The forex market gets more than $8 trillion in daily turnover. This vast financial arena now sees AI forex trading systems taking the lead, and all but one of these successful traders now use trading robots to stay ahead.

Our team has watched this evolution unfold, and the evidence speaks for itself. Modern forex trading AI solutions can do things traders could only dream of several years ago. These systems analyze millions of transactions at once and spot patterns that human traders often overlook. The numbers tell a compelling story – experts expect generative AI in trading to expand from $208.3 million in 2024 to over $1.7 billion by 2033, with a 26.3% yearly growth rate.

Table of Contents

AI forex trading bots excel because they know how to work non-stop without getting tired. These systems operate around the clock while human traders need rest and can’t monitor multiple time zones effectively. Smart algorithms now examine market sentiment from news and social media, which gives traders valuable insights about market shifts before they happen.

This piece reveals sophisticated AI forex trading signals and strategies that successful traders rarely share. We’ll show you how custom AI models use exclusive datasets and dynamic risk management approaches that are revolutionizing this competitive space.

How Top Traders Use AI to Read the Forex Market

Image Source: Dribbble

Top traders have moved beyond simple technical analysis. They now utilize sophisticated AI systems to decode the forex market’s complex patterns and signals. AI models analyze big datasets and adapt to changing market conditions1. This tech advantage explains why 90% of successful forex traders already use trading robots in their operations2.

Pattern recognition using historical price data

AI stands out at spotting complex patterns in historical price data that humans might miss. These smart algorithms study past market behaviors and detect subtle connections between price movements, volume, and other technical indicators.

Convolutional neural networks (CNNs) – first created to recognize images – now help analyze financial data by finding sequences and links between price points27. This smart adaptation lets AI predict market movements more accurately than old-school methods.

Modern AI systems can spot patterns that go way beyond simple trend lines. Here’s what high-level pattern recognition tools can identify:

- Complex chart formations including ascending/descending triangles and head & shoulders patterns

- Breaking trend lines and Fibonacci retracements

- Seasonal patterns and market cycles from years of data4

These systems learn from new market data and help traders fine-tune their strategies.

Sentiment analysis from news and social media

Currency movements often start with market sentiment before technical indicators catch up. Smart traders use AI-powered sentiment tools to scan news articles, social media posts, and financial blogs. These tools measure emotional tone and market opinions1.

Natural language processing (NLP) helps these systems assess text data. They can tell if market sentiment toward specific currencies is positive, negative, or neutral27. Traders get valuable hints about price movements based on what market participants think.

Sentiment analysis helps spot market reversals and trend changes early. Traders watch how sentiment changes after economic data releases or central bank announcements. This gives them early signals about possible market turns28.

Real-time volatility tracking with AI models

Quick data processing gives top traders an edge in the fast-paced forex world. AI systems watch price changes across major currency pairs. They alert traders the moment volatility spikes6.

These smart models process millions of data points every second. They spot unusual patterns like strange trading volumes or sudden price jumps7. Traders receive instant alerts about volatility events that might lead to good trades.

AI never sleeps or takes breaks, unlike human analysts. It watches news events, economic data releases, and market sentiment 24/7. This constant monitoring helps find trading opportunities as they emerge8.

The biggest advantage comes from combining pattern recognition, sentiment analysis, and volatility tracking into one system. Top traders see the market from multiple angles. This comprehensive view would be impossible with manual analysis alone.

Secret #1: Custom AI Models for Trading Signals

Image Source: AI-signals

Elite traders get their edge through proprietary AI models that generate superior trading signals. Market pattern analysis matters, but I found that exceptional performance comes from how these models are developed and fine-tuned.

Training proprietary models on private datasets

The best forex traders don’t just rely on public data. They build custom AI models trained on exclusive datasets that give unique insights other market participants can’t access. These proprietary datasets combine traditional market information with alternative data sources. This creates a competitive edge that others find hard to copy9.

AI systems built on proprietary algorithms showed a 71% win rate across all signal categories and a 2.5:1 average risk-reward ratio per trade9. These custom-built models can process huge amounts of market data faster than humans—without emotional biases that affect most traders.

Public forex data is accessible to more people, but successful traders keep their edge by:

- Developing algorithms specifically designed for their trading style

- Continuously updating models with fresh proprietary data

- Implementing strict data security protocols to protect their competitive advantage

Using synthetic data for rare market events

Training effective AI forex trading models faces a challenge due to lack of data about unusual market conditions like crashes or sudden volatility spikes. Smart traders solve this by using synthetic data—artificially generated information that mirrors real-life trading patterns without revealing actual transactions10.

Synthetic data is a great way to get several critical advantages for forex AI models. Traders can simulate realistic financial scenarios—from customer transactions to market movements—without using real customer data10. This method lets traders create unlimited training examples of rare but crucial market events that might happen once every few years in actual historical data.

Research by MIT and JPMorgan Chase showed stress tests using synthetic data found 18% more potential risk factors than traditional historical simulation methods11. Traders can create controlled variations to test model reliability and produce new combinations of features to spot false correlations.

Avoiding overfitting with ensemble learning

The most important challenge in developing AI forex trading signals is preventing overfitting—models that work great on training data but fail in ground application. Top traders use ensemble learning to solve this. This method combines multiple models in the same framework to get better performance12.

Single models might overfit to data noise, but ensemble methods like Random Forests and Gradient Boosting Machines lower this risk. They do this by combining predictions from many different models13. This approach reduces both bias and variance and makes trading signals more reliable.

Ensemble methods work best when base models are properly trained and combined12. Effective approaches include:

- Bagging: Training models on random data subsets to reduce variance (ideal for noisy forex data)

- Boosting: Focusing on correcting previous errors while preventing overfitting through regularization

- Stacking: Combining predictions from different model types using a meta-model for final output

Ensemble models need more computing power, but they’re essential for serious AI forex trading because they generalize better. These methods have proven they can adapt to market changes while performing consistently across different timeframes.

Secret #2: AI-Powered Risk Management Tactics

Risk management creates the foundation of profitable forex trading. Few traders talk about the AI tools they use to protect their capital. My experience shows that sophisticated risk management—not just signal generation—sets consistently successful traders apart from others.

Dynamic position sizing based on volatility

Top traders utilize AI to adjust position sizes dynamically based on live market volatility. These systems analyze volatility indicators like ATR (Average True Range) to calculate optimal trade volumes instead of using fixed lot sizes. AI systems automatically reduce position sizes to limit exposure during highly volatile periods14.

The formula follows this pattern: Position Size = Account Risk / (ATR × Multiple). To cite an instance, a $100,000 account risking 1% might adjust position sizing this way based on volatility:

- Low volatility (ATR $1.00): 500 shares

- Medium volatility (ATR $2.50): 200 shares

- High volatility (ATR $5.00): 100 shares15

This approach will give a consistent risk exposure whatever the market conditions. Your AI trading system automatically scales back your risk without manual intervention as markets become turbulent.

Stop-loss automation using predictive analytics

Advanced AI systems implement dynamic protection mechanisms that adapt to changing market conditions beyond simple stop-losses. These tools can forecast volatility spikes and adjust stop-loss levels preemptively to protect capital16.

Predictive stop-loss systems work through several mechanisms:

- Live volatility forecasting to anticipate potential price swings

- Analysis of multiple currency pairs to detect correlated movements

- Sentiment monitoring from news and social media to identify potential risks16

Proprietary systems like “AI Risk Shield” can detect unusual market behavior and trader anomalies. Users get alerts about potential risks before they materialize17. This proactive approach shows major improvements over traditional risk management methods that only react after price movements.

Correlation analysis across currency pairs

Markets rarely move alone—a fact that leading AI forex systems exploit through sophisticated correlation analysis. These tools monitor relationships between currency pairs to spot hidden risks and diversification opportunities18.

Multiple positions with high positive correlations (75% or higher) could see negative impacts across your entire portfolio from one adverse market movement18. AI correlation analysis fights this by monitoring cross-currency relationships continuously and adjusting exposures.

AI systems can identify traditionally uncorrelated assets that suddenly become correlated. This signals potential risk concentration needing immediate portfolio adjustments19. The capability proves valuable especially during market stress events when correlations unexpectedly increase.

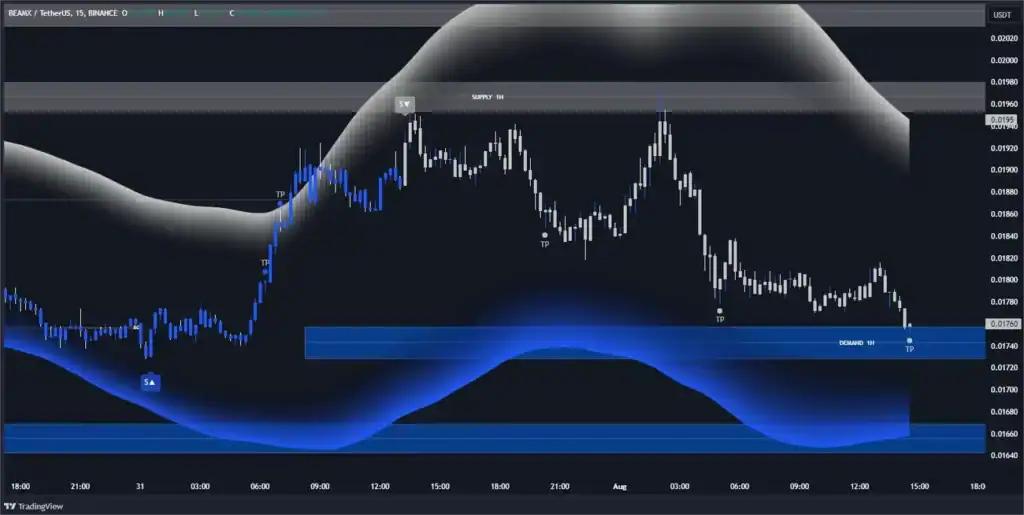

Secret #3: High-Frequency Trading with AI Bots

Image Source: Unite.AI

A millisecond advantage changes everything in high-frequency trading (HFT). Algorithmic systems now handle almost 67% of all forex trades20. Advanced AI forex trading technology redefines the limits of what’s technically possible with its speed-focused approach.

Latency optimization in AI forex trading bots

AI trading systems process data in nanoseconds instead of milliseconds, which creates vital competitive edges21. Elite forex trading AI systems need specialized infrastructure to reach this performance level:

- Hardware optimization: GPUs/TPUs for accelerated AI computations

- Network engineering: Low-latency networks with exchange co-location

- Infrastructure minimization: Removing unnecessary hops like firewalls

Professional HFT firms use dedicated VPS trading servers that offer secure, stable environments for their algorithms to minimize slippage and boost profits22. Achieving ultra-low latency needs a comprehensive system that optimizes each step from data transmission to execution21.

Order book prediction using LSTM networks

Long Short-Term Memory (LSTM) neural networks work better than traditional models for forex market movement predictions23. These advanced networks excel at analyzing order book data—the electronic list of buy and sell orders arranged by price level.

LSTM ALL models showed better prediction accuracy than ordered logit models and LSTM using transactions only for 1-minute midquote return forecasts23. Studies confirm LSTM models’ lower Root Mean-Square Error (RMSE) and Mean Absolute Error (MAE) compared to RNN models3.

Scientists recently created a modified loss function (MLF) for LSTM models. This innovation cut MSE by over 95% and doubled R-squared (R2) values compared to standard forex loss functions24.

Execution algorithms to reduce slippage

Slippage can destroy forex profits through differences between expected and actual execution prices. Advanced AI forex trading signals now include execution algorithms that specifically target this issue25.

Smart order routing (SOR) has become crucial for institutional traders. Reinforcement learning algorithms adapt to market conditions and optimize trade placement strategies26. These systems exploit live data to execute trades at optimal price points, which enhances liquidity and maintains market stability26.

RBC’s advanced electronic trading platform, Aiden, shows this approach in action. It analyzes hundreds of data inputs to reduce slippage against key measures while minimizing market effects25.

Secret #4: Personalization and Behavioral Modeling

Personalization emerges as the hidden advantage in ai forex trading systems, beyond algorithmic speed and custom models. Expert traders adapt their AI solutions to match their trading styles and risk profiles. Their systems evolve with their behaviors.

User profiling for tailored AI forex trading signals

Advanced forex trading ai systems look at many aspects of trader behavior to generate customized recommendations. These algorithms create a complete user profile by evaluating historical performance, priorities, trading style, and risk tolerance2. The system delivers trading signals tailored to your unique approach instead of generic recommendations.

Traders gain these most important advantages through customization:

- Conservative traders see signals that highlight low-risk opportunities

- Aggressive traders receive strategies that focus on high-risk, high-reward scenarios

- Intermediate traders get balanced recommendations that match their risk profile

We prioritized these customized trading recommendations to help traders spot potential market opportunities based on their specific data and priorities. This ensures suggestions arrange with both trading style and financial capacity2.

Behavioral clustering for strategy adaptation

Ai for forex trading reaches new frontiers through behavioral clustering that groups traders with similar characteristics. This enables strategy optimization in different market conditions5. The approach uses hierarchical agglomerative clustering (an unsupervised learning technique) to identify distinct trading styles5.

The clustering process depends on key variables that show behavioral patterns:

- Inventory ratio (position holding behavior)

- Order cancelation ratio

- Order frequency

- Number of stocks per trading server (showing latency priorities)

These variables reveal the mechanisms of investment objectives that stay consistent as market conditions change5. Research successfully identified ten distinct trader groups with unique behavioral fingerprints. These groups fell into three main trading styles based on frequency5.

The adaptability of these ai forex trading signals during volatile periods proves most valuable. To cite an instance, high-frequency market makers (HFT-MMs) show different reactions than other trader types. Their response times drop to almost one-third during turbulent markets compared to normal conditions5.

Conclusion

AI technologies have reshaped forex trading completely. These powerful tools analyze millions of data points at once and spot patterns that humans can’t see. They work non-stop in markets of all types. Traders accept these systems at record rates, and the results speak for themselves.

Top traders maintain their edge through four key advantages. They combine advanced pattern recognition with sentiment analysis to view markets from multiple angles. Their proprietary AI models, trained on exclusive data, generate better trading signals through ensemble learning. Smart risk management systems adjust positions and stop-losses based on market conditions automatically. Quick execution happens in nanoseconds through high-frequency trading.

A trader’s competitive edge comes from personalization. AI systems adapt to each trader’s style, risk comfort, and objectives through behavioral modeling. This creates a custom trading assistant instead of a basic algorithm.

The forex market will change as AI technology grows stronger. Machines handle complex analysis, but human insight remains vital to develop strategies and maintain oversight. Smart traders know this balance well. They use AI as a tool to enhance their market knowledge rather than replace it. Success belongs to those who become skilled at working with AI, not just using it.

FAQs

Q1. Can AI accurately predict forex market movements? While AI tools can analyze vast amounts of data to identify patterns and trends, they cannot predict forex markets with 100% accuracy. AI systems can provide valuable insights and trading signals, but the forex market is influenced by many complex factors that are difficult to fully model.

Q2. What are some key advantages of using AI in forex trading? AI offers several benefits for forex trading, including 24/7 market analysis, rapid processing of large datasets, identification of subtle patterns, and removal of emotional biases. AI systems can also adapt to changing market conditions and execute trades faster than humans.

Q3. How do top traders use AI to gain an edge in forex trading? Successful traders often use custom AI models trained on proprietary datasets to generate superior trading signals. They also employ AI for risk management, including dynamic position sizing and automated stop-loss adjustments based on market volatility.

Q4. Are AI-powered high-frequency trading systems effective in forex? High-frequency trading systems powered by AI can be effective, but they require significant technological infrastructure and expertise. These systems aim to capitalize on tiny price movements through ultra-fast trade execution, often operating in milliseconds or even microseconds.

Q5. How important is personalization in AI forex trading systems? Personalization is crucial in AI forex trading. Advanced systems analyze individual trader behavior, risk tolerance, and historical performance to tailor trading recommendations and strategies. This customization helps align the AI’s output with each trader’s unique style and goals.

References

[1] – https://site.financialmodelingprep.com/education/forex/AIDriven-Forex-Forecasting-Navigating-Volatility-with-Machine-Learning-Strategies

[2] – https://www.analyticsvidhya.com/blog/2023/09/how-is-ai-changing-the-forex-market/

[3] – https://www.researchgate.net/publication/355670731_LSTM_forecasting_foreign_exchange_rates_using_limit_order_book

[4] – https://medium.com/@Nsab22/the-top-5-ai-tools-for-forex-traders-in-2025-c61cf79c5710

[5] – https://www.efmaefm.org/0EFMAMEETINGS/EFMA%20ANNUAL%20MEETINGS/2019-Azores/papers/EFMA2019_0201_fullpaper.pdf

[6] – https://www.urbanforex.com/marketbeats

[7] – https://kx.com/glossary/fx-trading-analytics/

[8] – https://blueberrymarkets.com/market-analysis/forex-and-ai-how-is-ai-changing-the-forex-market-in-2024/

[9] – https://verifiedinvesting.com/products/verified-ai-day-trade-alerts?srsltid=AfmBOop0I0GZNm4Cr7KWyZC_0n_qlmEVTH0AqfomEcUlb6bPntXDwTDb

[10] – https://www.forbes.com/councils/forbestechcouncil/2024/04/03/synthetic-data-applications-in-finance/

[11] – https://www.numberanalytics.com/blog/innovative-synthetic-data-applications-finance

[12] – https://www.sciencedirect.com/science/article/pii/S1319157823000228

[13] – https://www.alphanome.ai/post/navigating-overfitting-in-quantitative-trading-the-ai-advantage

[14] – https://algosone.ai/ai-forex-trading/

[15] – https://www.luxalgo.com/blog/5-position-sizing-methods-for-high-volatility-trades/

[16] – https://www.spacedaily.com/reports/AI_Risk_Management_in_Forex_Beyond_the_Basics_999.html

[17] – https://codersguild.net/blog/the-role-of-analytics-and-ai-in-modern-forex-software-forecasting-and-risk-management

[18] – https://www.forex.com/en-us/trading-academy/courses/advanced-risk-management/currency-correlation-in-forex/

[19] – https://leomercanti.medium.com/ai-and-cross-asset-correlation-analysis-7bfb18b39820

[20] – https://www.forex.com/en-us/trading-guides/robo-trading/

[21] – https://iongroup.com/blog/markets/achieving-and-maintaining-an-ultra-low-latency-fx-trading-infrastructure/

[22] – https://paylinedata.com/blog/algo-execution

[23] – https://www.sciencedirect.com/science/article/abs/pii/S1544612321004827

[24] – https://papers.ssrn.com/sol3/papers.cfm?abstract_id=5036292

[25] – https://www.rbccm.com/en/expertise/electronic-trading/ai-trading.page?utm_source=rbc&utm_medium=va&utm_campaign=aiden

[26] – https://techbullion.com/ai-driven-forex-trading-transforming-market-efficiency-and-liquidity/

[27] – https://writingmate.ai/blog/ai-trading-pattern-recognition

[28] – https://www.morpher.com/blog/sentiment-analysis-in-forex-trading