Want to find the best crypto staking opportunities? You’re not alone. I found that Ethereum gives you a modest 2.87% APY , while other tokens can get you much better returns – Cosmos offers an impressive 21.16% and Polkadot comes in at 12.04% .

The world of crypto staking keeps growing, and platforms like Binance now let you stake more than 22 different cryptocurrencies . You can get anything from Solana’s solid 6.77% APY to Cardano’s steady 2.44% . These choices can make your head spin whether you’re new to investing or have been around the block. The highest returns aren’t always about chasing wild numbers – some smaller tokens claim they can give you anywhere from 65% to an eye-popping 936% . Just remember these come with much bigger risks.

Table of Contents

Let me break down the top staking coins that actually work, compare the best rates on major platforms, and show you how to pick options that match your investment style. This detailed look at the most profitable staking coins will help you make smart choices, whether you want steady returns or are ready to take calculated risks for bigger yields.

Ethereum (ETH)

Image Source: Hex Trust

Image Source: Hex Trust

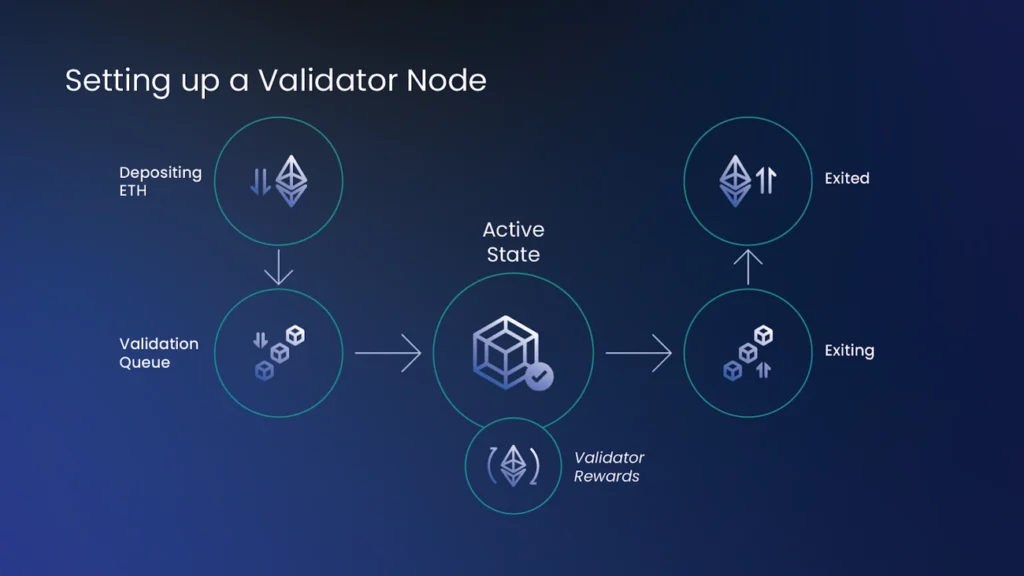

Ethereum leads the way in staking among major cryptocurrencies since its complete transition from proof-of-work to proof-of-stake. The backbone of DeFi, NFTs, and Web3, ETH has grown into a 3-year old staking option that fundamentally differs from other altcoins.

Ethereum key features

Over 1 million active validators secure the Ethereum blockchain [1]. These validators stake more than 34 million ETH (valued above $100 billion), which represents nearly 30% of the total ETH supply [1]. The network runs with remarkable efficiency and maintains a 99.2% validator uptime [1]. It uses minimal energy compared to mining systems.

On top of that, it strengthens the entire ecosystem because attacks become prohibitively expensive. Any attacker would need to acquire and stake over $100 billion worth of ETH to compromise the network [2].

Ethereum staking rewards

The staking rewards have evolved since the original transition to PoS:

Simple staking yield: 1.87% APY [1] Validators with MEV-Boost: 5.69% APY [1] Typical market yields: 4-6% [1] National average yield: 3.8% [1]

The reward rate has found stability between 3.5% and 4.0% since late 2023 [1], after dropping from early post-Merge highs of 5.3% [1]. Rewards flow from two sources: consensus rewards issued by the protocol (about 2.9%) and execution-layer rewards including transaction fees and MEV [2].

Ethereum inflation & real yield

Ethereum keeps a low 0.7% net inflation rate [3], which makes its real yield more attractive than competitors like Solana with 4.5% inflation [3]. Ethereum researchers have suggested reducing ETH issuance from 1.5% to 0.4% [4]. This change could make ETH scarcer as time passes.

The yield follows an inverse square root curve – rewards per validator decrease gradually as more ETH gets staked. This maintains economic balance [3].

Ethereum best for

Ethereum staking suits:

Long-term investors who want reliable yields from the second-largest cryptocurrency

Institutional investors (who control 9.2% of total ETH supply [1])

DeFi enthusiasts building on Ethereum’s $223 billion TVL ecosystem [1]

People with technical knowledge and 32 ETH to run a validator node

Environmentally-conscious investors (PoS uses minimal energy)

Investors looking for an inflation hedge with deflationary tokenomics

Experts project Ethereum could reach $7,000-$10,000 before 2026 [1][1]. This makes current staking rates potentially more valuable against future appreciation.

Cardano (ADA)

Image Source: Cardano Forum – Cardano.org

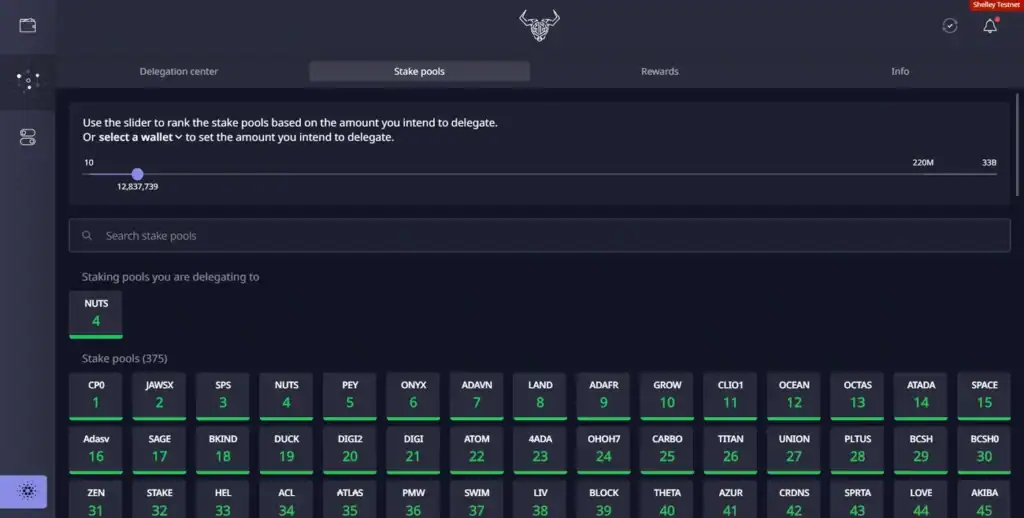

Cardano stands out with its academically-researched Ouroboros protocol that makes staking simple and reliable for investors who want passive income. The network’s strength shows in the numbers – 60% of all circulating ADA is staked [5], which proves users trust this Proof-of-Stake system.

Cardano key features

The platform uses a delegated Proof-of-Stake system that balances security and ease of use. Time splits into five-day epochs [6], and stake pools get selected randomly based on their delegated stake. Cardano needs only 4 ADA minimum to stake [1] and has zero bonding or unbonding periods [1]. Users can access their funds whenever they want.

The system protects delegators from slashing risk [1], unlike other networks that punish validators for downtime or mistakes. These features appeal to careful investors who want both earnings and quick access to their funds.

Cardano staking rewards

The platform’s staking rewards have decreased as planned, dropping from 5% APY to about 3.5% APY now [7]. Numbers suggest rewards could reach 3% or less by 2026 [7]. This aligns with the network’s long-term token strategy.

Each five-day epoch brings new rewards [6], though new delegators wait 3-4 epochs for their first earnings [1]. Rewards compound automatically [1], which helps maximize earnings without extra work.

Cardano inflation & real yield

The network has roughly 7% annual inflation [1], which exceeds Ethereum’s 0.7%. This creates a real staking yield of about 0.7% [8] – the actual increase in buying power.

Cardano’s design releases 0.3% of ADA reserves as rewards each epoch [8]. The inflation rate will naturally decrease as reserves drop and supply approaches 45 billion ADA [8]. This could boost real yields later.

Cardano best for

Cardano staking fits perfectly for:

Newcomers who want simple crypto staking without technical hassles

People who need quick access to their funds without waiting

Careful investors who avoid penalties and lockups

Patient holders who appreciate steady returns backed by academic research

Users who value security, given zero staking exploits so far

Supporters of Cardano’s ecosystem projects in DeFi, identity solutions, and supply chain management [9]

Cardano might offer lower yields than other staking coins, but its mix of simplicity, security, and solid technology makes it a great choice for diverse staking portfolios.

Solana (SOL)

Image Source: Solana

Solana stands out as one of the fastest-growing staking networks. It combines lightning-fast transaction speeds with high rewards for validators and delegators. The blockchain has captured investor interest with 67.7% of total SOL supply actively staked [10], as users seek the perfect balance between security and returns.

Solana key features

The network uses a hybrid consensus mechanism that combines Proof-of-Stake with Proof-of-History (PoH) [4]. This innovative approach helps process transactions efficiently with sub-second finality [11] and fees under $0.01 [4]. Staked SOL doesn’t need lockups but goes through activation and cooldown periods of 2-3 days per epoch [3]. This flexibility gives Solana an edge over many competitors.

The security model spreads stake across many validators. This makes fraud extremely difficult because attackers need large amounts of SOL to influence consensus votes [4]. The network doesn’t have automatic slashing penalties yet, though plans exist to add them [3].

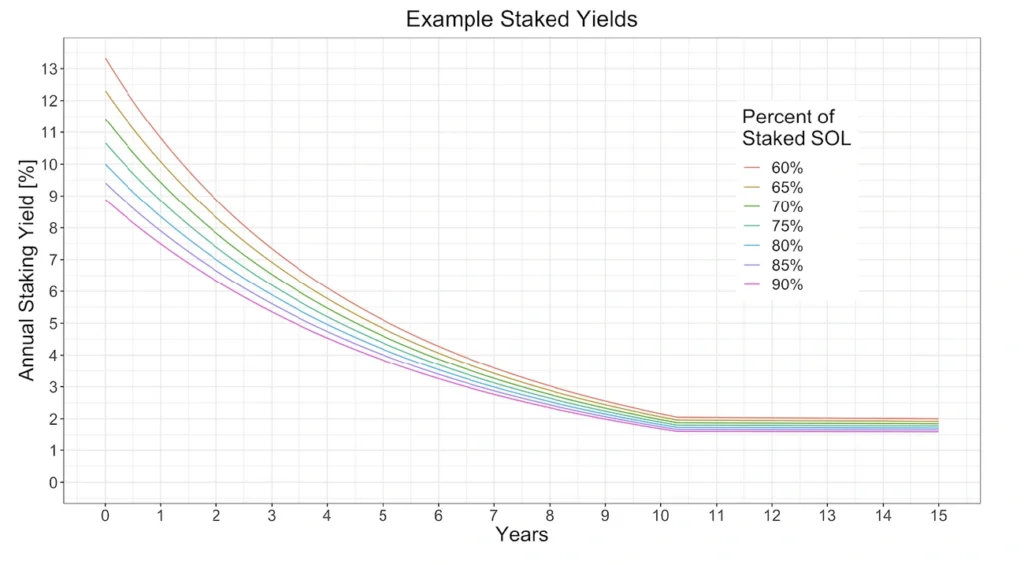

Solana staking rewards

Staking on Solana yields about 6.80% APY [12], which beats both Ethereum and Cardano [comparison to previous sections]. Users receive rewards every 2 days at the end of each epoch [4]. These rewards compound automatically, so your stake grows without manual reinvestment [4].

MEV rewards (Maximal Extractable Value) have become crucial lately. They make up 20-30% of total rewards in recent periods [10]. This boost has pushed staker earnings well beyond basic inflation rewards.

Solana inflation & real yield

The network started with an initial inflation rate of 8% that drops by 15% annually until reaching a fixed rate of 1.5% [4]. The current inflation rate is roughly 4.9% [10], which means real yield sits at about 1.9% after inflation.

The network has a built-in balance mechanism. It burns 50% of all transaction fees [13], which helps control supply growth as network activity increases.

Solana best for

Solana staking works best for:

Investors who want higher yields than other major networks

Users who need fast transactions and low fees for active trading

People who prefer short activation/deactivation periods over longer lockups

Investors ready to spread staking across multiple validators to minimize risk

DeFi users who want to use liquid staking derivatives in other applications [4]

Those who believe in Solana’s growing ecosystem, especially in DeFi, RWAs, and stablecoin adoption [11]

Polkadot (DOT)

Image Source: Polkadot

Polkadot stands out in the crypto staking space with its innovative Nominated Proof-of-Stake (NPoS) system that builds a reliable bond between validators and nominators. The network shows strong holder confidence, with 48-58% of total DOT supply staked actively [14].

Polkadot key features

Polkadot works as a multi-chain network that connects different blockchains smoothly [2]. The platform’s architecture lets it talk securely with networks like Bitcoin and Ethereum through its Substrate framework [2]. The network’s shared security model ranks among its most valuable features. Every connected blockchain gets protection from the network’s collective defense against attacks [2].

Stakers can join with just 1 DOT [14], and nomination pools give small holders the easiest way to start. Direct nominators need at least 250 DOT [15], and the system shares rewards among the top 22,500 nominators [15].

Polkadot staking rewards

Polkadot’s staking rewards now sit at 8.56% APY [16] – among the highest returns you’ll find in major cryptocurrencies. Past data shows even better numbers, averaging around 16.8% yearly [14], though rates shift based on network conditions.

The network gives equal rewards to validators whatever their stake size [7]. This fair system stops large holders from taking control. Validator activity earns era points that drive the reward system [7]. Validators take their commission first, then share rewards with all nominators based on their stake [7].

Polkadot inflation & real yield

The network cut its inflation rate from 10% to 8% yearly [17] to boost token value. With this change and several burn mechanisms in place, inflation should drop to about 5% by 2026 [17]. Coretime sales, treasury burning, and gas fee burning might even make the network deflationary [17].

Staking rewards get 85% of yearly inflation [7]. This gives stakers solid returns even after inflation, creating real yields around 3-4%.

Polkadot best for

Polkadot staking works great for:

Investors who want better returns than older PoS networks

People who like to control their assets while helping network security

Users who can handle the 28-day unbonding period [15]

Investors drawn to blockchain connection technology

Those wanting trustless, decentralized staking [14]

Users who like to pick multiple validators (up to 16) [15]

The mix of good returns, cutting-edge tech, and focus on decentralization makes Polkadot one of today’s most attractive staking options in the digital world.

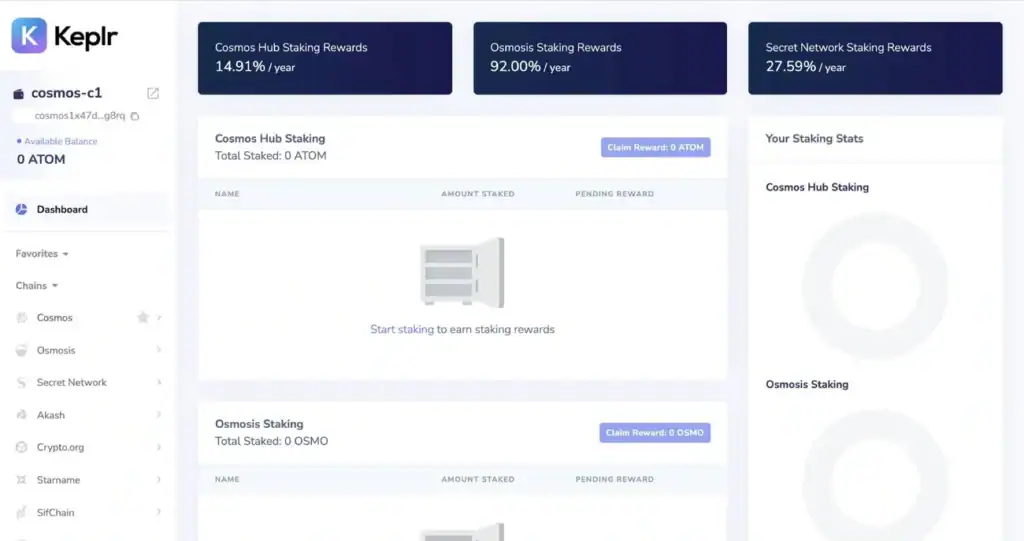

Cosmos (ATOM)

Image Source: Chorus One

Cosmos stands out as the “Internet of blockchains” among blockchain networks focused on interoperability. The network lets different blockchains communicate and work together naturally. The network shows strong user trust with 70.69% of total ATOM supply currently staked [18].

Cosmos key features

The Cosmos ecosystem puts cross-chain functionality at its core. Users can move their assets between independent blockchains. A groundbreaking feature in development will let users use staked ATOM for gas fees across every Cosmos chain [6]. This removes the need to move tokens between networks. Cosmos welcomes investors of all sizes since it has no minimum staking requirement [19].

Users get their staking rewards in real-time, approximately every 7 seconds [19]. This creates a steady stream of income instead of periodic payments. This sets Cosmos apart from other networks that have longer reward intervals or unbonding periods.

Cosmos staking rewards

Cosmos provides some of the highest staking rewards of major cryptocurrencies. The base rate starts at 9.7% APY [19] and can go up to 20% depending on the validator and platform [19]. Users can stake through various platforms:

These rewards stay separate from your original stake [19]. Users need to manually re-stake them to maximize their returns.

Cosmos inflation & real yield

Cosmos has a specific way of handling inflation and staking rewards. The network has a 7.5% inflation rate [18] that changes based on staked tokens. The inflation rate slowly drops toward a 7% minimum [18] when more than 67% of ATOM stays staked.

The real staking yield comes from dividing the inflation rate by the staking ratio. Current numbers show approximately 10.61% real rewards [18]. Block times affect actual earnings. Blocks take ~7.12 seconds instead of the ideal 6.50 seconds, which means stakers get about 8.58% effective rewards [18].

Cosmos best for

Cosmos staking suits:

Investors who want higher yields than traditional PoS networks

People interested in technology that connects different blockchains

Users who prefer instant rewards over periodic ones

Investors who can choose validators wisely for better rewards and security

Those starting with small investments due to no minimum requirements

DeFi users who want to use liquid staking derivatives in the ecosystem

Avalanche (AVAX)

Image Source: Coinlocally Blog

Avalanche stands out with its quick transactions and smart architecture. The network provides excellent staking chances through its design that balances speed with security. The platform has gained strong investor confidence with 39.24% of eligible tokens currently staked (approximately 165.7M AVAX worth $5.00B) [1].

Avalanche key features

A revolutionary tri-chain architecture forms the foundation of Avalanche by spreading network functions across specialized blockchains [8]. The Platform Chain (P-Chain) manages staking operations, while the Contract Chain (C-Chain) handles smart contracts with Ethereum compatibility. The Exchange Chain (X-Chain) takes care of asset transfers [8]. This setup delivers great performance with almost instant transaction completion.

Avalanche gives users plenty of choices. Stakers can pick commitment periods from 2 weeks to 1 year [21], and longer commitments lead to better rewards. The platform needs just 1 AVAX minimum to start staking [9], which makes it available to investors with smaller budgets.

Avalanche staking rewards

Avalanche now offers a current reward rate of 4.47% [1], calculated as yearly yield based on 365 days of holding. The rate has stayed steady with a tiny drop from 4.50% over the past month [1].

Some platforms offer up to 7.60% APY based on where and how long you stake [22]. The platform has no slashing mechanism [21], so staked tokens won’t face penalties from validator performance issues. Poor validator performance can still result in missed rewards.

Avalanche inflation & real yield

Governance can adjust Avalanche’s inflation rate [21]. The platform burns transaction fees instead of giving them as rewards [21], which helps control inflation. While some sources once showed inflation rates up to 23.4% [23], official documents point to much lower rates moving toward balance.

Avalanche best for

Avalanche staking works best for:

Investors who want decent yields without much risk (no slashing)

People who like flexible staking periods (2 weeks to 1 year)

Developers using Ethereum-compatible infrastructure

Investors who can wait up to 4 weeks to unstake [9]

Users who need a fast blockchain with adjustable staking options

DeFi users interested in liquid staking derivatives [9]

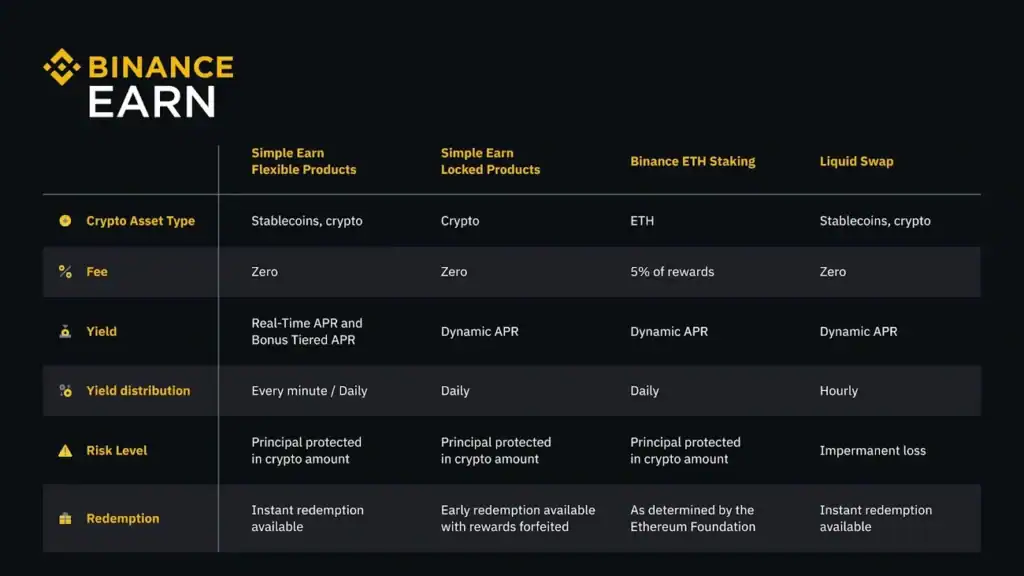

BNB (Binance Coin)

Image Source: Binance

BNB, the native token of the world’s largest cryptocurrency exchange, gives users some great staking benefits that blend exchange utility with blockchain rewards. Investors have shown strong interest in the token, with 26.3 million BNB staked in the ecosystem [5].

BNB key features

The token runs on a Proof of Staked Authority (PoSA) consensus model that helps secure the network and generates rewards. The network has 45 active validators out of a possible 52 [5]. Cold wallets store assets safely before they go to nodes that third-party staking service providers run [24].

BNB staking lets users choose from several options, from validator staking to easy exchange-based solutions. Many competitors require long lockup periods, but BNB stands out by offering instant unstaking options with a fee through some providers [25].

BNB staking rewards

Users can earn between 5.19% and 9.53% APY from BNB staking, depending on their chosen platform [25][12]. These rates change often – just 30 days ago, rewards reached 13.56% [12].

The staked BNB makes up 18.81% of the total supply, worth about $30 billion [12]. Platforms like Binance.US take a service fee of 25% to 35% from the rewards they generate [24].

BNB inflation & real yield

BNB takes a different approach from other cryptocurrencies that use inflation to fund staking rewards. Regular quarterly burns remove coins from circulation permanently [26]. This burning helps keep tokens scarce over time and might offset any pressure from inflation.

Real yield calculations need to look at both regular staking rewards and BNB’s deflationary system. This combination helps keep the real yield competitive even as market conditions change.

BNB best for

BNB staking suits:

Binance platform users who save on trading fees

Investors who want more than just staking rewards, like Launchpad access, Binance Liquid Swap, and payment options [27]

People interested in liquid staking derivatives for DeFi protocols [27][25]

Investors who prefer centralized staking solutions

Users looking for different reward sources through BNB Vault [28]

Investors should keep an eye on Binance’s regulatory challenges, as these could change how BNB performs [28].

Tezos (XTZ)

Image Source: Staking Tezos

Tezos made waves in June 2024 by revolutionizing its staking mechanism. The rewards tripled, making it one of the most rewarding staking options available. This self-amending blockchain runs on a Liquid Proof of Stake (LPoS) consensus mechanism that splits participants between bakers (validators) and delegators.

Tezos key features

Tezos’s unique LPoS system lets users loan their validation rights without moving their tokens [4]. The platform goes beyond basic staking and gives delegators full control of their assets. Users can unstake whenever they want with no lockup periods [4].

The Paris upgrade in June 2024 brought two reward paths to Tezos: delegation (liquid funds) and staking (locked funds) [10]. The network needs bakers to keep at least 6,000 XTZ (about $4,000) [4]. Anyone can delegate without meeting any minimum requirements [4].

Tezos staking rewards

Tezos now rewards stakers with an impressive 16.5% APY [29]. This is a big deal as it means that it outperforms competitors like Ethereum (4-6%), Solana (5-7%), and Cardano (3-6%) [29].

New delegators should wait about five weeks to get their original rewards. After that, they receive distributions roughly every three days [30]. Staking rewards are triple the delegation rewards because staked funds face actual risk [10].

Tezos inflation & real yield

Tezos maintains an annual inflation rate of about 5.51% [31]. The system mints new coins each block and distributes 80 XTZ per block [31]. Tezos’s inflation stays relatively stable because staked coins get their fair share of newly minted tokens [32].

Tezos best for

Tezos staking works great for:

Investors who want higher yields than other major networks

People who value self-custody while earning rewards

Users who need flexibility without lockup periods

Investors who want to participate in blockchain governance

Those who understand the difference between delegation and staking

DeFi users looking for stable, reliable returns

Near Protocol (NEAR)

Image Source: Staking Rewards

NEAR Protocol stands out as a developer-friendly Layer 1 platform that combines accessibility with strong staking economics. This platform has become one of the best staking coins that focuses on scalability and user experience, making it increasingly competitive in the staking ecosystem.

Near Protocol key features

NEAR uses Nightshade sharding technology to process 3,000 transactions per second [13]. The platform makes development easier with JavaScript as its coding language [13] and supports interoperability through Aurora EVM and Rainbow bridge [13]. The protocol stands apart from competitors with its storage staking mechanism where contract owners stake tokens based on their data storage needs [33].

Near Protocol staking rewards

The protocol delivers a 9.56% estimated reward rate [34], ranking it among the highest crypto staking rewards available. The platform has 45.27% of eligible tokens (565.8M NEAR worth $1.60B) actively staked [34]. Stakers should note the unbonding period of 48 hours [13] when rewards stop accumulating.

Near Protocol inflation & real yield

The protocol started with a 5% annual inflation rate [3]. The community governance now aims to lower this to 2.5% [3]. These changes would bring staking yields down to about 4.5% [3] and create more sustainable economics through reduced token issuance.

Near Protocol best for

NEAR serves perfectly for:

Developers who want user-friendly blockchain architecture

Investors who can manage moderate unbonding periods

Users looking for lower gas fees with 70% of transaction fees burned [13]

Stakers seeking balanced yields without complex lockups

Algorand (ALGO)

Image Source: Reddit

Algorand changed the staking landscape by introducing its Pure Proof-of-Stake (PPoS) mechanism that removes common barriers in other networks. The platform launched its staking rewards program in early 2025, which marked the most important move from its previous governance-based system [11].

Algorand key features

Algorand’s staking approach stands apart because it completely avoids punitive slashing mechanisms [16]. The architecture emphasizes security through advanced cryptography instead of economic penalties [11]. Staked tokens remain available without lockup periods, which gives users complete flexibility [16]. The network runs smoothly on basic hardware: 16GB RAM, 8 vCPU, and fast SSD storage [11].

Validators must maintain a minimum balance of 30,000 ALGO to participate directly [11]. Users with smaller balances can join through these options:

Liquid staking applications that maintain token liquidity

Staking pools enabling group participation

Delegated staking with third-party validators [11]

Algorand staking rewards

Algorand rewards users between 2-7% annually [16]. These rewards are distributed immediately as each block finalizes every 2.8 seconds [11]. The reward structure combines 50% of transaction fees with a supplementary bonus. This bonus starts at 10 ALGO per block and decreases by 1% every millionth block [16].

Algorand inflation & real yield

Algorand’s inflation stays low at 1-2% annually [16]. This provides real yields between 0-5% after counting new token issuance. Algorand’s staking rewards differ from competitors because they don’t inflate or affect the total supply [35].

Algorand best for

Environmentally conscious investors who prioritize sustainability will find Algorand appealing as it runs as a carbon-neutral blockchain [16]. Users who value flexibility without lockups will appreciate the platform [35]. The network attracts institutions that need instant finality and strong security guarantees without risking capital through slashing penalties [11].

Polygon (MATIC)

Image Source: Polygon

Image Source: Polygon

Polygon delivers faster performance as an Ethereum Layer 2 scaling solution and keeps the security benefits of the Ethereum mainchain intact. The platform, previously called Matic Network, has grown into a detailed ecosystem that serves both developers and stakers.

Polygon key features

Validators who stake POL tokens as collateral secure Polygon’s variant of Proof-of-Stake consensus [7]. The network completes transactions in about 1 second with partial confirmations to improve user experience [7]. The architecture uses two layers: Heimdall handles validation while BOR manages block production, which creates a balanced security model [7]. Users can stake any amount through platforms like Coinbase or liquid staking [36].

Polygon staking rewards

POL staking rewards typically range between 4-7% APY [37], though rates vary by platform. Coinbase currently offers 1.93% [38], which dropped from 2.76% in the last thirty days. Validators earn rewards from staking and transaction fees [7]. They can also charge commission from their pool’s earnings [7].

Polygon inflation & real yield

Polygon set aside 12% of its total supply (1.2 billion tokens) to generate staking yields [39]. The network has annual inflation of 3-5% [16]. This results in ground yields between 2-4% after inflation adjustments [16].

Polygon best for

Polygon staking suits:

Ethereum supporters who want exposure to scaling solutions

Investors who prefer flexible staking without slashing risk [40]

DeFi participants who use liquid staking derivatives

Users who value low gas fees (about $0.01) [41]

Comparison Table

Cryptocurrency | Current Staking APY | Minimum Stake | Inflation Rate | Total Staked | Unbonding Period | Key Features/Benefits |

Ethereum (ETH) | 3.5-4.0% | 32 ETH | 0.7% | ~30% | Not mentioned | – 1M+ active validators |

Cardano (ADA) | ~3.5% | 4 ADA | 7% | ~60% | None | – No slashing risk |

Solana (SOL) | 6.80% | Not mentioned | 4.9% | 67.7% | 2-3 days | – Sub-second finality |

Polkadot (DOT) | 8.56% | 1 DOT (pools) | 8% | 48-58% | 28 days | – Equal rewards distribution |

Cosmos (ATOM) | 9.7-20% | None | 7.5% | 70.69% | Not mentioned | – Rewards every 7 seconds |

Avalanche (AVAX) | 4.47-7.60% | 1 AVAX | Not mentioned | 39.24% | Up to 4 weeks | – No slashing mechanism |

BNB | 5.19-9.53% | Not mentioned | Deflationary | 18.81% | Varies | – 45 active validators |

Tezos (XTZ) | 16.5% | None (delegation) | 5.51% | Not mentioned | None | – No lockup period |

Near (NEAR) | 9.56% | Not mentioned | 5% (reducing to 2.5%) | 45.27% | 48 hours | – 3,000 TPS |

Algorand (ALGO) | 2-7% | 30,000 ALGO (validators) | 1-2% | Not mentioned | None | – No slashing |

Polygon (MATIC) | 4-7% | None | 3-5% | Not mentioned | Not mentioned | – ~1 second finality |

Conclusion

Your investment goals and risk tolerance will determine the best crypto for staking. My research shows staking rewards vary across cryptocurrencies. Ethereum offers a modest 3.5-4% APY, while Tezos delivers 16.5% and Cosmos can reach 20% returns.

Higher rewards come with specific trade-offs. Tezos gives exceptional yields without lockup periods – perfect if you want flexibility and high returns. Ethereum may have lower yields, but it makes up for this with minimal inflation and its position as a market leader.

You need to prioritize security when making staking decisions. Cardano has zero slashing risk and no bonding periods. Networks like Polkadot need 28-day unbonding periods before you can access your funds. These differences show why your staking strategy should match your investment timeline.

There’s another reason to look at inflation rates. Ethereum’s low 0.7% inflation creates strong real yields despite modest nominal returns. Cardano’s 7% inflation cuts into its effective yield. The headline APY percentages don’t tell the whole story about staking rewards.

These platforms have different barriers to entry. Ethereum needs 32 ETH for direct validation. Cosmos and Cardano let you start with minimal or zero investment. This makes staking accessible to investors of all sizes.

The comparison table shows these key metrics clearly, though rates change with market conditions. Many platforms give you more than just staking rewards – from Ethereum’s DeFi ecosystem to BNB’s exchange benefits.

Beginners might like Cardano, Algorand, or Tezos. They’re user-friendly and don’t lock up your funds. Experienced investors chasing maximum yields could explore Cosmos or Polkadot if they understand the risks and requirements.

Start your staking experience with more than just return calculations. A full picture of network security, tokenomics, development roadmaps, and community governance helps build a diverse staking portfolio. This matches both your risk tolerance and long-term investment goals.

Key Takeaways

Discover the most profitable crypto staking opportunities in 2026, from conservative 3.5% yields to exceptional 20% returns across major blockchain networks.

• Tezos leads with 16.5% APY after its 2024 upgrade, offering the highest returns among major cryptocurrencies with no lockup periods required.

• Real yields matter more than headline rates – Ethereum’s 3.5% APY with 0.7% inflation beats Cardano’s 3.5% with 7% inflation significantly.

• Entry barriers vary dramatically – while Ethereum requires 32 ETH ($100k+), Cosmos and Cardano welcome stakers with zero minimum requirements.

• Security models differ substantially – Cardano offers zero slashing risk, while Polkadot requires 28-day unbonding periods for fund access.

• Diversification across multiple networks reduces risk while capturing different reward mechanisms, from Solana’s MEV rewards to BNB’s deflationary burns.

The staking landscape has matured beyond simple yield chasing. Smart investors now balance returns against inflation rates, lockup periods, and network security to build sustainable passive income streams. Whether you’re seeking Ethereum’s stability or Cosmos’s high yields, understanding these fundamentals ensures your staking strategy aligns with your investment timeline and risk tolerance.

FAQs

Q1. Which cryptocurrencies offer the highest staking rewards in 2026? Based on current trends, Tezos (XTZ) leads with up to 16.5% APY, followed by Cosmos (ATOM) with 9.7-20% APY. Other high-yielding options include Polkadot (DOT) at 8.56% and Solana (SOL) at 6.80% APY.

Q2. How do real yields differ from advertised staking rates? Real yields account for inflation, providing a more accurate picture of returns. For example, Ethereum’s 3.5-4% APY with 0.7% inflation offers better real returns than Cardano’s 3.5% APY with 7% inflation, despite similar advertised rates.

Q3. What are the minimum requirements for staking different cryptocurrencies? Requirements vary widely. Ethereum requires 32 ETH for direct staking, while Cardano and Cosmos have no minimum. Polkadot needs 250 DOT for direct nomination, but only 1 DOT for staking pools. Always check current requirements as they may change.

Q4. How do lockup periods affect staking strategies? Lockup periods impact liquidity and flexibility. Some networks like Cardano and Tezos have no lockup, while others like Polkadot have a 28-day unbonding period. Consider your investment timeline when choosing a staking option.

Q5. What security considerations should investors keep in mind when staking? Security models vary across networks. Some, like Cardano, have no slashing risk, while others may penalize validators for downtime or misconduct. Additionally, consider the network’s overall security, validator reputation, and any smart contract risks associated with staking platforms.

References

[1] – https://www.coinbase.com/earn/staking/avalanche

[2] – https://www.bitdegree.org/crypto/tutorials/polkadot-staking

[3] – https://gov.near.org/t/reduce-inflation-for-near-protocol/41140

[4] – https://www.ledger.com/academy/topics/defi/staking-tezos-how-to-stake-xtz

[5] – https://www.bnbchain.org/en/bnb-staking

[6] – https://forum.cosmos.network/t/chips-discussion-phase-use-staked-atom-for-gas-on-every-cosmos-chain/14608

[7] – https://polygon.technology/blog/matic-network-staking-economics-matic-network-blog

[8] – https://zebpay.com/blog/best-projects-built-on-avalanche-a-complete-guide

[9] – https://www.ankr.com/staking-crypto/avalanche-avax/

[10] – https://tezos.com/stake-tez/

[11] – https://algorand.co/staking-rewards

[12] – https://www.coinbase.com/earn/staking/bnb

[13] – https://figment.io/staking/protocols/near-protocol/

[14] – https://polkadot.com/get-started/staking/

[15] – https://99bitcoins.com/cryptocurrency/best-crypto-staking-coins/polkadot/

[16] – https://www.webopedia.com/crypto/investing/best-coins-to-stake/

[17] – https://medium.com/@polkadot_eri/how-can-polkadot-accelerate-growth-after-the-8-dot-inflation-adjustment-f43f6b17f3ee

[18] – https://figment.io/insights/cosmos-inflation-staking-rewards-how-are-they-related/

[19] – https://cryptomus.com/blog/how-to-stake-cosmos-atom?srsltid=AfmBOoqU6hsCADBHa9ihL9sloyPoVZjC2O0BewmElco3JhOXvhmkFcsG

[20] – https://www.ledger.com/staking/ledger-node/cosmos

[21] – https://docs.cdp.coinbase.com/staking/staking-delegation-guides/avalanche/avalanche-faq

[22] – https://99bitcoins.com/cryptocurrency/best-crypto-staking-coins/avalanche/

[23] – https://www.reddit.com/r/Avax/comments/tm73i7/why_avaxs_inflation_rate_is_greater_the_staking/

[24] – https://www.binance.us/staking

[25] – https://www.ankr.com/staking-crypto/binance-bnb/

[26] – https://bingx.com/en/learn/what-are-the-best-crypto-staking-coins-to-earn-passive-income

[27] – https://www.bnbchain.org/en/blog/bnb-token-use-cases-defi-cefi-and-payfi

[28] – https://coinledger.io/tools/best-crypto-for-staking

[29] – https://spotlight.tezos.com/tezos-leading-the-way-in-staking-innovation/

[30] – https://www.ledger.com/staking-tezos

[31] – https://medium.com/cryptium/did-they-pull-the-5-51-out-of-their-oven-understanding-inflation-in-the-tezos-protocol-13493829a533

[32] – https://www.gemini.com/cryptopedia/what-is-tezos-xtz-governance-use-cases

[33] – https://docs.near.org/protocol/storage/storage-staking

[34] – https://www.coinbase.com/earn/staking/near-protocol

[35] – https://www.prnewswire.com/news-releases/algorand-rolls-out-cryptos-most-inclusive-staking-rewards-program-302358879.html

[36] – https://coinledger.io/learn/the-4-best-places-to-stake-matic

[37] – https://www.bitdegree.org/crypto/tutorials/polygon-staking

[38] – https://www.coinbase.com/earn/staking/polygon

[39] – https://docs.polygon.technology/pos/reference/rewards/

[40] – https://www.cryptovantage.com/guides/how-to-stake-polygon-matic/

[41] – https://www.nansen.ai/guides/how-to-stake-matic-the-complete-guide

![You are currently viewing The 11 Highest-Paying Crypto Staking Coins in 2026 [Real Results]](https://forexcryptohub.com/wp-content/uploads/2025/10/crypto-stake-2.jpg)