Table of Contents

Here’s a surprising fact: only 10% of options get exercised. Traders close out 60% of positions before expiration, and 30% simply expire worthless.

Bitcoin options create an exciting entry point into cryptocurrency derivatives. These financial instruments give traders the right – but not the obligation – to buy or sell Bitcoin at preset prices. Traders need a smaller original investment compared to direct Bitcoin purchases, which provides access to greater financial leverage.

The crypto market never sleeps and shows more volatility than traditional markets. Bitcoin options serve as powerful tools that help manage risk. Smart traders can minimize premium losses and profit from price movements whether markets rise or fall.

Many crypto enthusiasts want to move beyond the simple buy-and-hold strategy. Options trading could be your perfect next move. This piece walks you through the essentials of Bitcoin options trading. You’ll learn everything from simple concepts to detailed steps that help you place your first trade.

What Are Bitcoin Options?

Image Source: Stopsaving.com

Definition and how they work

Bitcoin options are financial contracts that give you the right—but not the obligation—to buy or sell Bitcoin at a set price before a specific date expires [1]. These financial derivatives work like reservations you make today for future Bitcoin transactions.

Every Bitcoin option contract has key parts. The strike price sets the predetermined price for the Bitcoin transaction if you exercise the option [2]. The premium is what you pay upfront to buy the contract [3]. The expiration date marks your deadline to exercise the option [2].

Bitcoin options come in two main styles: European and American. You can only exercise European-style options when they expire. American-style options let you exercise them any time before expiration [4]. These options trade on specialized platforms through centralized exchanges and decentralized platforms.

Here’s a real-world example: Let’s say Bitcoin trades at $30,000. You might buy a call option with a $30,000 strike price that expires in one month. If Bitcoin rises to $40,000 before expiration, you could buy Bitcoin at $30,000 and make $10,000 (minus what you paid for the premium) [4].

Why traders use options on Bitcoin

Traders turn to Bitcoin options for three main reasons. They help protect against price drops. Bitcoin’s price swings wildly, so protective puts help investors protect their holdings’ value during market uncertainty [3].

Options let you speculate on Bitcoin’s price without owning any cryptocurrency. This means traders need less money than they would to buy actual Bitcoin [5].

Smart traders make money by selling options premiums [3]. Bitcoin options also beat direct cryptocurrency purchases in several ways:

Limited risk exposure: Buying options caps your maximum loss at the premium paid, which protects you during market crashes [2].

Enhanced capital efficiency: You need less money upfront with Bitcoin options compared to buying actual Bitcoin, which helps you manage your money better [6].

Flexibility in strategy development: Options let you create sophisticated trading strategies that match market conditions, from basic directional trades to complex positions [2].

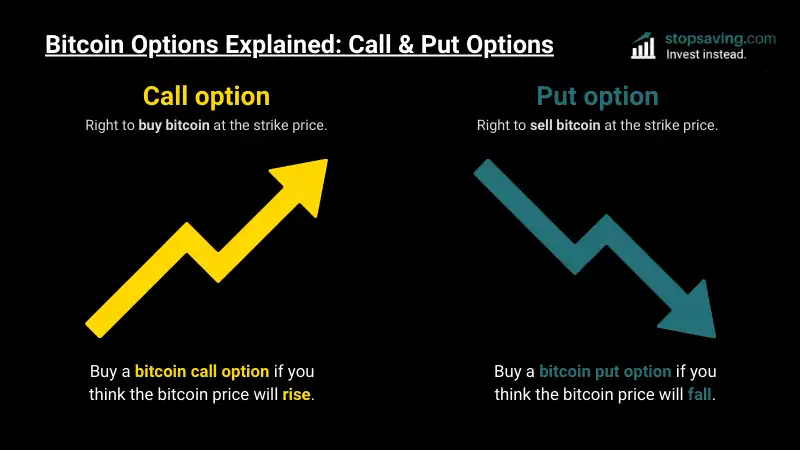

Difference between call and put options

Call and put options are the two basic types of Bitcoin options contracts. Each serves a different purpose based on what you think the market will do.

Call options let you buy Bitcoin at the strike price before expiration [1]. Traders buy calls when they expect prices to go up. This lets them get Bitcoin below market value if prices climb past the strike price [3]. Let’s say you buy a Bitcoin call option with a $90,000 strike price. If Bitcoin reaches $95,000, you could still buy it at $90,000 [5].

Put options work the other way around. They let you sell Bitcoin at the strike price before expiration [1]. Traders buy puts when they think prices will fall. This helps them sell Bitcoin above market value if prices drop below the strike price [3]. Using our earlier example, a Bitcoin put option with a $90,000 strike price lets you sell at that price even if Bitcoin drops to $85,000.

These option types offer different profit potential. Call options could make unlimited profits since Bitcoin’s price has no ceiling [5]. Put options have limited profit potential because Bitcoin can’t fall below zero [5].

Both calls and puts fall into three categories based on the current market price:

In-the-Money (ITM): Options you can exercise for immediate value

At-the-Money (ATM): Options where strike price matches current market price

Out-of-the-Money (OTM): Options with no immediate exercise value [5]

These categories help traders assess an option’s value and profit potential when planning their Bitcoin options trading strategies.

Key Terms You Need to Know

Image Source: Koinly

Image Source: Koinly

Bitcoin options trading starts with learning everything about the terminology. These terms are the foundations of every trade. Let me walk you through these vital concepts that will help you direct your way through the bitcoin derivatives market.

Strike price, premium, and expiration

The strike price is the fixed price where I can buy or sell Bitcoin when exercising an option [7]. A Bitcoin call option with a strike price of $100,000 gives me the right to buy Bitcoin at $100,000 whatever the current market price might be [1].

The premium is what I pay upfront to buy an option contract [7]. This non-refundable fee changes based on several factors:

Current price of the underlying asset

Strike price in relation to current price

Time left until expiration

Market volatility [1]

Here’s a simple example: I pay a $2,000 premium for a Bitcoin call option with a $90,000 strike price. Bitcoin rises to $105,000. My profit becomes $13,000 ($15,000 gain minus the $2,000 premium) [7].

The expiration date is the deadline to decide whether to exercise my option [7]. The option becomes void after this date [1]. Many exchanges give you options with different expiration timeframes. Monthly options line up with underlying futures contracts. You also get shorter-term weekly options with Monday, Wednesday, and Friday expirations for better precision [1].

In-the-money, at-the-money, out-of-the-money

These terms show how an option’s strike price relates to Bitcoin’s current market price. They help assess an option’s value:

In-the-Money (ITM) options have immediate exercise value [8]. Call options become ITM when Bitcoin’s current price is higher than the strike price [2]. Bitcoin trading at $100,500 means a call option with a $90,000 strike price is ITM [1]. Put options are ITM when Bitcoin’s price drops below the strike price [2].

At-the-Money (ATM) options have strike prices matching Bitcoin’s current market price [8]. Bitcoin trading at exactly $100,500 means both call and put options with $100,500 strike prices are ATM [1]. These options usually have little intrinsic value but might still have time value [1].

Out-of-the-Money (OTM) options lack immediate exercise value [8]. Call options become OTM when Bitcoin’s price falls below the strike price. Put options are OTM when Bitcoin’s price rises above the strike price [2]. Bitcoin trading at $100,500 means a call option with a $105,000 strike price is OTM. This option would expire worthless unless Bitcoin’s price climbs above $105,000 before expiration [1].

Bitcoin option price vs. underlying asset

A bitcoin option’s price (premium) is different from Bitcoin’s price. Here are the main factors that affect option pricing:

Intrinsic Value: This shows the actual value if exercised right now. Bitcoin trading at $50,000 with a call option at $45,000 strike price means the intrinsic value is $5,000 ($50,000 – $45,000) [5].

Time Value: Options with longer expiration periods cost more than similar options expiring sooner [5]. The option’s value drops through time decay as expiration approaches [9].

Implied Volatility: This shows what the market expects about future Bitcoin price movements. Higher option demand usually pushes prices up through higher implied volatility [5].

Interest Rates: These affect option pricing, though less than other factors [10].

Option prices come as bid and ask prices. Sellers get the bid price, while buyers pay the ask price [5]. An option with a $7.90 bid and $8.00 ask means sellers could get $790 per contract while buyers would pay $800 [5].

Different futures expirations can trade at different prices. December Bitcoin futures might trade at $7,900 while January futures sit at $8,100. December options follow December futures prices, and January options follow January futures [11].

How to Trade Bitcoin Options Step-by-Step

Image Source: ICO Bench

How to Trade Bitcoin Options

Want to start trading bitcoin options? Here are six key steps to place your first trade with confidence.

1. Choose a trading platform

Pick a trusted exchange that offers bitcoin options trading. Deribit leads the pack (holding 85% of BTC options market share), followed by Binance and OKX [3]. US traders face regulatory limits, making CME Group one of the few CFTC-approved choices [12].

Here’s what to look for in a platform:

Trading fees and liquidity

Available contract types

Security reputation

User interface design

Most experienced traders prefer Deribit because it focuses on derivatives and has reliable infrastructure. Beginners often start with Binance since it has a more user-friendly interface [13].

2. Complete KYC and fund your account

Next, create an account and finish the Know Your Customer (KYC) verification. This required step on centralized exchanges needs:

Full name

Date of birth

Residential address

Government-issued photo ID [14]

Some exchanges need extra documentation from high-risk customers [14]. Once verified, you can add funds using fiat currency or cryptocurrency based on your exchange’s supported methods [12].

3. Select call or put option

The type of bitcoin option you choose should match your market outlook:

Call option: Buy this if you think Bitcoin’s price will go up. You get the right to buy Bitcoin at the strike price before expiration. This can be profitable if prices rise above your strike price.

Put option: Buy this if you expect Bitcoin’s price to drop. You get the right to sell Bitcoin at the strike price. This can be profitable if prices fall below your strike price.

New traders should stick to basic single-leg options before trying complex strategies [12]. Many platforms offer demo accounts for practice trading [15].

4. Set strike price and expiration

Then pick your strike price and expiration date. Exchanges usually offer:

Daily, weekly, bi-weekly, and monthly expiration intervals

Strike prices at different levels around Bitcoin’s current price [3]

Short-term traders can use weekly options that expire on Mondays, Wednesdays, and Fridays [4]. Your strike price choice depends on risk tolerance. Strikes far from the current price cost less but have lower profit chances.

Options lose value as expiration gets closer. This affects out-of-the-money options the most [6].

5. Place your order and monitor it

After setting your parameters, place your order. You can trade Bitcoin options:

On electronic platforms like CME’s Globex (runs 23 hours daily from Sunday to Friday) [16]

Through block trades (available 24/7) [16]

Keep a close eye on market conditions that could affect your position. Crypto markets never close, so you need to watch your positions more carefully than traditional markets [17].

6. Settle or exit the trade

Finally, you have two main ways to lock in profits or cut losses:

Trading out: Most traders (about 60%) close positions early by selling the option back to the market instead of exercising it.

Exercise at expiration: If you hold until expiration, options settle automatically based on their value. In-the-money options usually convert to futures positions or cash depending on the contract terms [4].

European-style options (common on most platforms) only exercise at expiration. American-style options let you exercise anytime before expiration [4]. The “fixing price” in the final trading window determines if your option expires in-the-money or worthless [4].

Popular Bitcoin Options Strategies

Image Source: Option Alpha

Bitcoin options create strategic possibilities beyond simple buy and sell decisions. Professional traders use proven strategies to maximize opportunities in different market conditions. Let’s explore these strategies.

Covered calls and protective puts

Covered calls mix Bitcoin ownership with selling call options on that same asset to generate income from premium payments [1]. Bitcoin owners who expect sideways movement or moderate price increases can sell covered calls to collect premium income. This caps the upside potential at the strike price [8].

Protective puts (also called married puts) act as insurance policies for Bitcoin holdings. Buying put options while holding Bitcoin creates a price floor that limits losses if prices drop sharply [2]. The strategy needs a small upfront premium payment but protects against major downturns.

Vertical spreads and straddles

Vertical spreads happen when traders buy and sell options of the same type with different strike prices. A bull call spread works well for bullish outlooks. Traders buy a call option at a lower strike price and sell another at a higher strike price [1]. This costs less than buying calls outright but caps potential profits.

Bear put spreads make money from price drops by buying puts at higher strike prices and selling them at lower ones [1].

Straddles help during volatile periods when the price direction seems unclear. Traders who buy both call and put options at the same strike price and expiration date profit from big price swings either way [18]. Strangles work like straddles but use different strike prices. They cost less but need larger price movements to become profitable [19].

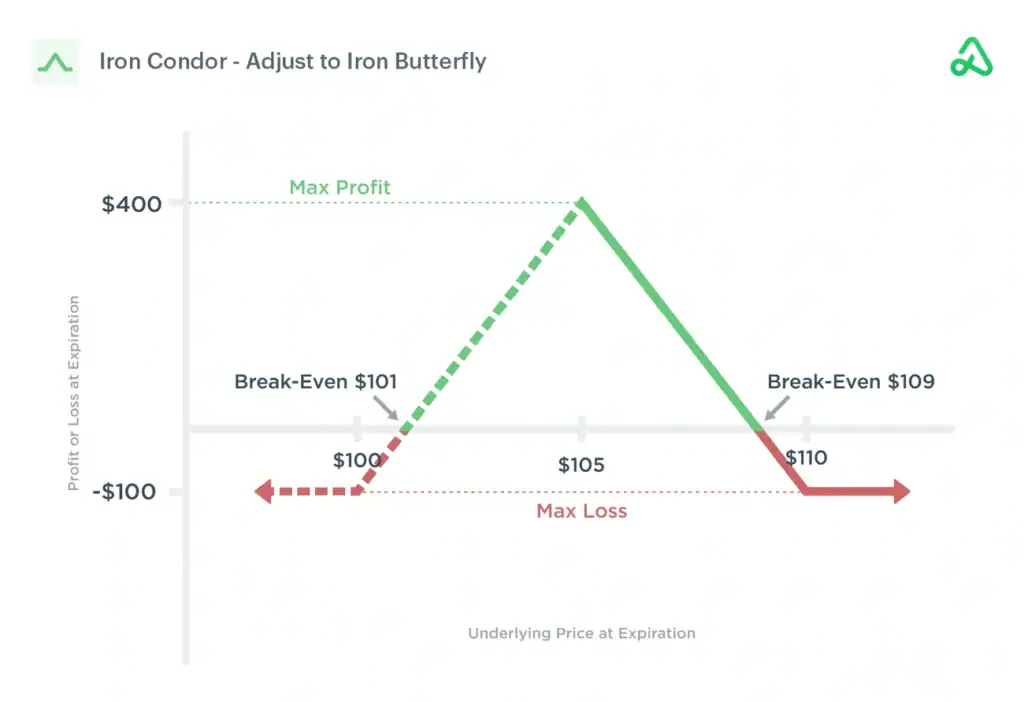

Iron condor and butterfly spread

Iron condors use four different options contracts to profit when Bitcoin stays within a specific price range [1]. Traders sell both a call and put option while buying a call at a higher strike price and a put at a lower strike price [20]. This creates a defined risk profile where potential losses and gains stay limited.

Butterfly spreads also profit from price stability but use three strike prices. A long butterfly spread combines buying two call options and selling two call options with different strikes [1]. This position makes the most money when Bitcoin’s price stays near the middle strike price at expiration.

These advanced strategies need close monitoring but give traders precise tools to handle Bitcoin’s unique volatility.

Where to Trade Bitcoin Options

Image Source: BitDegree

The right venue for Bitcoin options trading can make or break your success in this specialized market. Let’s look at the best platforms you can use to execute the strategies we discussed earlier.

Traditional stock brokers

Open a Brokerage Account: Select a traditional broker that supports crypto-related options trading, such as Interactive Brokers, Charles Schwab, Fidelity, or Robinhood. You may need to request specific trading permissions for options or crypto derivatives.

- Interactive Brokers: Offers Bitcoin futures options on the CME and spot crypto trading through partnerships with Paxos and Zero Hash. Fees are low (0.12–0.18% of trade value, $1.75 minimum per order).

- Charles Schwab: Provides access to Bitcoin ETF options and crypto-linked products with no transaction fees for ETFs and competitive options pricing.

- Fidelity: Supports Bitcoin ETF options and direct crypto trading (Bitcoin, Ethereum) through Fidelity Digital Assets, integrated with traditional accounts.

- Robinhood: Offers commission-free trading for Bitcoin ETF options and direct crypto trading, though with a spread markup (1% per transaction).

- TradeStation: Supports options on Bitcoin futures from CME and Bakkt, suitable for advanced traders.

Key Considerations:

- Liquidity and Volatility: Bitcoin options markets, especially for ETFs, are less liquid than traditional stock options, leading to higher premiums and potential price slippage due to Bitcoin’s volatility.

- Regulation and Risk: Unlike stocks, crypto investments lack Securities Investor Protection Corp (SIPC) insurance, increasing risk in case of broker or exchange failure. Options trading carries high risk, with potential loss limited to the premium paid but amplified by leverage.

- Tax Implications: Profits from BTC options may be taxed as capital gains or ordinary income, depending on your jurisdiction (e.g., US, UK, Canada treat as capital gains; Germany, Australia may treat as income if trading is frequent).

Centralized exchanges (e.g., Binance, Deribit)

Deribit leads the Bitcoin options market with an impressive 85% share of BTC and ETH options [21]. Their daily trading volumes are a big deal as it means that they exceed $1 billion [3]. The platform lets traders work with European-style options that settle in BTC and ETH.

Binance gives newcomers an easier way to start trading with options available on six cryptocurrencies: BTC, ETH, BNB, XRP, DOGE, and SOL [7]. Traders pay 0.03% for trades and 0.015% when they exercise options [22].

OKX provides European-style BTC and ETH options through their “Simple Options” interface that works great for beginners [7]. Their fees work on tiers from 0.015% to 0.02% for makers and 0.03% for takers [22].

US traders have fewer choices because of strict regulations. The Chicago Mercantile Exchange (CME) stands as one of the few platforms that has CFTC approval for American traders [12].

Decentralized platforms (e.g., Opyn, Hegic)

Smart contracts power decentralized options platforms without any central custody. Opyn works as a DeFi options protocol where users can buy, sell, and create options on ERC-20 tokens [23].

Hegic runs an on-chain peer-to-pool options trading protocol on Arbitrum [23]. Their liquidity pool model pays premiums to people who provide liquidity.

Premia uses the NFT contract standard ERC-1155 [24], while Stryke offers both European and American-style options with quick expiration times between 1-24 hours [7].

What to look for in a trading platform

Security should top your list when picking a platform. Good exchanges use cold storage, two-factor authentication, and have proven they can stop hacks [9].

Liquidity helps you trade efficiently. Platforms that handle more volume usually give you better spreads and less slippage [13].

Your profits depend on fees, so compare trading, exercise, and liquidation costs between platforms [9].

Check if the platform works in your country since many don’t allow traders from certain places, especially the United States [12].

The platform’s interface should match your skill level. Newer traders might like simpler setups like OKX’s “Simple Options,” while experienced traders often prefer advanced tools such as Deribit’s “Option Wizard” [7].

Risks and Rewards of Bitcoin Options Trading

Image Source: Master The Crypto

Bitcoin option trades balance chances and risks. This equilibrium helps traders make smart decisions in a high-stakes market.

Benefits: leverage, hedging, flexibility

Bitcoin options come with three important advantages. Traders can utilize leverage to control larger positions with minimal capital. This can increase profits beyond what’s possible with direct Bitcoin purchases [25]. To cite an instance, options contracts need much less money upfront compared to buying the same amount of Bitcoin [26].

Bitcoin options’ hedging capabilities make them particularly attractive. Bitcoin owners can use protective puts as insurance against market downturns [27]. This strategy creates a price floor that limits losses when prices drop [28].

The flexibility these options provide is just as valuable. Bitcoin options work with various market outlooks and strategies – bullish, bearish, or neutral [29]. This adaptability helps generate returns whatever the market direction [29].

Risks: volatility, premium loss, platform issues

Bitcoin options come with big risks. Bitcoin’s wild price swings create chances for profit but also mean bigger possible losses [10]. Even when Bitcoin prices move favorably, bullish options can lose value due to time decay and implied volatility changes [27].

Premium loss poses a major threat. Options lose value as they near expiration and can become worthless if prices don’t move as expected [5]. About 30% of contracts end up with no value [30].

Platform risks add more danger. Bitcoin options exchanges often run with little regulation compared to traditional markets. This exposes traders to manipulation and fraud [5]. Hacks, frozen withdrawals, or exchange failures can wipe out assets completely [31].

Tips to manage risk as a beginner

Here’s how to manage risk well:

Practice with a demo account before using real money [9]

Follow the 1-2% rule – never risk more than 1-2% of your portfolio on one trade [32]

Use stop-loss orders to cut losses automatically [32]

Pick trusted exchanges with proven security and cold storage [9]

Stay away from high leverage until you’re experienced [32]

Conclusion

Bitcoin options trading is a powerful way for both new and experienced cryptocurrency investors to participate in the market. This piece explores the fundamentals of options contracts, key terminology, and the steps needed to start your trading experience.

Understanding the difference between call and put options are the foundations of any successful trading strategy. Call options help us profit from price increases, while put options protect investments during market downturns. Traders can generate returns whatever the market direction.

On top of that, it shows how versatile Bitcoin options can be through various trading strategies – from simple calls and puts to complex structures like iron condors and butterfly spreads. Each strategy works best in specific market conditions and risk tolerances, giving traders tools for almost any scenario.

The right platform selection is a vital part of your trading experience. Centralized exchanges like Deribit and Binance lead the market with high liquidity, while decentralized platforms give you more privacy and self-custody benefits. Your choice should align with your specific needs and jurisdiction constraints.

Note that Bitcoin options come with significant risks despite their benefits. Premium loss, extreme volatility, and platform issues deserve careful consideration. New traders should start small, use demo accounts, and follow position sizing rules strictly.

Bitcoin options might seem complex initially, but they offer unique opportunities for hedging, speculation, and income generation that direct Bitcoin ownership can’t provide. Using these options means controlling larger positions with less capital, potentially increasing returns beyond traditional investment methods.

The Bitcoin options market grows more available and mature over time. The knowledge from this piece prepares you better to explore this fascinating aspect of cryptocurrency trading while managing risks responsibly.

Key Takeaways

Bitcoin options trading offers powerful tools for cryptocurrency investors to hedge risk, leverage positions, and profit from market movements without owning the underlying asset directly.

• Start with the basics: Call options profit from price increases, put options from decreases – master these fundamentals before attempting complex strategies like iron condors or butterfly spreads.

• Choose reputable platforms carefully: Deribit dominates with 85% market share, while Binance offers beginner-friendly interfaces – prioritize security, liquidity, and regulatory compliance.

• Manage risk aggressively: Never risk more than 1-2% of your portfolio per trade, use stop-losses, and practice with demo accounts before trading real capital.

• Understand the cost structure: Options lose value through time decay, with 30% expiring worthless – factor in premiums, fees, and volatility when calculating potential profits.

• Leverage requires discipline: While options control larger positions with less capital, Bitcoin’s extreme volatility can amplify both gains and losses exponentially.

Bitcoin options provide unique opportunities for hedging existing positions, generating income through premium collection, and accessing cryptocurrency markets with defined risk parameters that traditional spot trading cannot match.

FAQs

Q1. What are the main advantages of trading Bitcoin options? Bitcoin options offer leverage, allowing traders to control larger positions with less capital. They also provide hedging capabilities to protect existing investments and offer flexibility to profit in various market conditions.

Q2. How do call and put options differ in Bitcoin trading? Call options give the right to buy Bitcoin at a set price, profiting from price increases. Put options provide the right to sell at a set price, benefiting from price decreases. Both have different risk-reward profiles and uses in trading strategies.

Q3. What should beginners look for when choosing a Bitcoin options trading platform? Beginners should prioritize platforms with strong security measures, high liquidity, competitive fees, and user-friendly interfaces. Popular centralized exchanges like Deribit and Binance are good starting points for most new traders.

Q4. What are some common risks associated with Bitcoin options trading? Key risks include potential premium loss if options expire worthless, amplified losses due to Bitcoin’s high volatility, and platform-related issues like hacks or withdrawal freezes. Proper risk management is crucial for options traders.

Q5. How can new traders manage risk when starting with Bitcoin options? New traders should start with demo accounts, limit position sizes to 1-2% of their portfolio, use stop-loss orders, and avoid excessive leverage. It’s also important to thoroughly understand each strategy before implementing it with real funds.

References

[1] – https://www.delta.exchange/blog/advanced-crypto-options-trading-strategies-for-seasoned-investors

[2] – https://www.bitstamp.net/learn/crypto-trading/understanding-crypto-options-strategies/

[3] – https://www.datawallet.com/crypto/best-crypto-options-exchanges

[4] – https://www.cmegroup.com/education/courses/micro-bitcoin-basics/managing-expiration-and-exercise-for-micro-cryptocurrency-options.html

[5] – https://bitcoin.tax/blog/bitcoin-options-trading-explained/

[6] – https://medium.com/@giannisandreoua/bitcoin-options-expiry-explained-what-traders-need-to-know-b55cf1771fd6

[7] – https://nftevening.com/best-crypto-options-trading-platforms/

[8] – https://osl.com/academy/article/what-are-bitcoin-options-how-to-own-the-worlds-no-1-crypto-for-less

[9] – https://www.investopedia.com/how-to-buy-and-sell-bitcoin-options-7378233

[10] – https://www.fidelity.ca/en/insights/articles/managing-risk-in-crypto-investments/

[11] – https://www.cmegroup.com/education/courses/introduction-to-bitcoin/get-to-know-options-on-bitcoin-futures.html

[12] – https://www.cointracker.io/blog/crypto-options

[13] – https://www.optionstrading.org/blog/crypto-options-trading-and-trends/

[14] – https://www.veriff.com/kyc/guides/what-is-kyc-in-crypto

[15] – https://wundertrading.com/journal/en/learn/article/crypto-options

[16] – https://www.cmegroup.com/articles/faqs/frequently-asked-questions-options-on-cryptocurrency-futures.html

[17] – https://koinly.io/blog/bitcoin-crypto-options-trading/

[18] – https://www.nasdaq.com/articles/trading-vertical-options-versus-trading-straddles-and-strangles

[19] – https://www.coinmetro.com/learning-lab/crypto-options-trading—strategies-and-platforms

[20] – https://insights.deribit.com/education/multi-leg-options-positions-part-3-butterflies-and-condors/

[21] – https://www.deribit.com/

[22] – https://koinly.io/blog/best-crypto-options-trading-platforms/

[23] – https://www.alchemy.com/dapps/best/decentralized-options

[24] – https://collectiveshift.io/defi/dex/decentralized-options-platform-overview/

[25] – https://tokentax.co/blog/bitcoin-crypto-options-trading

[26] – https://www.cftc.gov/sites/default/files/2019-12/customeradvisory_urvct121517.pdf

[27] – https://www.schwab.com/learn/story/trading-options-on-spot-bitcoin-etfs

[28] – https://osl.com/academy/article/how-to-hedge-with-crypto-options-to-maximize-gains-during-btc-uncertainty

[29] – https://tiomarkets.com/en/article/bitcoin-options

[30] – https://cointelegraph.com/learn/articles/how-bitcoin-options-expiry-influences-market-volatility

[31] – https://changelly.com/blog/risk-management-in-crypto-trading/

[32] – https://www.kucoin.com/learn/trading/mastering-risk-management-in-crypto-trading