The U.S. government faces a massive challenge – a staggering $9.31 trillion of federal debt that needs to be paid within 12 months. BitBonds could be the answer to this fiscal problem and save taxpayers $70 billion each year in interest payments.

BitBonds blend the safety of government bonds with Bitcoin’s growth prospects. Traditional bonds give modest returns, but BitBond crypto investments could deliver nearly 7% yearly gains even with conservative Bitcoin growth estimates. The returns might reach 17% annually if Bitcoin performs at its historical average.

Table of Contents

Our research shows BitBonds are now available to everyday Americans. The numbers tell an interesting story – if each of the 132 million American households put in about $3,025, they could cover 20% of a $2 trillion BitBond release. These investments give you a chance to reduce dependence on dollars while you retain control of government-backed investments.

The Bitcoin from these bonds would sit in a Strategic Bitcoin Reserve as a shield against inflation. Past performance suggests the gains could reach $6 trillion over ten years.

Let’s dive into the essentials of BitBond investing. We’ll cover their structure, check their legitimacy, and help you decide if they belong in your investment portfolio.

What Are Bitcoin-Backed Bonds?

“BitBond investors receive 100% of Bitcoin appreciation up to a threshold, for instance a 4.5% compound annual return ($155.30 per $100 bond) over 10 years).” — Brad Lander, New York City Comptroller

BitBonds are a new kind of financial product that brings together regular government bonds and cryptocurrency. These days, economists, Bitcoin fans, and finance pros are excited about how these could help fix money problems.

Definition and structure of BitBonds

BitBonds work as hybrid debt instruments that mix U.S. government bonds with Bitcoin exposure. The setup puts 90% of your money into regular government bonds and uses the other 10% to buy Bitcoin [1]. This creates an investment that’s both safe and has room to grow.

Here’s what you get when you buy a BitBond:

- A fixed yearly payment of 1% in dollars that’s guaranteed [1]

- Your original investment stays safe whatever Bitcoin does [1]

- You can make money if Bitcoin goes up [1]

BitBonds are interesting because they protect you from losing money while letting you win big. Even if Bitcoin becomes worthless, you’ll still get your $100.00 face value plus interest when it matures [1]. So you can’t lose much but could gain a lot.

The way returns work is pretty straightforward. You get all Bitcoin gains up to 4.5% yearly (just like regular 10-year Treasury bonds) [1]. After that, any extra money gets split 50/50 between you and investors with the U.S. government [1]. This works well for everyone – you get Bitcoin with protection, and the government might save money on borrowing.

These bonds last 10 years, just like normal Treasury bonds [2]. When time ends, up you get back the Treasury bond part ($90.00 for every $100 bond) plus the Bitcoin portion’s worth at that time [2]

.

How to Start Investing in BitBonds

BitBonds vs Traditional Bonds

Image Source: Smart Valor

“Municipal bonds issued on a tax-exempt basis are subject to federal arbitrage tax rules, which limit the purposes for which debt can be issued and limit the earnings on the proceeds of such debt.” — Brad Lander, New York City Comptroller

Investors need to understand basic differences between financial instruments to make smart decisions. BitBonds and traditional bonds play different roles in investment portfolios and come with their own risk-reward profiles.

Fixed income vs. Bitcoin exposure

Traditional bonds give predictable returns through fixed interest payments. They usually beat inflation with minimal risk and volatility. BitBonds work differently. They combine elements of both conservative and growth investments in their return structure.

These investments differ mainly in their makeup:

- Traditional bonds: 100% allocation to government or corporate debt with fixed coupon rates (currently around 4.5% for 10-year Treasuries) [1]

- BitBonds: 90% allocation to traditional government expenditures with 10% used to purchase Bitcoin [6]

This mix creates a unique risk-reward profile. BitBond investors get a guaranteed 1% annual coupon in USD plus any Bitcoin gains at maturity [1]. They capture all of Bitcoin’s upside up to 4.5% per year (matching standard Treasury yields). Beyond that, gains split 50/50 between investors and the government [1].

Break-even points change based on coupon rates. A 4% coupon BitBond breaks even with zero Bitcoin growth. Lower-yield versions need stronger Bitcoin performance. Bonds with 2% coupons need 13.1% Bitcoin CAGR, while 1% coupon bonds need 16.6% Bitcoin CAGR [7].

Bitcoin’s exceptional performance (30-50% CAGR) could push returns up to 282% [7]. BitBond investors take on Bitcoin’s full downside risk, though their principal stays protected [1].

Inflation protection and purchasing power

BitBonds offer a big advantage over traditional fixed-income investments. They might protect against inflation and currency debasement.

Standard Treasury bonds lose buying power if inflation tops their yield. Many bond investors have watched rising prices eat away their real returns. Bitcoin has emerged as a possible inflation hedge because of its fixed supply and decentralized nature [8].

Sigel explains: “Bond investors want protection from US dollar inflation and asset inflation, which makes Bitcoin a good fit as a component of the bond” [8]. This combination fixes a key weakness in traditional bonds—they’re vulnerable to monetary debasement.

Modest Bitcoin performance (37% CAGR) could let the government keep USD 1.77 trillion in Bitcoin upside. This could cut national debt substantially [1]. Bitcoin’s historical median performance might mean upside potential of USD 6 trillion [1].

Trade-offs exist though. During bear markets, low-yield BitBonds might lose 20% to 46% compared to other investments or inflation [1]. Risk-averse or income-focused investors might find them less attractive during Bitcoin downturns.

Transparency and blockchain integration

BitBonds move government bond markets toward greater transparency through blockchain. Traditional bond markets often use complex middlemen and limit visibility into trades and holdings.

Blockchain-based bonds use smart contracts that automate interest payments and principal repayments [3]. Key benefits include:

- No middlemen needed

- Faster settlement times

- Better transparency through permanent ledger records [3]

Blockchain visibility builds trust between investors and issuers [3]. BitBonds’ hybrid nature—mixing sovereign debt with volatile digital assets—raises questions about SEC, IRS, and CFTC regulations [1].

BitBonds could create a unique sovereign bond class. They give the US a chance at Bitcoin upside while reducing dollar-based obligations [7]. Matthew Sigel says, “BTC upside just sweetens the deal. Worst case: cheap funding. Best case: long-vol exposure to the hardest asset on Earth” [7].

Conservative investors can get Bitcoin exposure without owning cryptocurrency directly through BitBonds [9]. They turn part of a safe investment into a potential high-return play while protecting against losses. This appeals to people interested in Bitcoin but worried about its ups and downs.

Pros of Investing in BitBonds

Image Source: VantagePoint Software

BitBonds bring a new approach to cryptocurrency investing that combines security with growth potential. Many investors want to join the digital asset space without too much risk, and these hybrid bonds offer several compelling advantages.

Low-risk Bitcoin exposure

BitBonds give investors a safe entry into the cryptocurrency market. They only allocate 10% of funds to Bitcoin and secure 90% in traditional Treasury bonds [10]. This setup creates what investment pros call an “asymmetric bet” – where you limit downside risk but keep big upside potential.

Direct Bitcoin buys expose investors to the crypto market’s full swings. BitBonds make this smoother. Your principal stays secure even during Bitcoin’s wild periods. This changes Bitcoin from a risky speculative bet into a controlled growth part within a mostly safe investment.

Matthew Sigel, Head at VanEck, says this approach “lines up the interests of the gov and investors over a 10-year period” [11]. Traditional crypto funds or ETFs don’t have this safety floor, making BitBonds a balanced pick for risk-wary investors curious about digital assets.

Government-backed principal

BitBonds’ most reassuring feature is their gov guarantee. Your investment’s face value ($100 per bond) has full protection [1]. This sets BitBonds apart from other crypto bets.

“BitBonds come with U.S. gov backing. Your principal is safe,” one analysis notes [12]. This comes from the bond’s setup—90% of funds back standard government spending, like a regular Treasury bond that guarantees repayment.

Bondholders get their original investment plus fixed interest even if Bitcoin tanks to zero [1]. This removes the catastrophic loss risk that keeps many conservative investors away from crypto.

Potential for higher returns

BitBonds’ return system can beat traditional bonds. Investors get all Bitcoin gains up to a 4.5% yearly yield [2]. After that, gains split 50/50 with the gov [4].

Potential returns look strong:

- Conservative cases with Bitcoin at 30% yearly growth (its 10th percentile historical avg) could earn ~7% annually [1]

- Returns could hit over 17% per year if Bitcoin tracks its typical historical rates [1]

- Bullish cases with 30–50% Bitcoin CAGR could outpace Treasury yields by a wide margin [4]

American families get these earnings tax-free [1], making after-tax returns even better than traditional bets.

BitBonds let you ride Bitcoin’s growth with a safety net. Andrew Hohns, PhD economist at Newmarket Capital, says investors “could gain important Bitcoin exposure via BitBonds knowing the gov returns 100% of their principal” [13].

BitBonds reshape crypto’s risk-reward game. Instead of big wins or huge losses like direct Bitcoin buys, investors get downside protection with upside potential.

Cons and Risks Associated to Consider

Risk checks are key for any bet, especially new ones like BitBonds. These bonds have great features, but you gotta weigh the downsides.

Volatility of Bitcoin’s swings

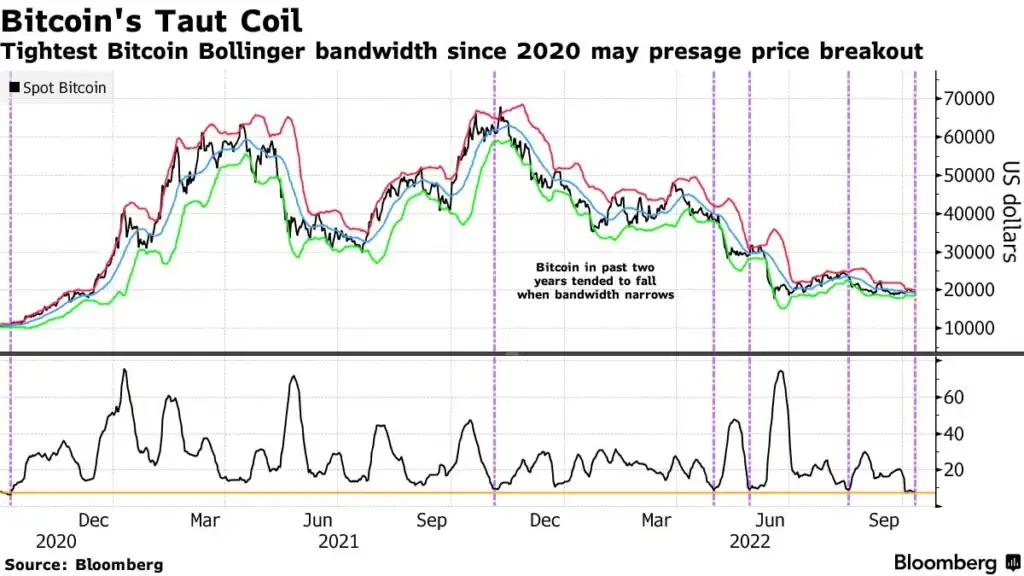

Bitcoin’s wild price swings are a big worry for BitBond folks. It showed 3–4x higher volatility than stocks from 2020–2024 [14]. BitBonds protect your principal but take full Bitcoin price hits T[1]. Low-yield BitBonds could lose 20–46% vs. inflation in bear markets [1].

Bitcoin’s price can double or halve in months [9]. These swings hit returns hard. Sure, Bitcoin’s vol has paid off long-term (Sortino ratio 1.86, ~2x Sharpe), but quick moves spook bond types [2].

Limited upside cap

You get 100% of Bitcoin’s rise till your return hits 4.5% yearly T[1]. Beyond that, the gov splits gains 50/50, capping your share of Bitcoin’s big runs T[1].

This deal favors the Treasury. Sigel notes: “BTC upside sweetens it. Worst case: cheap funds. Best case: exposure to the hardest asset” [5]. The gov gets low-cost borrowing even if Bitcoin crashes T[5].

You need Bitcoin’s CAGR at 8–17% to break even, based on the rate T[4]. In Bitcoin’s flat times, returns might barely beat a savings account T[9].

Experimental nature

The Treasury must issue ~11% more debt since 10% of bonds go to Bitcoin buys T[1]. This could spark political heat T[1].

Billions in federal Bitcoin holdings need new custody and compliance—think multi-sig wallets, cold storage, all tricky T[1]. Mixing bonds with volatile crypto raises SEC/FTC/IRS rule questions T[1]. Some might see it as gambling despite the structure T[1].

Knowing these factors helps you see if BitBonds fit your goals and risk comfort.

Are BitBonds Legit?

BitBonds in the Bigger Picture

The U.S. faces a huge fiscal mess—~$9.3T in federal debt due in 12 months, with $14T+ in three years T[21].. BitBonds could be a fix.

Role in U.S. debt strategy

BitBonds could shake up America’s debt game. Issuing $2T at 1% could save $70B yearly—20% of 2025’s refinancing needs, $700B over a decade T[21].

The Treasury wins with lower costs, even if Bitcoin flops. Refinancing $2T at 4.5% costs $90B/year in interest; BitBonds at 1% drop it to $20B, saving $70B T[1].

Impact on global financial systems

The U.S. could lead a global finance shift byby greenlighting crypto-bonds. Others might launch their own to counter U.S. dominance, speeding up a diversified system and denting the dollar’s reserve role T[22].

The Strategic Bitcoin Reserve, set by March 2025 order, holds BitBonds’ Bitcoin . It hedges inflation and cuts reliance on foreign creditors .

How VanEck’s BitBond fits into the market

VanEck’s Matthew Sigel pitched BitBonds at the 2024 Strategic Bitcoin Reserve Summit T[23]. His 10-year bonds mix 90% Treasury with 10% Bitcoin .

Investors keep 100% of Bitcoin gains till 4.5% yield, then split profits . This setup’s a win-win for the Treasury and folks dodging dollar devaluation T[1].

Tips for First-Time Investors

Getting into crypto-backed bonds takes good planning, especially for newbies. These steps will guide you safely through this new investment space.

Know the deal

Dig into the paperwork before betting on BitBonds. Check:

- Coupon rates and payment setup

- How Bitcoin’s moves hit your returns

- Maturity timeline

- Fees or early cash-out rules

A clear view avoids surprises and helps you decide if BitBonds match your goals.

Talk to a pro

Chat with a financial advisor before diving into BitBonds or crypto stuff. Pros are key if you’re betting big T[24].

Find advisors with crypto cred like Certified Digital Asset Advisor or Blockchain certs T[25]. Ask if they’ve bet on crypto themselves—those who do often give sharper advice .

Pros can map how BitBonds fit your plan, explain taxes, and spot risks you might miss.

Conclusion

BitBonds sit at the edge of safe bonds and crypto’s growth. They put 90% in gov bonds and 10% in Bitcoin, creating a bet that guards principal while chasing big gains.

Bitcoin’s wild swings spook some, but BitBonds’ gov backing eases that with principal protection no matter what Bitcoin does. Returns can beat regular bonds, especially when Bitcoin soars.

Risks need a hard look—Bitcoin’s ups and downs, the 4.5% gain cap, and their newness. Dig deep to spot real BitBonds and dodge scams.

BitBonds could tackle America’s debt mess, saving $70B yearly with lower rates and maybe cashing in on Bitcoin’s rise.

Newbies should play it smart—start small, mix with other bets, and know the terms. A pro advisor’s a must for big moves.

BitBonds bridge safe bets and crypto kicks. They let cautious folks tap Bitcoin’s potential without full risk. Still evolving, they’re a solid way to straddle traditional and digital markets.

Smart bets start with knowing the game. This guide lays out the basics to see if BitBonds fit your goals and risk vibe.

FAQs

Q1. How do BitBonds differ from traditional bonds?

BitBonds mix 90% gov bonds with 10% Bitcoin. They guard principal like regular bonds but add crypto upside. Unlike standard bonds, they hedge inflation via crypto.

Q2. What’s the potential return from BitBonds?

You get 100% of Bitcoin gains up to 4.5% yearly. Beyond that, gains split 50/50 with the gov. At 30% Bitcoin growth, you could earn ~7% yearly; historical rates could hit 17%+.

Q3. How risky are BitBonds vs. other crypto bets?

Less risky than straight crypto since the gov protects principal. But the 10% Bitcoin slice takes full price swings. In bear markets, low-yield BitBonds could lag inflation by 20–46%.

Q4. Where can I buy BitBonds?

BitBonds are still a concept, not yet for sale. If launched, expect them via U.S. Treasury or big brokers handling gov securities.

Q5. Are BitBonds good for newbies?

They could suit beginners wanting crypto with less risk, thanks to gov backing. But research is key—Bitcoin’s swings carry risks.

References

[1] – https://www.forbes.com/sites/tonyaevans/2025/04/22/bitbonds-a-new-take-on-treasury-bonds-to-tackle-the-us-debt-crisis/

[2] – https://comptroller.nyc.gov/newsroom/comptroller-brad-lander-pours-cold-water-on-mayor-adams-bitbonds-proposal/

[3] – https://www.bitbond.com/resources/bitbond-sto-the-benefits-of-bonds/

[4] – https://chainplay.gg/blog/vaneck-proposes-bitcoin-backed-‘bitbonds’-to-tackle-debt-crisis/

[5] – https://www.cbinsights.com/company/bitbond-1

[6] – https://thedefiant.io/news/tradfi-and-fintech/vaneck-proposes-110-billion-bitbonds-10-bitcoin-to-refinance-14-trillion-u-s-44c0cbc4

[7] – https://cryptoslate.com/vaneck-proposes-bitcoin-linked-treasury-bonds-to-offset-14-trillion-in-us-debt/

[8] – https://cointelegraph.com/news/bitcoin-treasury-bond-refinance-14-trillion-us-debt-vaneck

[9] – https://www.forbes.com/sites/davidbirnbaum/2025/03/31/could-bitcoin-based-bit-bonds-build-a-better-america/

[10] – https://www.onesafe.io/blog/bitbonds-future-crypto-banking

[11] – https://beincrypto.com/bitbonds-us-treasury-bitcoin-debt/

[12] – https://medium.com/@gbarb18/bitbonds-a-bold-fusion-of-treasuries-and-bitcoin-6bc03e19627d

[13] – https://www.forbes.com/sites/digital-assets/2025/04/05/bitbonds-the-2-trillion-idea-that-could-slash-the-national-debt/

[14] – https://www.fidelitydigitalassets.com/research-and-insights/closer-look-bitcoins-volatility

[15] – https://www.bitbond.com/

[16] – https://www.supermoney.com/reviews/bitbond-company

[17] – https://www.cryptoaegis.io/audits/Due Diligence – Bitbond – 2023-04-28.pdf

[18] – https://consumer.ftc.gov/articles/what-know-about-cryptocurrency-and-scams

[19] – https://stomarket.com/sto/bitbond-bb1/trading

[20] – https://www.fireblocks.com/blog/fireblocks-x-bitbond-simple-secure-and-scalable-tokenization-for-institutions/

[21] – https://www.jellyc.io/insights/bitbonds-bitcoin-treasury-bonds

[22] – https://www.gate.com/learn/articles/bit-bonds-how-bitcoin-bonds-could-reshape-u-s-fiscal-policy-and-the-global-economic-landscape/8415

[23] – https://www.bitdegree.org/crypto/news/vanecks-bitbond-plan-bitcoin-meets-treasury-debt-in-new-proposal

[24] – https://money.usnews.com/financial-advisors/articles/should-you-get-a-financial-advisors-advice-before-investing-in-bitcoin

[25] – https://wealthtender.com/insights/financial-planning/cryptocurrency-financial-advisors/