Want to supercharge your portfolio with the best leveraged ETF? The results tell an amazing story. Two Palantir-linked funds have rocketed up 262% through mid-August 2025, showing the incredible potential these investment vehicles pack .

The broader market has done well too. The S&P 500 has jumped 2.9% and the Dow Jones has climbed 3.7% . Yet these top leveraged ETFs have generated returns that make traditional investments look modest. Outstanding performance shows up in sectors of all types – from cutting-edge tech to gold mining. Gold prices have shot up 27% to hit record highs, but leveraged ETFs that focus on miners have left the metal’s performance in the dust .

Table of Contents

My analysis covers eight top-performing leveraged ETFs you should watch in 2026. The deep dive includes everything from semiconductor powerhouses like Direxion Daily Semiconductor Bull 3x Shares (SOXL) to energy players such as Direxion Daily S&P Oil & Gas Exploration & Production Bull 2X Shares (GUSH) . This complete breakdown will help you understand these high-powered investment options, whether you seek long-term growth or spot short-term opportunities.

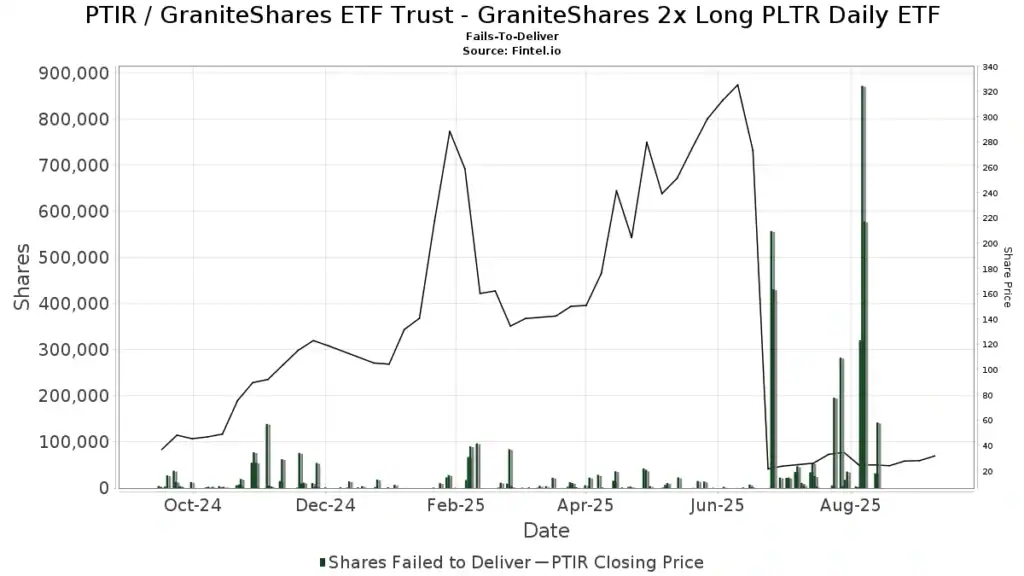

GraniteShares 2x Long PLTR Daily ETF (PTIR)

Image Source: Fintel

The GraniteShares 2x Long PLTR Daily ETF has become one of the financial world’s biggest success stories in 2025. This specialized investment vehicle gives investors a chance to profit from one of tech’s hottest stocks through a leveraged approach.

PTIR sector focus and strategy

We focused on information technology equity, as PTIR gives twice the daily leverage exposure to Palantir Technologies Inc. stock, minus fees and expenses [1]. GraniteShares launched this ETF in September 2024 with a focused strategy instead of spreading investments across multiple companies [1].

The fund’s mechanism works in a straightforward yet sophisticated way. PTIR employs swaps, options, and sometimes direct PLTR holdings to reach its exposure targets [2]. It also rebalances daily to keep that vital 2× exposure level. This actively managed ETF wants to mirror twice the daily percentage change of Palantir’s stock [3].

PTIR’s unique feature is its single-stock focus. Unlike other funds that spread risk, PTIR’s gains and losses depend solely on Palantir’s performance [2]. This creates both risks and rewards based on your investment timeline and risk tolerance.

PTIR 2025 performance highlights

The numbers tell an amazing story. PTIR has delivered a staggering 1,183.39% total return in the last year with dividends [1]. The average annual return since its launch has reached an even more impressive 1,467.67% [1].

PTIR has generated year-to-date gains of about 110% in 2025, making it one of the two best U.S.-listed ETFs this year [4]. The fund now manages assets worth $700-750 million [2], showing strong investor interest despite its specialized nature.

Palantir’s stock has done well with a 71% gain, but PTIR has outperformed it with returns around 110% — about 1.5 times the stock’s performance instead of the exact 2× multiple [4]. This shows how leveraged ETFs held beyond single trading days can create unique compounding effects.

Why PTIR is among the best leveraged ETFs

PTIR stands out among leveraged ETFs for several reasons:

Exposure to high-growth tech: PTIR gives amplified exposure to Palantir, a company at the crossroads of AI and defense [5].

Liquidity and trading volume: The fund sees significant trading volume, giving most investors enough liquidity [2].

Strategic fit for specific needs: PTIR works well for various investment strategies, from short-term tactics to boosting existing tech exposure. Investors who believe strongly in Palantir’s growth find it especially valuable [2].

But PTIR needs careful consideration. The daily reset creates compounding effects that might make long-term returns differ from the expected 2× multiple [4]. The fund also costs more to run, with net annual operating costs of 1.15% after fee waivers [2].

PTIR shows how specialized leveraged ETFs can bring exceptional returns when paired with strong-performing assets. Smart timing and risk management remain key to success with any leveraged instrument.

MicroSectors Gold Miners 3X Leveraged ETN (GDXU)

Image Source: Composer.trade

Gold’s run in 2025 has been impressive, but one fund stands head and shoulders above the rest. The MicroSectors Gold Miners 3X Leveraged ETN (GDXU) shines as a star performer with returns that leave other investments in the dust.

GDXU sector focus and strategy

GDXU differs from standard ETFs that hold physical assets. This exchange-traded note (ETN) is a debt instrument from Bank of Montreal [6]. The structure opens up possibilities but also brings risks, as investors face both issuer credit risk and market exposure [6].

The fund tracks the S-Network MicroSectors Gold Miners Index, which blends two major gold mining ETFs [6]:

VanEck Gold Miners ETF (GDX): Large-cap miners with focused holdings

VanEck Junior Gold Miners ETF (GDXJ): Smaller-cap mining companies

This approach gives investors wide exposure to gold miners of all sizes, from industry giants to up-and-coming producers [6]. The fund’s 3x leverage resets each day, which triples the daily moves of its underlying index [6].

GDXU’s expense ratio sits at 0.95%, making it a budget-friendly option for triple-leveraged gold mining exposure compared to similar funds [6]. The fund now trades at USD 190.50 after jumping 6.37% in a recent trading session [7].

GDXU 2025 performance highlights

GDXU’s results in 2025 have blown past expectations. The fund has shot up about 470% this year [7], ranking it among the best ETFs across every category [7]. Other sources point to a 163% gain year-to-date [8].

These stellar returns have caught investors’ attention. Assets under management jumped from USD 230 million to USD 628 million since January [8]. Latest figures show further growth to USD 1.52 billion [7], which proves investors keep pouring money into the fund.

Price swings are part of GDXU’s DNA. To cite an instance, April saw the fund drop 27% on April 4, then bounce back 26% just five days later [8]. The fund’s 52-week range stretches from USD 25.83 to USD 195.81 [7].

GDXU has left standard gold mining funds in its wake. The VanEck Gold Miners ETF (GDX) and Sprott Gold Miners ETF (SGDM) each gained about 105% year-to-date [7]. These returns look modest next to GDXU’s performance.

Why GDXU is a top leveraged ETF for gold

GDXU stands out among the best leveraged ETFs for gold exposure for several reasons:

The fund covers the entire mining sector by including both major miners and junior explorers through its index makeup [6]. This gives broader exposure than funds that focus on just one segment.

The 3x leverage amplifies returns during gold rallies, which Federal Reserve rate cuts, central bank gold buying, and safe-haven demand during global tensions have fueled [7].

Investors should know about some key limits. Daily rebalancing and compounding effects make GDXU best suited as a short-term trading tool [9]. Despite this year’s amazing gains, the fund still shows a 70% loss over five years [8]. This shows how hard it can be to hold leveraged positions long-term.

GDXU has earned its reputation as the rocket fuel of gold investments [7]. In a year where precious metals outshine most assets, this triple-leveraged ETN leads the pack for traders who want maximum exposure to gold mining stocks.

Direxion Daily Semiconductor Bull 3x Shares (SOXL)

Image Source: MiFsee

Semiconductor-focused funds have become the life-blood for investors who want amplified exposure to technology growth in the competitive world of leveraged ETFs. The Direxion Daily Semiconductor Bull 3x Shares (SOXL) leads this space and gives investors a powerful way to ride the semiconductor industry’s momentum.

SOXL sector focus and strategy

SOXL wants to deliver 300% of the daily performance of the NYSE Semiconductor Index [10]. This index uses a rules-based, modified float-adjusted market capitalization-weighted methodology to track the 30 largest U.S. listed semiconductor companies [2]. The fund gives investors focused exposure to industry leaders who drive state-of-the-art chip technology.

SOXL’s assets total USD 12.10 billion [11], making it one of the largest leveraged ETFs in the market. The fund’s expense ratio sits at 0.75% [12], while the gross expense ratio is 0.89% before fee waivers [1]. These waivers will stay in place through September 1, 2026, which helps investors plan their costs [1].

SOXL stands out from regular semiconductor investments because of its triple leverage mechanism. The fund uses sophisticated financial instruments to multiply both gains and losses by three each day. A 5% rise in the underlying index would result in a 15% gain in SOXL that same day [10]. Daily rebalancing is needed for this structure, which creates unique situations for investors beyond single-day periods.

SOXL 2025 performance highlights

SOXL showed impressive growth throughout 2025, with a year-to-date increase of 24.57% [2]. This builds on earlier momentum, though the fund dropped 14.2% over the last 12 months [2].

The ETF managed to keep substantial trading activity, averaging about 60.9 million shares daily [11]. This strong liquidity makes it easy to buy and sell SOXL, which works well for different trading strategies.

Price swings define this fund’s character. SOXL’s price moved between USD 7.23 and USD 41.19 [11] in 2025, showing how much leveraged instruments can fluctuate. The fund’s beta of 4.43 [11] shows this higher volatility compared to broader market measures.

SOXL pays quarterly distributions for investors who want income. The last ex-dividend date was September 23, 2025 [11]. The twelve-month dividend yield is 0.65% [11], which shows the fund focuses more on growing capital than generating income.

Why SOXL is the best leveraged ETF for tech

SOXL has become the top choice for tactical tech growth exposure because:

AI innovation catalyst: The semiconductor sector has taken off due to artificial intelligence adoption and data center needs. SOXL is ready to capture this momentum [10]. The underlying index companies build the foundation of AI infrastructure.

Tactical flexibility: SOXL works best as a tactical tool to capture short-term semiconductor momentum, not for passive buy-and-hold strategies [10]. Investors can multiply their tech sector conviction without picking individual stocks.

Broad industry exposure: SOXL gives detailed access to the entire semiconductor ecosystem instead of betting on single chip makers [10]. The underlying index includes the “cream of the semiconductor industry” [10], spreading risk across this specialized sector.

AI-related investments continue to create perfect conditions for SOXL. BlackRock noted, “As we have gained more clarity on tariffs, and more importantly, more confidence in the economy’s resilience, investors have rotated back into longer-term secular themes, notably artificial intelligence (AI), software, semiconductors and power generation” [13].

In a nutshell, SOXL gives investors a powerful way to get concentrated, leveraged exposure to semiconductor growth. The fund works best for short-term tactical moves, but investors should watch out for its volatility and how daily rebalancing affects longer holding periods.

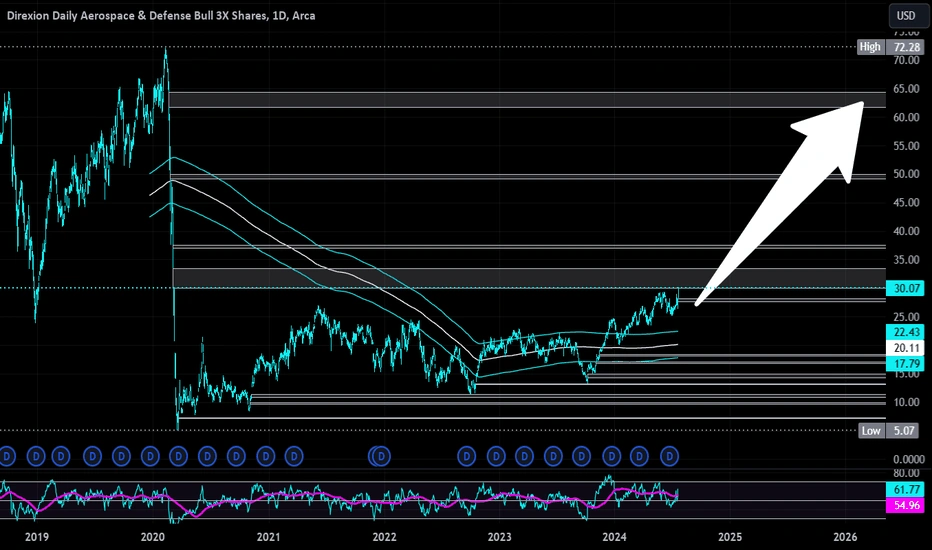

Direxion Daily Aerospace & Defense Bull 3X (DFEN)

Image Source: TradingView

Rising global tensions have pushed defense spending higher, making aerospace and defense stocks a prime target for tactical investors. The Direxion Daily Aerospace & Defense Bull 3X Shares (DFEN) gives traders a powerful way to magnify their exposure to this vital sector.

DFEN sector focus and strategy

DFEN’s goal is to deliver triple the daily performance of the Dow Jones U.S. Select Aerospace & Defense Index (DJSASDT) before fees and expenses [4]. The index tracks U.S. equity market companies in the aerospace and defense industry, which are selected by their float-adjusted, market capitalization weight [4].

The fund puts at least 80% of its assets into financial instruments that give leveraged exposure to the index and ETFs that track it [5]. It uses a complex strategy with swaps, futures, and other derivatives to keep its leverage ratio steady.

The underlying index covers manufacturers, assemblers, and distributors of aircraft and aircraft parts in aerospace. It also includes companies that make defense industry components like military aircraft, radar equipment, and weapons [4]. GE Aerospace, RTX Corporation (formerly Raytheon Technologies), and Boeing made up about 40% of the fund’s allocation as of May 2025 [14].

DFEN launched on May 3, 2017 [4], with a competitive expense ratio of 0.95% [4] compared to other leveraged sector ETFs. The fund’s beta of 2.84 [3] shows how much more volatile it is than broader market indices.

DFEN 2025 performance highlights

DFEN has shown impressive results in 2025, with gains reaching 102.34% by late September [15]. The fund built this momentum through varied monthly returns: +23.0% in January, -4.6% in February, -4.8% in March, -0.2% in April, +42.1% in May, +19.3% in June, +11.8% in July, +1.5% in August, and +11.2% in September [16].

The fund now manages $343.58 million in assets [3], growing significantly from previous periods. Trading at $65.39, DFEN posted a 3.86% daily gain [3]. The fund’s price moved between $17.64 and $66.90 throughout 2025 [3], showing the typical price swings of leveraged instruments.

Income-seeking investors can benefit from DFEN’s quarterly distributions. The fund’s trailing twelve-month dividend stands at $3.80 [3], yielding about 5.81% [3]. The latest ex-dividend date was September 23, 2025 [3].

The fund’s liquidity remains strong with 222,263 shares traded daily [3]. This volume helps traders enter and exit positions efficiently.

Why DFEN is a strong leveraged ETF for defense

DFEN stands out as one of the best leveraged ETFs for three main reasons:

The fund gives focused exposure to a sector that benefits from rising global defense spending. Defense budgets are growing worldwide, especially in Europe, and DFEN lets traders tap into this growth [14]. While the S&P Aerospace & Defense index rose 17% in 2025 [14], DFEN’s 3x leverage turned this into much higher returns.

It also gives investors broad industry access through 53 holdings [3], which removes single-company risk while keeping focused sector exposure. Investors can access the entire aerospace and defense ecosystem instead of picking individual defense contractors.

DFEN performs better than regular aerospace ETFs like XAR (SPDR S&P Aerospace & Defense ETF), ITA (iShares U.S. Aerospace & Defense ETF), and PPA (Invesco Aerospace & Defense ETF) in bull markets [17]. When these standard ETFs gained 1.89%, 1.28%, and 1.21% in a recent session [17], DFEN’s leverage structure made these gains much larger.

Traders should know that DFEN rebalances daily to keep its target leverage ratio, which makes it better suited for short-term trading than long-term investing [16]. The fund’s prospectus makes this clear: “The fund should not be expected to provide three times the return of the benchmark’s cumulative return for periods greater than a day” [4].

Direxion Daily Crypto Industry Bull 2X Shares (LMBO)

Image Source: Direxion

Crypto equities have grown into a major market segment, with the asset class now worth nearly $3 trillion [9]. The Direxion Daily Crypto Industry Bull 2X Shares (LMBO) gives investors an innovative way to get amplified exposure to this fast-evolving sector.

LMBO sector focus and strategy

Unlike direct cryptocurrency investments, LMBO aims for daily investment results of 200% of the Solactive Distributed Ledger & Decentralized Payment Tech Index performance [18]. This index tracks US-listed securities that operate in distributed ledger or decentralized payment technology fields [19].

The fund started on July 17, 2024 [20] and invests at least 80% of its net assets in financial instruments that provide leveraged exposure to its underlying index [19]. LMBO’s diverse portfolio includes these top holdings:

Crypto Bull & Bear ETF Swap (19.00%)

Goldman Financial Square Treasury (12.78%)

Robinhood Markets (6.66%)

MercadoLibre (5.84%)

NVIDIA (5.74%) [21]

LMBO’s portfolio leans heavily toward financial services (46.78%) and technology (18.44%), while consumer cyclical stocks make up 9.41% [19]. US companies represent 61.90% of holdings, with Latin America accounting for 9.27% [19].

LMBO 2025 performance highlights

LMBO has shown impressive results through 2025, gaining 46.11% year-to-date [22]. The fund’s one-year return of 59.69% [22] shows strong momentum.

During 2025, LMBO’s price moved within this range:

52-week low: $10.41 (April 7, 2025)

52-week high: $37.27 (September 23, 2025) [22]

By September 2025, LMBO managed total net assets of $6.47 million [19] and traded about 10,000 shares daily [22]. While capital appreciation remains its focus, the fund offers a small dividend yield of 0.35% [22].

Why LMBO is a high-growth leveraged ETF

LMBO stands out among the best leveraged ETFs for good reasons. Edward Egilinsky, Direxion’s managing director, calls its holdings “among the fastest-growing companies in the world” [9].

The fund’s balanced approach sets it apart. Rather than direct cryptocurrency exposure, LMBO invests in companies that build blockchain infrastructure, decentralized finance solutions, and digital asset mining hardware [9]. This strategy might reduce volatility compared to direct crypto holdings.

LMBO also maintains competitive costs. Rafferty Asset Management has agreed to cap expenses through September 2026, keeping the net expense ratio at 1.00% [20].

In spite of that, like all leveraged products, LMBO needs careful consideration. Industry analyst Kirsten Chang points out that these products “are timely but often risky and not well-suited for a buy-and-hold audience” [9]. The fund targets knowledgeable investors who make tactical short-term moves based on their crypto industry conviction.

Direxion Daily S&P Oil & Gas Bull 2X Shares (GUSH)

Image Source: LinkedIn

Energy markets offer lucrative opportunities for tactical traders who seek amplified returns. The Direxion Daily S&P Oil & Gas Bull 2X Shares (GUSH) is an effective way to capture these movements through a leveraged approach.

GUSH sector focus and strategy

GUSH delivers twice (200%) the daily performance of the S&P Oil & Gas Exploration & Production Select Industry Index, before fees and expenses [8]. This index covers domestic companies from the oil and gas exploration and production sub-industry [7].

The fund takes a strategic approach and invests at least 80% of its assets in financial instruments that provide leveraged exposure to the index [8]. Its holdings combine energy companies and swaps, with top positions in Murphy Oil Corp (1.86%), Valero Energy Corp (1.86%), and Marathon Petroleum Corp (1.82%) [23].

GUSH has an expense ratio of 0.93%, making it competitive among leveraged sector ETFs [24]. The fund launched on May 28, 2015, and its leverage factor changed from 3x to 2x on April 1, 2020 [8].

GUSH 2025 performance highlights

GUSH has shown a volatile but generally upward trend throughout 2025. The fund trades at $26.53, showing a 1.57% daily gain [24]. Its 52-week range moves from $14.70 to $35.87, which shows the substantial price swings common in leveraged instruments [24].

GUSH manages about $257.20 million in total net assets as of September 2025 [24]. The fund maintains reliable liquidity with an average daily trading volume of 965,430 shares [24], sometimes reaching 1.2 million shares [6].

Traders focused on income can benefit from GUSH’s quarterly distributions with a 2.40% dividend yield [24]. Year-to-date distributions add up to $0.31, following $0.82 distributed throughout 2024 [24].

Why GUSH is a top leveraged energy ETF

GUSH stands out among the best leveraged ETFs because it offers focused exposure to a vital economic sector. The oil and gas exploration industry is a significant component of energy markets, making GUSH attractive for traders who want concentrated exposure.

The fund serves as an effective tactical tool to capitalize on short-term energy price movements. GUSH becomes especially appealing for optimistic market participants due to policy incentives, OPEC production decisions, and deepwater expansion [7].

GUSH’s 2x leverage creates a balanced approach between amplification and risk management. This moderate leverage might reduce some volatility compared to 3x alternatives while still offering significant upside potential during bullish periods in the energy sector.

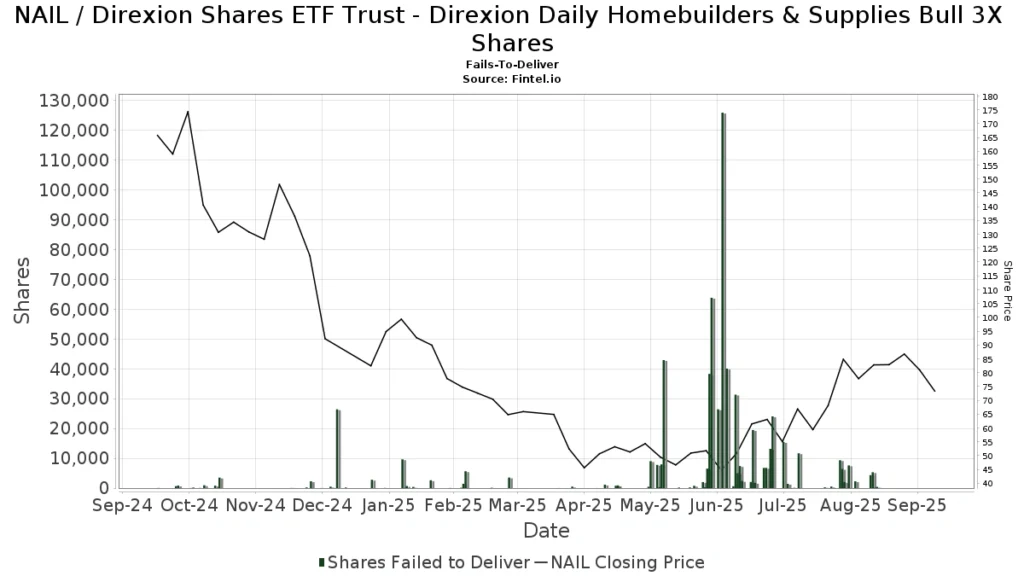

Direxion Daily Homebuilders & Supplies Bull 3X Shares (NAIL)

Image Source: Fintel

Direxion Daily Homebuilders & Supplies Bull 3X Shares (NAIL) gives investors a powerful way to profit from short-term momentum in residential construction while they track the housing market.

NAIL sector focus and strategy

The fund wants to deliver daily investment results of 300% of the Dow Jones U.S. Select Home Construction Index performance [25]. This index covers companies in the residential construction ecosystem, from homebuilders to material producers, fixture suppliers, and home improvement retailers [25].

Swaps, futures, and derivative instruments help the fund maintain its triple leverage [26]. The portfolio has substantial cash positions (30.36%) with index swaps (19.38%) and industry leaders like D.R. Horton (10.55%), Lennar (6.42%), and PulteGroup (5.87%) [27]. NAIL launched in August 2015 and carries an expense ratio of 0.95% [10].

NAIL 2025 performance highlights

NAIL expressed extreme volatility in 2025, with monthly returns swinging from +41.9% in August to -23.1% in February [10]. The fund has underperformed broader markets, showing a one-year decline of -54.10% [10] compared to the S&P 500’s +16.9% gain [26].

The fund has shown mixed results – outperforming in the three-month period (+42.0%) yet struggling in the past two weeks (-17.3%) [26]. The fund trades at $72.83 with a support level of $66.90 and resistance at $73.58 as of September 2025 [26].

Why NAIL is a leveraged ETF to watch

NAIL showed substantial reactivity to monetary policy changes as the Federal Reserve made interest rate decisions [28]. Homebuilder ETFs surged dramatically after recent rate cuts [28].

Tactical traders can get amplified exposure without short-selling requirements through NAIL’s concentrated access to this cyclical industry [10]. In spite of that, like all leveraged funds, NAIL needs disciplined risk management since it’s designed primarily for single-day holding periods [25].

Direxion Daily MSCI Mexico Bull 3X Shares (MEXX)

Image Source: PortfoliosLab

Image Source: PortfoliosLab

Mexico has become a hot investment destination as companies move their operations closer to home. The Direxion Daily MSCI Mexico Bull 3X Shares (MEXX) gives investors a powerful way to tap into this growing economy through advanced leverage tools.

MEXX sector focus and strategy

The fund wants to deliver triple the daily returns of the MSCI Mexico IMI 25/50 Index [29]. This standard covers about 99% of Mexico’s free float-adjusted market cap across large, mid, and small companies [2]. MEXX puts money into financial instruments like swaps and index securities, plus ETFs that follow the index [30]. The fund’s net expense ratio sits at 1.24% after fee waivers [29].

MEXX 2025 performance highlights

MEXX has posted amazing returns in 2025. The fund’s YTD gains reached 92.18% [2], with some sources reporting gains as high as 149.23% [31]. MEXX hit its 52-week peak at $23.09 on September 23, 2025, climbing from $8.44 in April [31]. The three-month returns were strong at 57.85% [2]. The fund’s NAV reached $21.74 with a market price of $21.69 on September 25, 2025 [29].

Why MEXX is a top international leveraged ETF

U.S. companies moving their supply chains to Mexico have given MEXX a big boost, and Mexican consumer spending keeps growing [32]. On top of that, investors can ride these economic trends without dealing with derivatives directly [32]. Whatever the market does in the short term, MEXX remains the quickest way for tactical traders to bet on Mexico’s growing economy.

Comparison Table

ETF (Ticker) | Leverage Factor | Expense Ratio | AUM | YTD Performance (2025) | Underlying Index/Focus | Notable Features |

PTIR | 2x | 1.15% | $700-750M | 110% | Palantir Technologies Stock | Single-stock leveraged ETF; Daily rebalancing |

GDXU | 3x | 0.95% | $1.52B | 163-470%* | S-Network MicroSectors Gold Miners Index | Combines exposure to both large and junior gold miners |

SOXL | 3x | 0.75% | $12.10B | 24.57% | NYSE Semiconductor Index | Tracks 30 largest U.S. semiconductor companies |

DFEN | 3x | 0.95% | $343.58M | 102.34% | Dow Jones U.S. Select Aerospace & Defense Index | Focused on defense and aerospace manufacturers |

LMBO | 2x | 1.00% | $6.47M | 46.11% | Solactive Distributed Ledger & Decentralized Payment Tech Index | Focuses on crypto-related equities |

GUSH | 2x | 0.93% | $257.20M | Not mentioned | S&P Oil & Gas Exploration & Production Select Industry Index | Reduced from 3x to 2x leverage in 2020 |

NAIL | 3x | 0.95% | Not mentioned | -54.10%** | Dow Jones U.S. Select Home Construction Index | Covers homebuilders and construction supplies |

MEXX | 3x | 1.24% | Not mentioned | 92.18-149.23% | MSCI Mexico IMI 25/50 Index | Focuses on Mexican market exposure |

*Various sources report different YTD returns **Performance shown for one year instead of YTD

Conclusion

Leveraged ETFs are powerful tools that help investors get amplified exposure to high-growth sectors. This piece looks at eight exceptional funds with remarkable returns in a variety of market segments. PTIR shows this potential with its staggering 1,183% annual return linked to Palantir’s performance. GDXU has made the most of gold’s stellar run by delivering gains that outpace the precious metal itself.

These funds give tactical advantages for short-term strategies and provide concentrated exposure without complex direct derivatives trading. SOXL offers triple leverage to semiconductor state-of-the-art advances. DFEN captures momentum from rising global defense spending. New entrants like LMBO bring fresh approaches to emerging sectors like blockchain and decentralized finance.

These investment vehicles need careful thought. Daily rebalancing creates compounding effects that often make long-term returns differ from expected multiples. NAIL proves this with its extreme volatility despite the homebuilding sector’s potential. Most leveraged ETFs work best as short-term tactical moves rather than buy-and-hold investments.

The range of top performers tells an interesting story. GUSH offers amplified exposure to energy markets while MEXX captures Mexico’s economic growth. Each fund brings unique opportunities that match specific market beliefs. The returns are substantial – many funds have delivered triple-digit gains while broader markets showed single-digit increases.

These powerful instruments can enhance your portfolio, but their basic purpose remains clear. Leveraged ETFs work as precision tools to express short-term market views or tactical moves based on strong market outlooks. Your investment timeline, risk comfort level, and sector expertise should guide your choices about these high-powered options.

A good grasp of both rewards and risks will help you decide if these leveraged ETFs fit your investment strategy for 2026 and beyond.

Key Takeaways

Leveraged ETFs can deliver extraordinary returns when aligned with strong-performing sectors, with some funds posting gains exceeding 1,000% in 2025.

• PTIR and GDXU lead performance: Palantir-focused PTIR delivered 1,183% returns while gold miners ETF GDXU surged 470% year-to-date • Sector diversification matters: Top performers span tech (SOXL), defense (DFEN), energy (GUSH), and international markets (MEXX) • Daily rebalancing creates complexity: These funds work best for short-term tactical trades, not buy-and-hold strategies • Risk management is essential: Extreme volatility requires disciplined approach – NAIL shows -54% returns despite sector potential • Leverage amplifies both gains and losses: 2x-3x multipliers can generate massive returns but demand careful timing and risk tolerance

These high-powered investment vehicles offer tactical opportunities for experienced investors seeking amplified exposure to specific market convictions, but require thorough understanding of their mechanics and limitations.

FAQs

Q1. What are the top-performing leveraged ETFs in 2025? Based on recent performance, some of the best-performing leveraged ETFs include PTIR (focused on Palantir stock) with over 1000% returns, GDXU (gold miners) with 470% year-to-date gains, and MEXX (Mexico) with up to 149% returns. However, performance can vary greatly and past results don’t guarantee future returns.

Q2. Are leveraged ETFs suitable for long-term investing? Leveraged ETFs are generally not recommended for long-term buy-and-hold strategies. Due to daily rebalancing and compounding effects, their long-term performance often deviates from the expected multiple of their underlying index. They are best suited for short-term tactical trades by experienced investors.

Q3. What sectors do the top leveraged ETFs cover? The best-performing leveraged ETFs in 2025 cover a diverse range of sectors, including technology (SOXL for semiconductors), defense (DFEN), energy (GUSH for oil & gas), homebuilding (NAIL), and international markets (MEXX for Mexico). This diversity allows investors to target specific high-growth areas.

Q4. What are the risks associated with leveraged ETFs? Leveraged ETFs come with significant risks, including amplified losses, high volatility, and potential deviation from expected returns over longer periods. For example, NAIL showed a 54% decline despite potential in the homebuilding sector. These products require careful risk management and are not suitable for all investors.

Q5. How do leveraged ETFs achieve their multiplied returns? Leveraged ETFs use financial instruments such as swaps, futures, and derivatives to achieve their multiplied daily returns. For instance, a 3x leveraged ETF like SOXL aims to deliver 300% of its underlying index’s daily performance. This is achieved through a combination of direct investments and derivative contracts that are rebalanced daily.

References

[1] – https://www.direxion.com/product/daily-semiconductor-bull-bear-3x-etfs

[2] – https://www.direxion.com/uploads/MEXX-Fact-Sheet.pdf

[3] – https://stockanalysis.com/etf/dfen/

[4] – https://www.direxion.com/product/daily-aerospace-defense-bull-3x-etf

[5] – https://www.marketwatch.com/investing/fund/dfen

[6] – https://www.nasdaq.com/articles/dig-oil-with-these-leveraged-energy-etfs

[7] – https://www.direxion.com/xchange/oil-be-back-gush-and-drip-take-production-stocks-for-a-spin

[8] – https://www.direxion.com/product/daily-sp-oil-gas-exp-prod-bull-bear-2x-etfs

[9] – https://etfdb.com/leveraged-inverse-channel/direxion-new-bull-bear-etfs-turn-crypto/

[10] – https://www.sumgrowth.com/etf-profile/invest-in-NAIL-etf.html

[11] – https://stockanalysis.com/etf/soxl/

[12] – https://www.bankrate.com/investing/best-leveraged-etfs/

[13] – https://etfdb.com/leveraged-inverse-channel/stay-aboard-tech-trade-bold-etfs/

[14] – https://www.etftrends.com/leveraged-inverse-channel/increased-defense-spending-boon-leveraged-etf/

[15] – https://etfdb.com/etfs/industry/aerospace–defense/

[16] – https://www.sumgrowth.com/etf-profile/invest-in-DFEN-etf.html

[17] – https://finance.yahoo.com/quote/DFEN/performance/

[18] – https://www.etftrends.com/leveraged-inverse-channel/crypto-bulls-lmbo-rekt/

[19] – https://markets.ft.com/data/etfs/tearsheet/summary?s=LMBO:PCQ:USD

[20] – https://www.direxion.com/product/daily-crypto-industry-bull-2x-and-bear-1x-etfs

[21] – https://www.morningstar.com/etfs/arcx/lmbo/quote

[22] – https://www.cnbc.com/quotes/LMBO

[23] – https://www.morningstar.com/etfs/arcx/gush/quote

[24] – https://www.marketwatch.com/investing/fund/gush

[25] – https://www.direxion.com/xchange/nailing-homebuilders-caught-in-a-fixer-upper-market

[26] – https://marketchameleon.com/Overview/NAIL/Summary/

[27] – https://www.morningstar.com/etfs/arcx/nail/quote

[28] – https://www.marketwatch.com/investing/fund/nail

[29] – https://www.direxion.com/product/daily-msci-mexico-bull-3x-etf

[30] – https://www.etftrends.com/leveraged-inverse-channel/as-mexicos-economy-grows-get-leveraged-exposure-with-this-etf/

[31] – https://www.cnbc.com/quotes/MEXX

[32] – https://www.etf.com/sections/data-dive/best-leveraged-etfs-2025-gdxu-ubrl-mexx