities and Investments Commission (ASIC) – A top-tier regulator that provides strong oversight and client protection standards21

- Vanuatu Financial Services Commission (VFSC) – Lets the broker serve additional jurisdictions23

- Financial Services Authority of Seychelles (FSA) – Enables further international reach21

Canadian traders won’t get protection through the Canadian Investment Regulatory Organization (CIRO), which typically offers investor protection up to CAD 1 million22. ASIC regulation requires strict client fund protection measures, including keeping client money in separate trust accounts with prominent banks like HSBC and National Australia Bank23.

Fusion Markets serves Canadian traders but doesn’t accept clients from Afghanistan, Congo, Iran, Iraq, Japan, Myanmar, New Zealand, North Korea, Ontario (specifically), Palestine, Russia, Spain, Somalia, Sudan, Syria, Ukraine, Yemen, and the United States23.

Available Trading Products

Traders can access more than 250 financial instruments across several asset classes through Fusion Markets30. This detailed selection works well for different trading strategies and priorities.

The broker’s product range has:

- Forex – More than 90 currency pairs including majors, minors, and exotics, ready to trade 24 hours a day, 5 days a week31

- Commodities – Options to trade gold, silver, zinc, copper, platinum, crude oil, brent oil, natural gas, plus agricultural products like coffee, wheat, cocoa, and sugar31

- Indices – CFDs on major global equity indices that let you access the world’s biggest markets31

- Cryptocurrencies – Commission-free CFDs on popular cryptocurrencies including Bitcoin, Ethereum, Litecoin, Stellar, and EOS31

- US Share CFDs – Trade over 110 of the world’s largest US equities with CAD 0.00 commission through the MetaTrader 5 platform7

Traders can take both long and short positions on all trading instruments, which works well in various market conditions31. The broker stands out for its low-cost structure, especially in forex where their commissions (CAD 3.14 per side) are 36% lower than competitors on average7.

Independent reviews show that Canadian traders get some of the industry’s lowest commissions with Fusion Markets. They pay about CAD 8.36 round-turn per one lot traded32, beating 15 other brokers in comparison tests.

Fusion Markets Account Types for Canadian Traders

Simplicity is the life-blood of Fusion Markets’ account structure for Canadian traders. The broker avoids overwhelming clients with too many options and delivers straightforward choices that match different trading priorities and requirements.

Classic Account Features ($0 Commission)

The Classic account serves traders who value simplicity and predictability. The spreads start from 0.9 pips with zero commission charges, and this account type removes the need to calculate extra fees before trades33. This “what you see is what you get” approach makes the Classic account perfect for:

- Beginners who value transparent pricing without hidden calculations

- Traders who want smooth execution without separate commission charges

- People who prefer trading costs built into the spread

On top of that, the Classic account provides complete access to Fusion Markets’ full suite of more than 250 trading instruments, including forex, commodities, indices, and US share CFDs33. You can start with any amount since there’s no minimum account size requirement33. The Classic account features New York-based servers, micro lot trading capabilities, and works with all trading styles33.

Raw Account Features ($2.25 Per Lot)

Active traders looking for tighter spreads will find the Raw account (also called the Zero account) an attractive option. This account delivers unfiltered spreads starting from 0.0 pips with a commission of CAD 3.14 per side (or CAD 6.27 round turn)34.

The Raw account shows Fusion Markets’ low-cost philosophy in its purest form and gives traders direct access to raw market pricing34. So, it becomes the top choice for:

- Experienced traders who can calculate their own commissions

- Active traders and scalpers who need the tightest possible spreads

- Algorithmic traders using Expert Advisors who need ultra-fast execution

The Raw account’s overall trading costs can be lower than the Classic account based on your trading volume and style9. The Raw option needs no minimum account size and gives you access to the same range of instruments and trading platforms as the Classic account34.

Islamic Account Options

Fusion Markets respects religious requirements by offering Swap-Free accounts for Islamic traders who cannot receive or pay overnight interest due to Sharia law compliance35. These accounts give access to more than 50 popular financial instruments at Fusion Markets’ standard low rates35.

Islamic accounts handle overnight positions differently. Instead of traditional swap charges, Fusion Markets uses an administrative fee system that applies only once each 7 days per position35. You’ll only pay the admin charge once if you close a trade 13 days after opening it, making it budget-friendly for longer-term positions35.

Islamic accounts work with either the Classic or Raw account structure14. These accounts support both MetaTrader 4 and MetaTrader 5 options35. They also allow scalping, Expert Advisors, and hedging strategies35.

Fusion Markets has specific terms for Islamic accounts. Clients can only have swap-free accounts or swap-charged accounts—not both35. The broker might convert the account to a swap-charged type if they suspect misuse of the swap-free feature35.

Canadian traders can open an Islamic account by contacting their account manager or reaching out to Fusion Markets’ support team35.

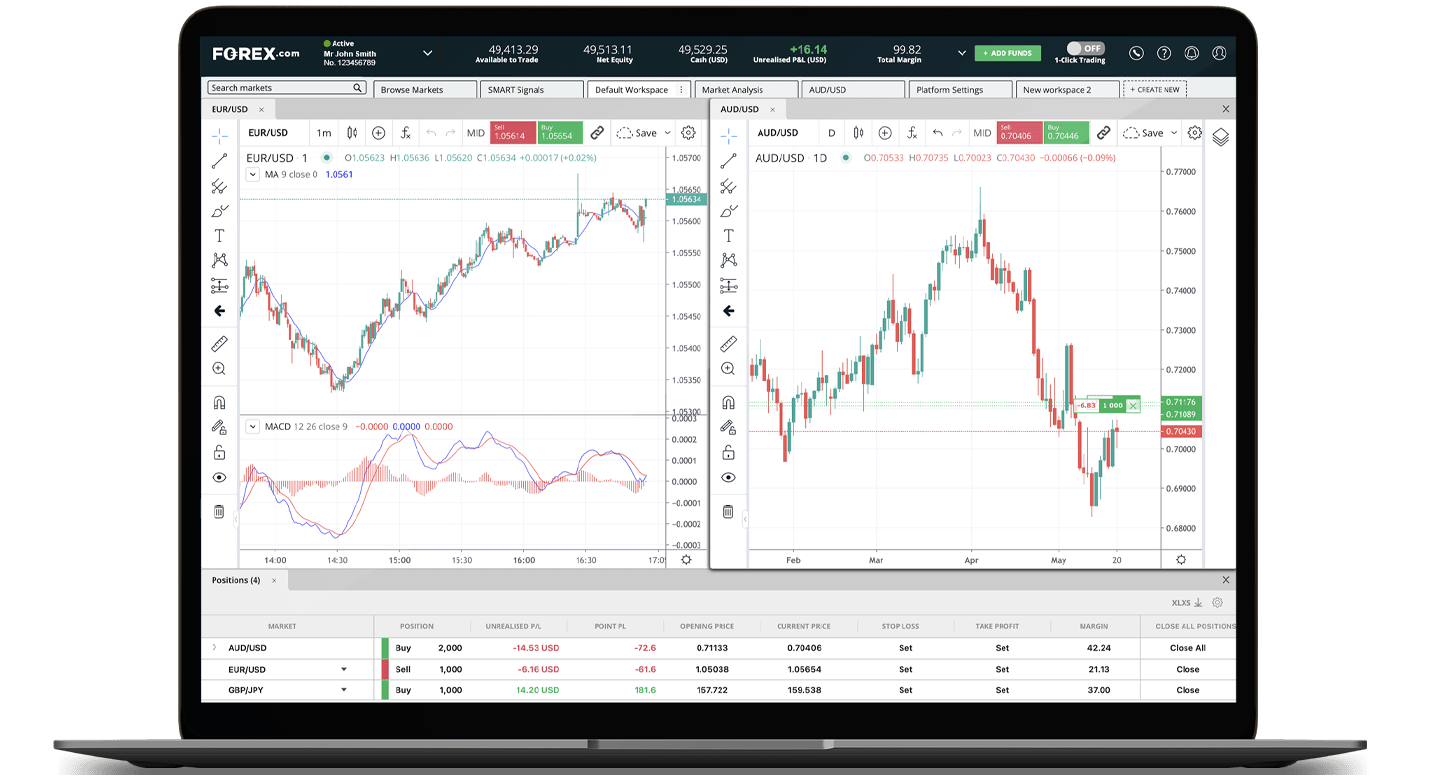

Trading Platforms: MT4, MT5, and More

Fusion Markets stands out from other brokers by giving Canadian traders more platform choices than usual. They offer four different trading interfaces—MetaTrader 4, MetaTrader 5, TradingView, and cTrader. This setup lets traders of all skill levels find what works best for them.

MetaTrader 4 Capabilities

MT4 platform remains the life-blood of Fusion Markets’ services, known for how stable and reliable it is. Since its launch in 2005, MT4 has become the top choice for forex traders worldwide because of its accessible interface and strong features. The platform has 50+ technical indicators and scripts and charts that traders can adjust to match their priorities36.

MT4 shines with its powerful automated trading through Expert Advisors (EAs). These programmed systems run trading strategies on their own, and about 70% of MT4 trades happen through automation37. The platform also lets you use different order types and trade with just one click36.

Technical analysts will find MT4 packed with detailed tools. It comes with 9 timeframes and 30 technical indicators to help make smart trading decisions37. Fusion Markets has improved their MT4 even further with their own technology that brings down prices and speeds up trades36.

MetaTrader 5 Advanced Features

MetaTrader 5 shows a major step forward as a multi-asset platform that works with many exchanges and markets38. MT5 runs much faster than MT4 and offers 21 timeframes instead of 9, plus 80+ technical analysis objects38.

You’ll find more features in MT5 like advanced pending orders, detailed market depth analysis, and full Expert Advisor support through the better MQL5 programming language38. The platform works with object-oriented programming like C++, better debugging tools, and handles events more efficiently38.

Canadian traders love MT5 because they can trade forex, stocks, futures, and other financial instruments as CFDs from one place39. Built-in Virtual Private Server (VPS) keeps automated trading running smoothly38.

TradingView and cTrader Integration

Fusion Markets made a smart move by adding TradingView to its lineup. This charting platform serves over 50 million users worldwide40 and mixes great charting tools with social networking for traders.

You can now trade right from TradingView charts without extra downloads. Users also get over 10 million custom scripts and indicators40 to use with Fusion Markets instruments. This partnership brings together “one of the most trusted and lowest-cost FX brokerages” with “one of the most comprehensive financial charting and social sites in the world”40.

cTrader brings its own accessible interface with advanced features like 26 timeframes and 70+ technical indicators39. Three market depth settings help you see liquidity and executions better, along with solid risk management tools7.

Mobile Trading Experience

Fusion Markets knows traders need flexibility and offers mobile apps for all platforms. These apps let you handle accounts, trade positions, check prices live, and use popular indicators while moving around41.

Each platform—MT4, MT5, TradingView, and cTrader—has its own app that works on iOS and Android devices41. The cTrader mobile app stands out with 65 popular technical indicators and four chart types including standard time frames, tick, Renko, and range charts42.

The mobile apps come with useful features like push notifications and email alerts about price changes. You get detailed trade statistics to track performance and can create watchlists for favorite trading instruments42. Quick-trade mode lets you trade with one tap, just like desktop versions42.

Fusion Markets stays true to its goal: giving traders low-cost access to markets without cutting corners on technology or execution quality.

Fusion Markets Fees and Costs Breakdown

Fusion Markets builds its business model around affordable trading. The broker aims to be among the best-priced options for Canadian traders. The company takes trading costs “very seriously” and has cut its spreads to become “one of the most cost-effective brokers in the industry”6.

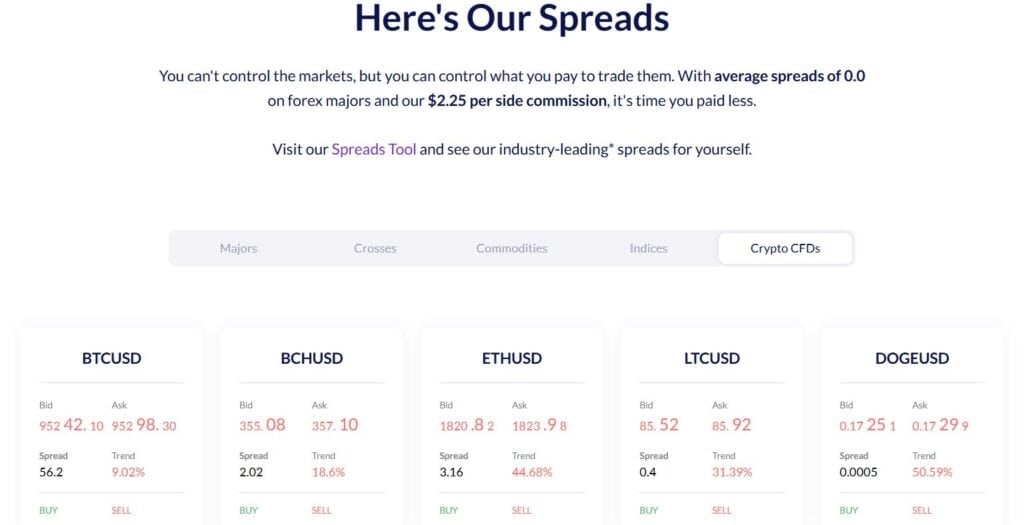

Spread Comparison: EUR/USD at 0.0 Pips

The broker’s spreads on major currency pairs are incredibly tight. During peak trading hours, the EUR/USD spread on the ZERO account sits at 0.0 pips11. This makes it tough to beat in the forex market. Other major pairs show equally impressive spreads: GBP/USD, AUD/USD, and EUR/GBP all at 0.0 pips11.

Fusion Markets knows that spreads affect trading profits by a lot. They rank their liquidity providers aggressively and remove any that fall short of their standards6. Traders get consistently tight spreads as a result. Of course, spreads can jump during major economic news or holidays when markets thin out6. These spikes usually don’t last long.

Commission Structure Analysis

Traders can pick between two pricing plans that fit different styles. The Classic Account wraps all costs into the spread, starting at 0.9 pips without commission12. The ZERO Account gives raw spreads with a commission structure, which works better for active traders.

The commission comes to CAD 3.14 per side per lot or CAD 6.27 round turn13. This rate beats the market standard by far. In fact, Fusion Markets charges about 36% less than many rivals7. Similar brokers like IC Markets and Pepperstone charge CAD 4.88 per side13.

Let’s look at a real example with a standard lot (100,000 units) of EUR/USD. The ZERO account charges the CAD 3.14 commission plus tiny spread costs. The Classic account’s all-in spread for EUR/USD runs around 0.92 pips9, which adds roughly 0.9 pips to the raw spread9.

Non-Trading Fees (Deposits, Withdrawals)

The broker stands out by cutting extra costs that often hit traders elsewhere. Here’s what Fusion Markets charges:

- No deposit fees on any method including Visa/Mastercard, PayPal, Skrill, Neteller, cryptocurrencies, and bank transfers9

- No withdrawal fees from their end, though banks might charge for international transfers (usually CAD 27.87-41.80)14

- No inactivity fees whatever the account dormancy period14

- No account maintenance fees which keeps costs clear8

Crypto users can deposit through Bitcoin, Ethereum, Litecoin, USDT, and other coins via their client hub9. This adds flexibility without extra costs.

Cost Comparison with Canadian Brokers

Fusion Markets beats other Canadian brokers on costs consistently. Their CAD 3.14 per side commission is cheaper than IC Markets and Pepperstone’s CAD 4.88 per side11. This saves frequent traders a lot of money.

The broker’s competitive edge goes beyond forex. S&P 500 index CFD spreads average 0.3 points8. Apple stock CFDs come with 0.0 spreads and a fee near CAD 0.14 per share8. This is nowhere near what competitors charge – between CAD 0.28-0.848.

The game-changer is Fusion Markets’ CAD 0.00 commission US Share CFD trading7. Other brokers typically charge CAD 6.97-13.93 per trade for these instruments7.

These fee advantages across different trading products, plus no extra charges, make Fusion Markets one of the most affordable options for Canadian traders in 2025.

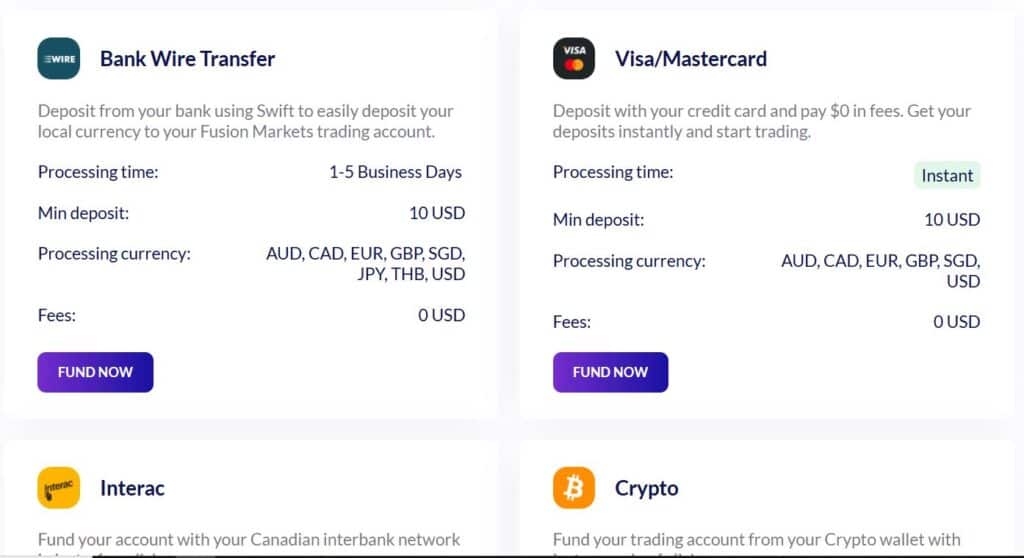

Deposit and Withdrawal Methods for Canadians

Fusion Markets gives Canadian traders excellent banking flexibility. The broker has optimized money movement in and out of trading accounts with multiple funding options and simple processes.

Available Payment Options

Canadian traders can choose from several deposit and withdrawal methods that match their needs. Interac is a standout option for Canadians. It lets traders fund their accounts through their Canadian interbank network in 30 minutes to 3 hours1. Fusion Markets also supports:

- Credit/debit cards (Visa and Mastercard) with instant processing1

- Bank wire transfers with global coverage1

- E-wallets including PayPal, Skrill, and Neteller15

- Cryptocurrency deposits via Bitcoin, BCH, LTC, ETH, USDT, and XRP15

Canadian traders looking for economical solutions will appreciate that Fusion Markets charges CAD 0.00 for all deposit methods1. This zero-fee policy helps traders save money across all funding channels.

Processing Times and Limits

Different payment methods have varying processing speeds. Credit cards and e-wallets offer instant deposits15, while bank wire transfers take 1-5 business days1. Interac provides a middle ground and completes processing within hours1.

Most methods require a low minimum deposit of CAD 10 equivalent1. Cryptocurrency has a slightly higher threshold at CAD 20 minimum1. Fusion Markets doesn’t set an official maximum deposit but suggests keeping credit card deposits under CAD 34,834.01 per transaction to avoid card issuer rejections9.

Fusion Markets handles all withdrawal requests received before 10 AM AEST/11 AM AEDT (00:00 GMT) on the same business day15. Fund arrival times depend on the withdrawal method:

- Local bank transfers: 1-2 business days15

- International bank wires: 3-5 business days15

- Interac for Canadians: 1-2 business days15

- E-wallets (PayPal, Skrill, Neteller): Instant after processing15

- Cryptocurrency: Instant after processing15

Withdrawal Experience and Potential Issues

Client testimonials show positive withdrawal experiences. A client reported receiving a verification call for a large withdrawal, and the funds were processed within 15 minutes after confirmation16.

Canadian traders should note these important withdrawal details:

The “matching principle” requires funds to return to the original deposit method before using alternatives9. If you deposit CAD 139.34 via Visa, that amount must go back to the same card9.

Fusion Markets doesn’t charge withdrawal fees9. However, intermediary or receiving banks might charge their own fees (usually CAD 27.87-41.80) for international transfers9.

Incorrect banking details cause most withdrawal errors. Taking time to verify this information before submission prevents delays and rejections17.

Fusion Markets Trading Experience

Fusion Markets excels at blending technical capabilities with practical features that help traders of all skill levels. The broker’s performance with real money tells the true story beyond just platform choices.

Execution Speed and Reliability

The broker’s execution quality stands out from the crowd. They deliver what they call “lightning-quick” executions7. This makes their platform ideal for scalpers and algorithmic traders. The speed advantage proves valuable when you use Expert Advisors or trade during market volatility. Those milliseconds can make a big difference in your profits.

A trader’s feedback shows this reliability clearly: “Even with high volatility during economic events, spreads rise only to 1.5-3 pips for seconds before quickly stabilizing again, making them excellent for scalping traders”18. Traders also report the same smooth execution whether they trade on desktop, web, or mobile platforms.

Order Types and Trading Tools

The platforms support these order types:

- Web and mobile platforms: Market, Limit, and Stop orders2

- Desktop platforms: Market, Limit, Stop, and Trailing Stop orders2

The platform offers more than simple order types. Their Technical Insight tool lets traders see short, medium, and long-term technical pictures. You can create alerts on favorite products and work with interactive charts3. Market Buzz uses AI to analyze thousands of articles. It summarizes market sentiment and spots price movements3.

The platform includes other useful tools. Analyst Views by Trading Central gives up-to-the-minute trade setups. An Economic Calendar shows how previous announcements moved prices. You also get customized news feeds and clear spread monitoring tools19.

Fusion+ Copy Trading Platform

Fusion+ helps traders who want automated strategies. You can copy successful Fusion clients, let others copy your trades, or copy between your own accounts “all within a few clicks”7. This copy trading platform blends naturally with the Fusion Markets ecosystem20.

Many brokers charge extra for copy trading, but Fusion+ comes with “no additional fees beyond the usual trading commissions and spreads”14. You can set how much of your account to use for copying trades, which helps manage your risk14.

The platform executes trades automatically in real-time without manual input14. This ensures you catch every trade from the traders you follow. New investors can check performance metrics, profit/loss records, risk levels, and trading styles. These details help them choose the right strategies to follow14.

Safety and Security for Canadian Traders

You need to think over regulation and security first when checking if a broker is trustworthy. Canadian traders looking at Fusion Markets must understand how regulation works.

ASIC Regulation Explained

The Australian Securities and Investments Commission (ASIC), a 25-year old global top-tier regulator, oversees Fusion Markets established in 19985. ASIC sets strict rules for brokers as Australia’s national corporate regulator. These rules include:

- A minimum 1 million USD operational fund requirement5

- Regular financial reports and audit statement submissions5

- An Australian physical office to stay accountable5

ASIC rules limit retail traders’ leverage to 30:1 and provide negative balance protection5. This oversight works well but mostly applies to Australian clients21.

Lack of Canadian Investor Protection

Here’s a crucial fact – Fusion Markets has no registration with Canadian regulatory bodies. This includes the Ontario Securities Commission (OSC), British Columbia Securities Commission (BCSC), and Alberta Securities Commission (ASC)14.

The Canadian Investment Regulatory Organization (CIRO) offers investor protection up to CAD 1 million22. Fusion Markets’ clients can’t access this protection. Canadian traders have no local regulatory safety nets or compensation plans14.

Fund Security Measures

Fusion Markets uses several ways to protect client funds:

The broker keeps segregated client trust accounts away from their operating funds23. These accounts sit with solid banks – HSBC (managing USD 4.16 trillion in assets) and National Australia Bank, one of the top 20 banks globally by market value23.

Account security gets a boost through two-factor authentication (2FA)4. The broker accepts deposits and withdrawals only from the account holder’s registered accounts to fight fraud and follow anti-money laundering laws4.

Client money stays safe even if the company goes bankrupt4. Most good brokers separate funds this way – it’s not unique to Fusion Markets.

Educational Resources and Customer Support

Image Source: FOREX.com

Fusion Markets takes a practical approach by focusing on trading tools rather than extensive educational content. This balance affects how traders learn and grow with this broker.

Learning Materials for New Traders

Many brokers load up on educational content, but Fusion Markets keeps things simple with a focused selection of resources. Their blog covers trading basics through articles like “The Real Cost of Forex Trading” and “A Beginner’s Guide to Automated Trading”24. Traders who want to learn more can turn to recommended external resources. These include books such as “Currency Trading for Dummies” by Brian Dolan and online platforms like Investopedia Academy and Udemy25.

The broker makes up for limited theory with a demo account where beginners can practice trading without risk26. This hands-on experience helps new traders build confidence before they put real money on the line.

Customer Service Quality and Availability

The broker’s customer service stands out with exceptional user feedback. Their Trustpilot rating sits at 4.5 out of 5 from 1,990 reviews14. Users often praise the quick support response. One client described their technician as “incredibly patient, professional, and thorough”27. Another mentioned how support solved their problem “after 4 times of back and forth from different customer support staff”27.

Traders with live accounts get “White Glove Support” – a dedicated trading specialist to help them with platforms and markets7. Support options include:

- Live chat on the website

- Email correspondence

- FAQ section for common questions

Community and Trading Resources

Fusion Markets balances its limited educational content with useful trading tools. Their Economic Calendar helps traders time their moves with major data releases10. This serves as a key resource for fundamental analysis.

Market Buzz uses AI to scan thousands of articles daily and summarizes market sentiment and price movements3. The broker points out that “everyday, 2,273 years of reading is added to the internet”3. This tool helps cut through information overload effectively.

Technical Insight teaches traders about indicators while letting them set alerts and see popular community trades3. These tools are a great way to get practical knowledge beyond basic educational content.

Conclusion

My research reveals Fusion Markets offers low trading costs and fast execution speeds. Their spreads begin at 0.0 pips and commissions are as low as CAD 3.14 per side, making them competitive for Canadian traders.

ASIC regulation provides solid oversight, but traders should think about the absence of Canadian regulatory protection. The broker maintains client funds separately at major banks like HSBC and National Australia Bank.

The platform choices are impressive. Traders can use traditional MT4/MT5 among modern options such as TradingView and cTrader. This variety allows everyone to choose their preferred trading environment without sacrificing features or execution quality.

The broker’s customer service quality reflects in positive user reviews. Practical tools like Market Buzz and Technical Insight help make up for the simple educational resources. They focus on delivering core trading capabilities instead of extra features.

Fusion Markets works best for Canadian traders who want low costs and quality execution over comprehensive learning materials. Their clear fee structure and dependable support make them a solid choice, especially if you’re comfortable with international regulation.

FAQs

Q1. Is Fusion Markets suitable for beginner traders? Fusion Markets offers low transaction costs and no minimum deposit, making it accessible for beginners. However, their educational resources are somewhat limited compared to other brokers. They do provide a demo account for practice and practical tools like Market Buzz and Technical Insight to support learning.

Q2. How safe is it to trade with Fusion Markets? Fusion Markets is regulated by ASIC, a reputable Australian regulator. They segregate client funds in top-tier banks and use two-factor authentication for account security. However, Canadian traders should note the lack of local regulatory protection.

Q3. What are the withdrawal processing times at Fusion Markets? Fusion Markets processes all withdrawal requests received before 11 AM AEDT on the same business day. After processing, e-wallet and cryptocurrency withdrawals are instant, while bank transfers typically take 1-5 business days depending on the method.

Q4. Does Fusion Markets offer negative balance protection? Fusion Markets provides negative balance protection for retail clients in certain jurisdictions. Traders outside eligible areas may need to meet specific conditions to receive this protection. It’s advisable to use stop-loss orders to manage risk if you’re not covered.

Q5. How competitive are Fusion Markets’ trading costs? Fusion Markets offers highly competitive trading costs, with spreads starting from 0.0 pips and commissions as low as CAD 3.14 per side. They also charge no fees for deposits or withdrawals on their end, making them one of the most cost-effective brokers for Canadian traders.

References

[1] – https://fusionmarkets.com/Trading/Deposit-options

[2] – https://brokerchooser.com/broker-reviews/fusion-markets-review/take-profit-order

[3] – https://fusionmarkets.com/Trading/Trading-Tools

[4] – https://tradingcritique.com/broker-review/is-fusion-markets-safe-or-scam/

[5] – https://brokersway.com/brokers-blog/fusion-markets-asic-regulation/

[6] – https://fusionmarkets.com/Trading/Forex-cfd-spreads

[7] – https://fusionmarkets.com/

[8] – https://brokerchooser.com/broker-reviews/fusion-markets-review/fusion-markets-fees

[9] – https://fusionmarkets.com/FAQ

[10] – https://fusionmarkets.com/posts/a-beginners-guide-to-automated-trading

[11] – https://brokerchooser.com/broker-reviews/fusion-markets-review/fusion-markets-forex-spread

[12] – https://www.compareforexbrokers.com/reviews/fusion-markets/

[13] – https://brokerchooser.com/broker-reviews/fusion-markets-review

[14] – https://hellosafe.ca/en/investing/broker/fusion-markets

[15] – https://fusionmarkets.com/Trading/Withdrawal-options

[16] – https://ca.trustpilot.com/review/fusionmarkets.com?page=6

[17] – https://www.linkedin.com/pulse/how-withdraw-money-from-fusion-markets-bank-account-ietvc

[18] – https://www.forexpeacearmy.com/forex-reviews/16886/fusion-markets-review

[19] – https://fusionmarkets.com/posts/our-top-five-most-used-tools

[20] – https://fusionmarkets.com/About-us/Testimonials

[21] – https://brokerchooser.com/broker-reviews/fusion-markets-review/fusion-markets-regulation

[22] – https://brokerchooser.com/broker-reviews/fusion-markets-review/fusion-markets-canada

[23] – https://fusionmarkets.com/About-us/Regulations

[24] – https://fusionmarkets.com/Blog?tags=Trading

[25] – https://fusionmarkets.com/posts/beginners-guide-to-trading-forex

[26] – https://brokerchooser.com/invest-long-term/tools/educational-material-at-fusion-markets

[27] – https://ca.trustpilot.com/review/fusionmarkets.com

[28] – https://fusionmarkets.com/About-us/Who-we-are

[29] – https://www.bestbrokers.com/reviews/fusion-markets/

[30] – https://fusionmarkets.com/Trading/Energy-and-soft-commodities

[31] – https://fusionmarkets.com/Trading/Products-and-accounts

[32] – https://www.compareforexbrokers.com/ca/trading/

[33] – https://fusionmarkets.com/Trading/Classic-Trading-Account

[34] – https://fusionmarkets.com/Trading/Zero-Trading-Account

[35] – https://fusionmarkets.com/Trading/Swap-Free-Accounts

[36] – https://static.fusionmarkets-staging.com/Platforms/Metatrader-4

[37] – https://fusionmarkets.com/posts/why-is-metatrader4-so-popular

[38] – https://fusionmarkets.com/Platforms/Metatrader-5

[39] – https://tradingcritique.com/broker-review/fusion-markets-trading-platforms-metatrader-4-metatrader-5/

[40] – https://globalfintechseries.com/trading/low-cost-fx-trading-comes-to-tradingview-with-fusion-markets-integration/

[41] – https://tradingcritique.com/broker-review/how-to-trade-on-the-go-using-fusion-markets-mobile-app/

[42] – https://play.google.com/store/apps/details?id=com.fusionmarkets.app&hl=en_CA